Summary

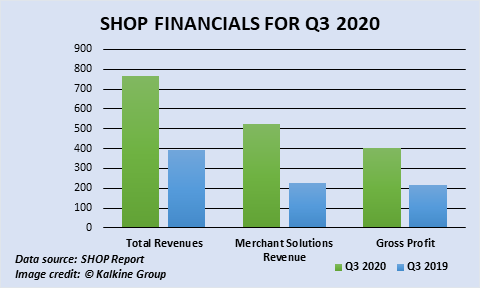

- Shopify Inc gross profit grew 87 per cent to US$405.1 million in Q3 2020

- The stock has advanced by 151.10 per cent YTD

- In the third quarter, Shopify rolled out Shop Pay Installment, a “buy now, pay later” feature to help merchants boost sales.

Shopify Inc’ revenues zoomed 96 per cent year-over-year (YoY) to touch US$767.4 million in the third quarter of 2020. But despite reporting a strong financial performance for its latest quarter, stocks of Canada’s largest e-commerce firm dropped nearly 5 per cent during intraday trading on Thursday, October 29.

The gross profit grew 87 per cent to US$405.1 million in Q3 2020 while operating income (comprising 7 per cent of revenue) stood at US$50.6 million. In Q3 2019, the company reported an operating loss of US$35.7 million. The net income of US$191.1 million in latest quarter is up from net loss of US$72.8 million a year ago.

Revenue from subscription solutions increased by 48 per cent YoY to US$245.3 million, primarily because of many merchants signing up on the Shopify platform and leveraging to reach out to buyers. Shopify’s merchant solutions revenue increased 132 per cent to US$522.1 million, driven by growth of Gross Merchandise Volume (GMV).

The GMV saw a phenomenal 109 per cent or US$16.1 billion increase to US$30.9 billion.

As of September 30, Shopify (TSX:SHOP) reported US$6.12 billion in cash, cash equivalents and marketable securities, as compared to US$2.46 billion on December 31, 2019.

In the third quarter, Shopify rolled out Shop Pay Installment, a “buy now, pay later” feature to help merchants boost sales. This service was offered to a select number of merchants, who can further pass on the benefit to customers to make payment choices and enhanced flexibility for easy checkout. Shopify Payments launched in Belgium recently, expanding its availability now to 17 countries.

Shopify also joined hands with TikTok to launched channel enabling merchants to market their products using the latter’s platform for business. The company continues to build on its Shopify Fulfilment Network to develop software that connects the network, add partner nodes, improve features on the merchant facing app and enhance support functions to maintain high quality standards, while achieving the product-market fit at this stage of development.

The company recently announced a collaboration with Operation HOPE to provide up to US$130 million resources to create one million new Black-owned businesses in the U.S. by 2030. This operation aims to remove the systemic barriers to entry into entrepreneurship faced by the Black community in America at large.

SHOP Stock Performance

Stock Price: C$1,296.41

Shopify’s bull run started in March as the pandemic decimated the markets worldwide. The stock has advanced by over 150 per cent year-to-date.

YTD price chart of Shopify Inc. (Source: Refinitiv, Thomson Reuters)

Current market capitalization of Shopify is C$142.66 billion. The stock holds profit-to-book (P/B) ratio of 25.959 and profit-to-cash flow (P/CF) ratio of 1,235.00, as per details on the TMX portal.