Highlights

- Retail business is a necessity, and these stocks offer stable returns with high growth potential.

- One of the retail stocks here rocketed by more than 127 per cent in the past year.

- A retail company among the below posted a return on equity of 487.23 per cent.

Many investors believe that the COVID-19 outbreak has severely affected retail businesses globally, making them reluctant to invest in retail stocks. However, a few Canadian retailers stood tall despite the pandemic setback and survived it quite well, largely driven by eCommerce initiatives.

These Canadian retailers are likely to do even better as the world economies step up for the post-pandemic market recovery to regain normalcy in business. Investors who want to invest their moolah in the Canadian retail sector may consider the below-mentioned retail stocks.

Furthermore, the Canadian retail sector is expected to flourish as the holiday season and shopping kicks in with rising vaccination rates and relaxation in the pandemic restrictions across the country.

Also read: Canada’s Big Five bank stocks to buy & hold long term

Let us explore five top Canadian retail stocks listed on the Toronto Stock Exchange (TSX).

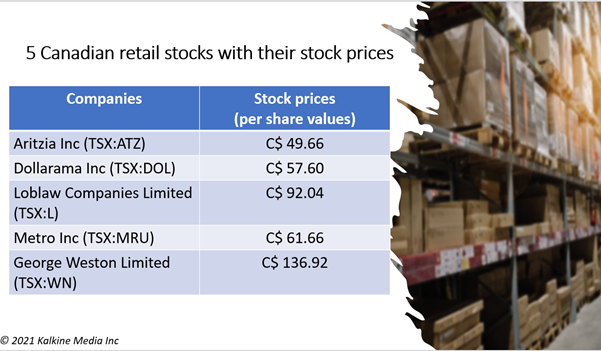

Image description: 5 TSX listed retail stocks with their stock prices at the market close on Tuesday, October 19, 2021

1. Aritzia Inc (TSX:ATZ)

The stocks of integrated design house Aritzia Inc dropped by 1.312 per cent to C$ 49.66 apiece at the market close on Tuesday, October 19. At this closing price, it slipped by about two per cent from its 52-week high of C$ 50.68 on Monday, October 18.

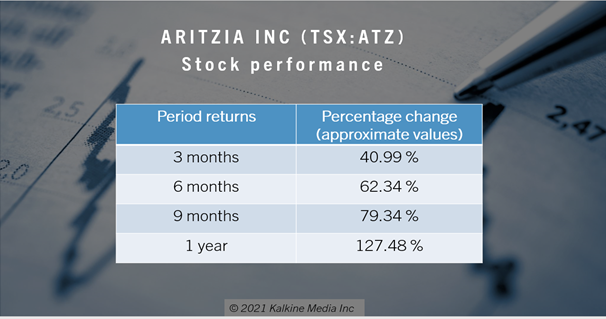

The stock rocketed by more than 127 per cent in one year and soared by roughly 93 per cent on a year-to-date (YTD) basis. It jumped nearly 41 per cent in the last three months and expanded by almost 17 per cent in the past month.

Aritzia, in the second quarter of fiscal 2022, reported a year-over-year (YoY) growth of 74.9 per cent in net revenue to C$ 350.1 million. Out of the net revenue, eCommerce revenue noted a YoY increase of 48.7 per cent to C$ 130.4 million, and retail revenue marked a phenomenal YoY growth of 95.3 per cent to C$ 219.6 million in Q2 2022.

In addition, Aritzia’s stock posted an adjusted EBITDA of C$ 72.9 million in its latest quarter, up from C$ 12.3 million in Q2 2021.

The C$ 4.3 billion market cap Canadian fashion retailer held a price-to-earnings (P/E) ratio of 53, a price-to-book (P/B) ratio of 12.865 and a return on equity (ROE) of 28.97 per cent on Wednesday, October 20.

2. Dollarama Inc (TSX:DOL)

The Montreal-based retailer witnessed its scrip closing at C$ 57.60 per share, up by 0.104 per cent, on October 19. However, at market close, it had dropped by more than five per cent from its 52-week high of C$ 60.87 on August 20.

The stock of the Canadian retail stores owner and operator noted a surge of approximately 12 per cent in the past year and it soared by about 11 per cent on a YTD basis. Its scrip also marked a quarter-to-date (QTD) gain of almost five per cent and climbed nearly three per cent in the last month.

Dollarama, in its latest quarter, posted a YoY increase of 1.6 per cent in sales to C$ 1.02 billion. It also marked a growth of 5.7 per cent in EBITDA to C$ 293.7 million and direct COVID-19 costs reduced to C$ 11.7 million in the second quarter of fiscal 2022, down from Q2 2021.

With a market capitalization of C$ 17.31 billion, the company noted a P/E ratio of 29.80, an ROE of 487.23 per cent, a return on asset (ROA) of 15.70 per cent and a dividend yield of 0.349 per cent at the time of writing.

The company is expected to pay a quarterly dividend of C$ 0.05 per share, payable on November 5.

Also read: Noront agrees to Wyloo's offer. What’s in store for shareholders?

3. Loblaw Companies Limited (TSX:L)

Loblaw Companies Limited is one of the largest integrated grocery, pharmacy, and general merchandise retailers in Canada. On October 19, the retailer saw its stock closing at C$ 92.04 apiece, down by 1.096 per cent. At this closing price, its stock marked a fall of more than one per cent from its 52-week high of C$ 93.39 scored on Monday, October 18.

Loblaw’s stock rose by more than 34 per cent in the past year and grew by roughly 47 per cent on a YTD basis. It grew by nearly 15 per cent in the last three months and jumped more than seven per cent in the past month.

The Ontario-headquartered retail company, in the second quarter of 2021, reported a YoY increase of 4.5 per cent in revenue to C$ 12.49 billion. It noted adjusted net earnings attributable to common shareholders to the amount of C$ 464 million, up by 78.5 per cent compared to the corresponding quarter of 2020.

Loblaw stood at a market capitalization of C$ 30.8 billion and posted an ROE of 12.38 per cent, an ROA of 3.81 per cent and a dividend yield of 1.586 per cent on October 20.

4. Metro Inc (TSX:MRU)

The Canadian grocery retailer Metro Inc noted a fall of 0.852 per cent to C$ 61.66 apiece at market close on October 19. At this closing, it was up by more than 17 per cent from its 52-week low of C$ 52.63 on February 25.

The stock of Metro descended by more than two per cent in the past year. However, it surged by roughly nine per cent on a YTD basis and climbed almost three per cent in the last month.

Metro posted a decline of two per cent in sales to C$ 5.71 billion and a reduction of 4.2 per cent in net earnings to C$ 252.4 million in the third quarter of 2021 compared to the previous year quarter. It also reported an expense of C$ 38 million related to COVID-19, which included gift cards of C$ 8 million to front-liners.

The Montreal-headquartered grocer held a P/E ratio of 18.90, an ROE of 13.39 per cent, an ROA of 6.24 per cent and a dividend yield of 1.622 per cent at the time of writing.

Metro is supposed to roll out a quarterly dividend of C$ 0.25 per share, payable on November 9.

5. George Weston Limited (TSX:WN)

George Weston Limited is a Toronto-based holding firm with subsidiaries in the retail, real estate and consumer sectors. On October 19, the firm saw its stock slip by 0.328 per cent at market close, priced at C$ 136.92 apiece. It marked a fall of approximately one per cent from its 52-week high of C$ 138.22 on September 13.

Its stock soared by nearly 42 per cent in the last year and expanded by about 10 per cent in the past three months. It climbed almost four per cent in the previous month.

George Weston recorded C$ 108 million of net earnings available to shareholders in Q2 2021, up by C$ 363 million from the same quarter a year ago.

On the valuation front, George Weston held a P/B ratio of 3.196, an ROE of 9.73 per cent and a dividend yield of 1.753 per cent on October 20.

Bottom line

Retail business is a necessity as we all are consumers, and hence, it makes a more reliable investment option for investors to bet their money on to fetch returns. However, not every retailer is successful and the market can change. The above-mentioned retail stocks have lived through the pandemic and are likely to perform better in the post-pandemic era.

Also read: Top 5 Canadian gold stocks to buy at low prices & hold long term

Before buying any of these retail stocks, investors should actively research the company, its operations, future business plans, stock performance, etc., to analyze its fundamentals and financial soundness, considering their risk profile and investment goals.