Highlights

- Manulife Financial is set to pay a quarterly dividend of C$ 0.33 on June 20.

- Manulife has launched Impact Agenda to boost its focus on ESG efforts.

- Power Corp’s annualized dividend growth rate was almost 15 per cent in three years.

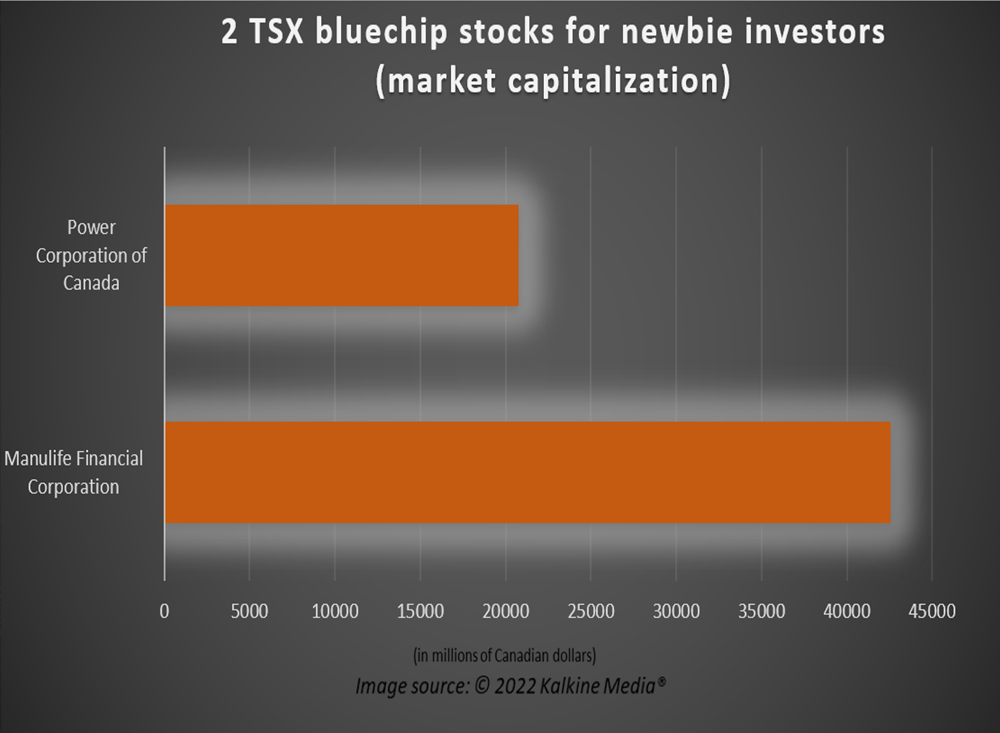

Taking that first step in stock investing can be frightening for newbie investors. In this case, bluechip stocks can be among the safest options to explore in the stock market. And Manulife Financial (TSX:MFC) and Power Corporation (TSX:POW) are two major TSX bluechip stocks that Canadian investors could consider for long-term gains.

The idea behind investing in bluechip stocks is that they hold large market capitalization, sturdy business history and expanded operations, thereby including less risk.

Now, let us quickly look at two TSX bluechip stocks.

Also read: Understanding undervalued stocks and where to find them

Manulife Financial Corporation (TSX: MFC)

Insurer and wealth manager Manulife Financial had a market capitalization of more than C$ 42.5 billion as of writing. Manulife’s dividend yield was nearly six per cent.

The Canadian financial company held a debt-to-equity (D/E) ratio of 0.26, representing low financial risk as it prefers equity over debt financing. The bluechip stock’s quarterly dividend of C$ 0.33 is scheduled for distribution on June 20.

On June 1, Manulife Financial launched Impact Agenda to boost its focus on Environmental, Social and Governance (ESG) efforts for long-term value creation. Hence, one could consider Manulife if looking for long-term investment options to capture gains.

Power Corporation of Canada (TSX: POW)

Power Corporation is another financial service company that investors can explore for future gains. The insurance player’s quarterly dividend of C$ 0.495 is set for payment on July 29.

Power Corp’s dividend yield was nearly six per cent. Its annualized dividend growth rate was almost 15 per cent over the last three years.

POW involves low financial risk as it had a D/E ratio of 0.85 (below 1). Hence, income investors with a low-risk appetite can explore POW.

Bottomline

Manulife Financial and Power Corporation belong to the financial sector, which makes them less cyclical, thereby mitigating the impact of economic cycles affecting your portfolio. Investors can also consider their developments, like Manulife’s attempt to enhance its ESG efforts, as such actions could determine the company’s long-standing.

Also read: 5 TSX stocks to buy for +5% dividend yield - GWO, ENB, RNW, MFC, SRU

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.