Highlights

- Stocks of Sea Limited (NYSE: SE, SE:US), a Singapore-based company, crashed by over 18 per cent on Monday, February 14.

- Sea Limited is known to provide internet technology solutions to consumers and businesses worldwide.

- Sea saw its third-quarter revenue increase by 121.8 per cent year-over-year (YoY) to US$ 2.68 billion in fiscal 2021.

Stocks of Sea Limited (NYSE: SE, SE:US), a Singapore-based company, crashed by over 18 per cent on Monday, February 14.

Sea Limited is known to provide internet technology solutions to consumers and businesses worldwide. The US$ 72-billion market cap company is diversified and operates in the digital entertainment, e-commerce and digital financial services space.

The digital entertainment business develops and offers mobile and online games through the Garena platform to the global gaming market.

Let us get to know more about why this internet company nosedived on Monday.

Why Sea Limited (NYSE:SE, SE:US) stocks nosedived?

The decline in Sea Limited’s stock price came after reports noted that India has banned several of its apps, including Free Fire, one of its most popular games. Reports also said that the country took this step citing security concerns.

On Monday, US-based Law Offices of Howard G Smith also said that it is initiating a probe on behalf of the communication player’s investors regarding Sea Limited’s possible violations of federal securities laws.

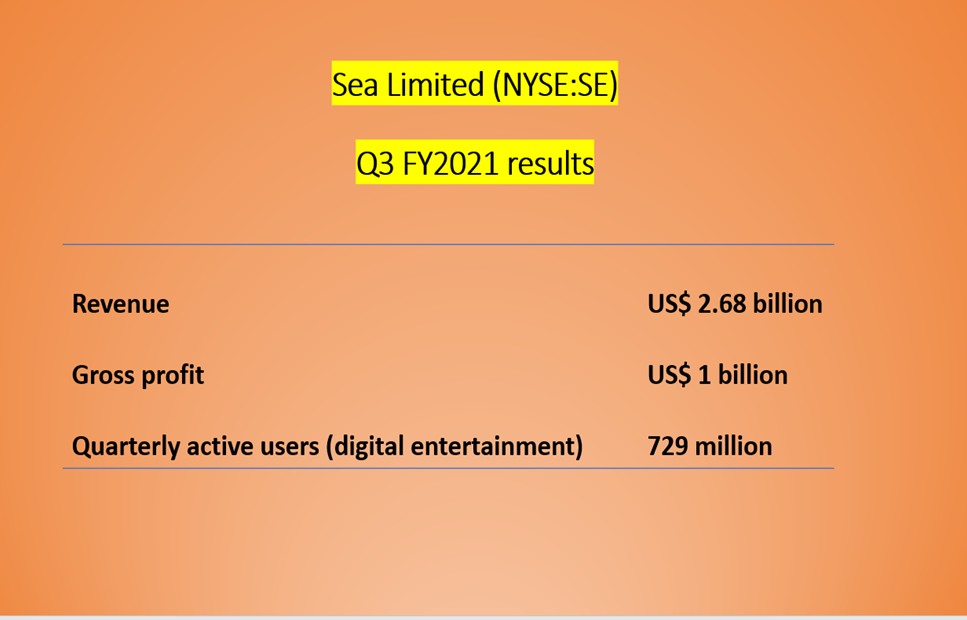

Sea Limited (NYSE:SE) Q3 FY2021 results

Sea saw its third-quarter revenue increase by 121.8 per cent year-over-year (YoY) to US$ 2.68 billion in fiscal 2021.

The internet solutions company recorded a YoY surge of 147.5 per cent in its gross profit to US$ 1 billion in the latest quarter.

Also read: Enbridge (ENB) & Suncor (SU): 2 TSX energy stocks to bag in 2022

Its digital entertainment segment saw its quarterly active users reach 729 million in Q3 FY2021, up 27.4 per cent YoY.

Image source: © 2022 Kalkine Media®

Data source: Sea Limited

Sea Limited stock performance

Sea stock plummeted by over 42 per cent year-to-date (YTD).

The internet stock closed at US$ 129.17 apiece on Monday, near to its 52-week low of US$ 119.41 apiece (January 28).

Sea stock touched a 52-week high of US$ 372.6999 on October 19 last year.

What can investors do now?

Investors can take note of how much India contributes to Sea’s total revenue and how this latest move could affect its overall business.

As Sea also operates two other segments, Shopee and SeaMoney, with e-commerce being a major revenue generator, some experts think of this sell-off could be a long-term opportunity keeping in mind the growth prospects of the global e-gaming, e-commerce and fintech industries.

Also read: H2O Innovation (TSXV:HEO) sees 20% revenue growth in Q2. A buy?

Please note, the above content constitutes a very preliminary observation or view based on industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.