Highlights:

- Last year, BuzzFeed went public after merging with a special purpose acquisition company (SPAC).

- Stocks of BuzzFeed Inc. (NASDAQ:BZFD) were up about 11 per cent on February 1 and closed at US$ 4.42 per share.

- BuzzFeed went public on December 6, and the BZFD stock had opened at US$ 10.95 per share.

Stocks of BuzzFeed Inc. (NASDAQ:BZFD) were up about 11 per cent on February 1 and closed at US$ 4.42 per share. Since the past few days, BuzzFeed has recorded an increase in share prices after continuously declining since its stock market debut.

The New York-based entertainment and media company had gone public late last year after merging with a special purpose acquisition company (SPAC).

Also Read: MariaDB plans a public debut. How can you buy this stock?

Notably, the BuzzFeed stock continued a four-day price surge streak on Tuesday, which could be a sign of regaining investors' confidence.

Has BuzzFeed stock recovered?

It is too early to say that BuzzFeed stock has recovered from its past of constantly declining share prices. Since the past week, BZFD stock jumped 14.5 per cent. However, it has also declined 17 per cent in the last 30 days.

BuzzFeed went public on December 6, and the BZFD stock had opened at US$ 10.95 per share. During the trading session, it achieved a high of US$ 14.77 apiece, and since then, it plunged 70 per cent as of February 1.

©2022 Kalkine Media®

©2022 Kalkine Media®

There is no particular news that could have led to the increase in BuzzFeed stock prices. Earlier on February 1, a report claimed that the entertainment and media company had limited hiring due to its rough public debut.

Published reports claimed that BuzzFeed would only hire people for critical positions, and it will not add any new jobs unless there is a business-case justification.

BuzzFeed reportedly had a tough start as the SPAC merger deal suffered 94 per cent redemptions, and this left the company with only US$ 16 million in cash instead of US$ 287.5 million.

Bottom line

BuzzFeed is looking to make organizational changes, and on January 6, it named Christian Baesler as the Chief Operating Officer (COO). Mr Baesler was working as the chief executive officer of Complex Networks, a company acquired by BuzzFeed last month.

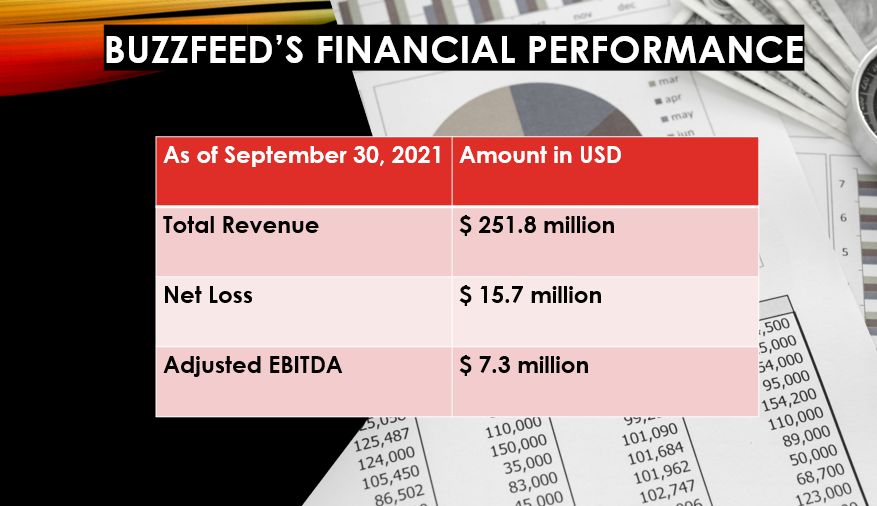

According to the Current Report filed with the Securities and Exchange Commission, BuzzFeed's total revenue was US$ 251.8 million for the nine months ended September 30, 2021.

Also Read: Is Mark Cuban Cost Plus Drug Company IPO happening?