Highlights

- In the wake of the clean energy revolution, lithium has been drawing the attention of battery manufacturers and automakers, especially in the electric vehicles (EV) industry.

- The element is also widely used as commodity for electrification across different sectors and industries.

- The demand for lithium is likely to surge in the future as more new developments come into the clean technology space.

In the wake of the clean energy revolution, lithium has been drawing the attention of battery manufacturers and automakers, especially in the electric vehicles (EV) industry. The element is also widely used as commodity for electrification across different sectors and industries.

The demand for lithium is likely to surge in the future as more new developments come into the clean technology space.

On that note, let us explore two Canadian lithium stocks listed on TSXV.

Also read: RBC (RY) hikes dividend by 11%, National Bank's (NA) up 23%. Buy call?

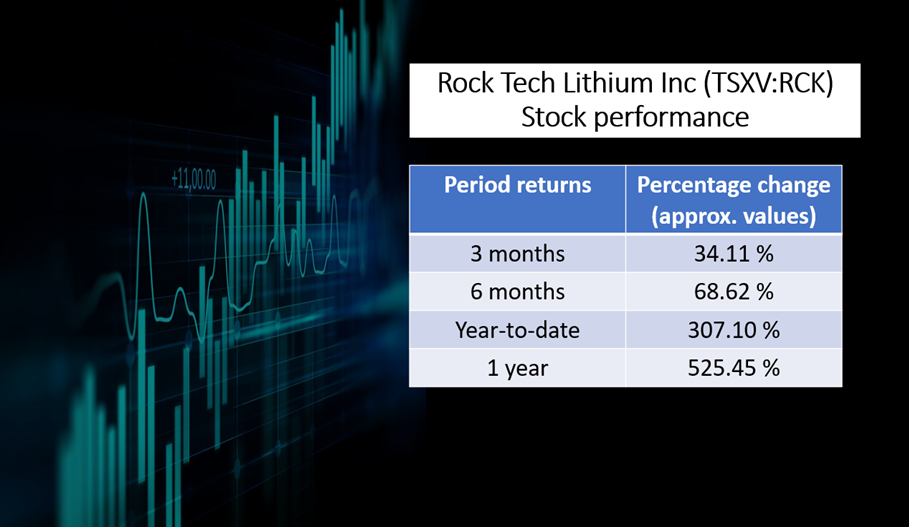

Rock Tech Lithium Inc (TSXV: RCK)

Rock Tech Lithium Inc is a Vancouver, British Columbia-based cleantech firm that engages in lithium-related technologies.

2 Canadian lithium stocks to buy before 2022

The firm is said to be working on lithium hydroxide production technology that can minimize energy consumption and wastage. With this, it aims to provide sustainable lithium to the automotive industry.

RCK stock jumped by about 307 per cent so far in 2021. In the last year, it has rocketed by over 525 per cent.

The lithium stock clocked a day high of C$ 7.33 on Wednesday, December 1, and closed at C$ 6.88 apiece, up by nearly two per cent.

Image source: © 2021 Kalkine Media Inc

1. Alpha Lithium Corporation (TSXV:ALLI)

Alpha Lithium Corporation is a junior lithium explorer that owns and develop lithium brine projects.

In November, the company said that it encountered consistent lithium grades ranging between 345 and 351 milligram per litre, which resulted from its six-well program in Tolillar Salar.

Alpha Lithium owns a 100 per cent interest Salta, Argentina-based Tolillar Project covering 27,500 hectares.

As for its stock performance, ALLI scrip rose by roughly 11 per cent in the last one week and swelled by more than 177 per cent in the past three months.

The stock grew by about 96 per cent year-to-date (YTD).

The lithium stock closed at C$ 1.47 apiece on December 1, up by almost three per cent. It clocked a new 52-week high of C$ 1.69 during the session.

Also read: Can Canada’s Big Six banks be gearing up for epic dividend hikes?

Bottom line

With the rising concerns over climate change and environmental ill-effects, clean energy and technology have become more in demand.

Being on the forefront of such technologies, lithium-ion batteries are well known for their vital usage in the manufacturing of EVs. As this industry continues to expand, lithium is expected to see a notable surge in its demand in the future.