Highlights

- FirstService Corporation (TSX:FCV) and Restaurant Brands International (TSX:QSR) are trending on the stock markets.

- The real estate company also raised its quarterly dividend by 11 per cent to US$ 0.203 apiece, payable on April 7.

- The restaurant company reported total revenues of US$ 1.54 billion in Q4 FY2021, up from US$ 1.35 billion a year ago.

Restaurant Brands International (TSX:QSR) and FirstService Corporation (TSX:FCV) are currently trending hot on the stock markets after the restaurant giant and the real estate firm released their Q4 results on Tuesday, February 15.

FirstService is a North American real estate company with headquarters in Toronto, Ontario, while Restaurant Brands is known to be one of the largest restaurant chains around the globe.

Let us see what these two giants have in their earnings closet.

FirstService Corporation (TSX: FSV)

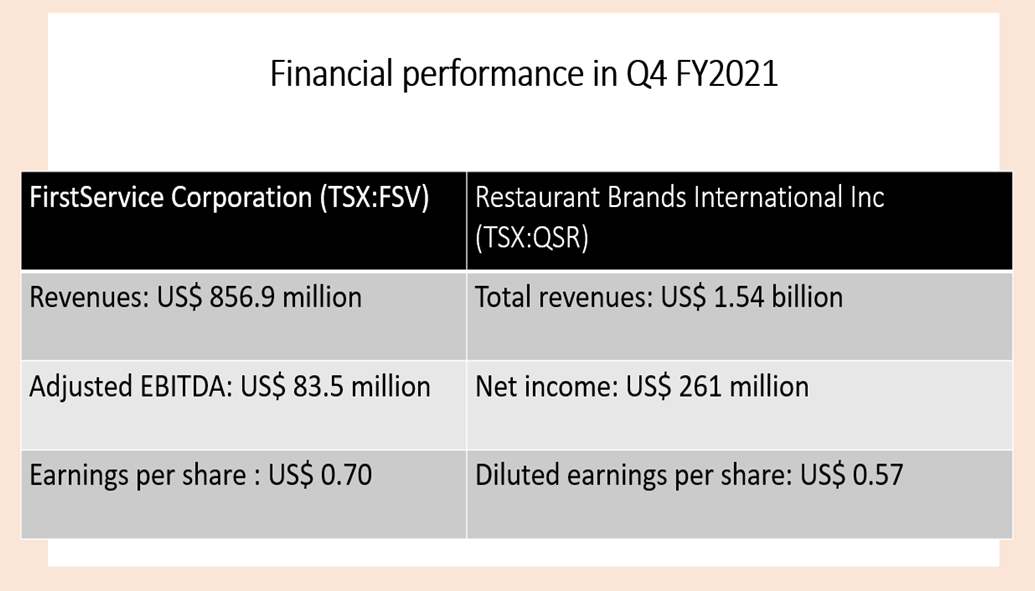

The Toronto-based real estate company saw its fourth-quarter revenue amount to US$ 856.9 million in fiscal 2021, up 11 per cent year-over-year (YoY).

The C$ 8-billion market cap company recorded a five per cent YoY surge in its adjusted EBITDA to US$ 83.5 million in the latest quarter, as compared to US$ 79.9 million a year ago.

Also read: Why is Avis Budget (CAR) stock trending?

The property services provider noted net earnings of US$ 35.3 million, up from US$ 32.9 million in the previous-year quarter.

The real estate company also raised its quarterly dividend by 11 per cent to US$ 0.203 apiece, which will be payable on April 7.

FirstService stock jumped by nearly two per cent in the last nine months to close at C$ 193.23 apiece on Monday.

Restaurants Brands International Inc (TSX: QSR)

The restaurant chain owner reported total revenues of US$ 1.54 billion in Q4 FY2021, up from US$ 1.35 billion a year ago.

On an annual level, RBI earned a net income of US$ 1.24 billion in FY2021 (which was attributable to common shareholders and noncontrolling interests), significantly up from that of US$ 748 million a year ago.

Stocks of Restaurant Brands climbed over two per cent month-to-date (MTD) and closed at C$ 72.69 apiece on Monday.

Image source: © 2022 Kalkine Media®

Bottomline

Both FirstService and Restaurants Brands seem to have noted a significant YoY growths in their revenue despite COVID worries and market setbacks. This could indicate that the Canadian two companies have robust business operations, which can improve in favourable market conditions.

However, investors should ideally keep a tab on market and company-related changes that can impact such businesses before investing.

Also read: Why is Sea Limited (SE) stock crashing?

Please note, the above content constitutes a very preliminary observation or view based on industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.