Highlights

- H2O Innovation Inc, on Monday, February 14, announced its second-quarter financial results for the fiscal year 2022.

- H2O Innovation is a junior water technology company that offers water treatment solutions across North America, Saudi Arabia, Spain and the rest of the world.

- The water technology stock gained almost 11 per cent in the last five days.

H2O Innovation Inc, on Monday, February 14, announced its second-quarter financial results for the fiscal year 2022.

H2O Innovation is a junior water technology company that offers water treatment solutions across North America, Saudi Arabia, Spain and the rest of the world. The Quebec City-based company leverages its membrane filtration technology to serve end-users in municipal, natural resource and energy spaces.

Let us look at how the water tech company did in Q2 FY2021.

Also read: Why is Magna International’s (TSX:MG) stock tanking?

Key highlights from H2O Innovation’s (TSX:HEO) Q2 FY2021 results

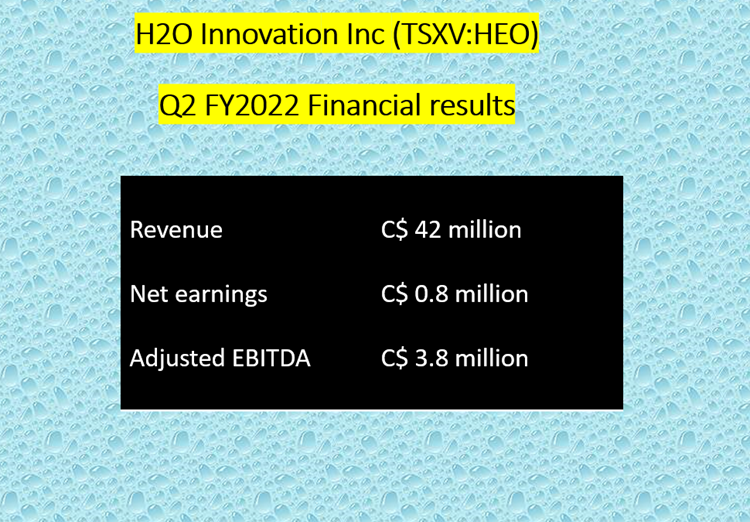

H2O Innovation saw its top line increase by 20.1 per cent year-over-year (YoY) to C$ 42 million in Q2 FY2022. The water firm posted an adjusted EBITDA of C$ 3.8 million in the latest earnings, up from C$ 3.6 million a year ago.

The integrated water solution provider recorded net earnings of C$ 0.8 million or C$ 0.009 apiece in the second quarter of fiscal 2022 compared to C$ 0.3 million or C$ 0.003 apiece in the same quarter a year ago.

Image source: © 2022 Kalkine Media®

H2O Innovation stock performance

Stocks of H2O Innovation shot up by roughly two per cent on Friday, February 11, to close at a value of C$ 2.58 apiece. At this close, it was nearly 23 per cent up from a 52-week low of C$ 2.1 (March 5, 2021).

This water technology stock gained almost 11 per cent in the last five days.

Bottom line

H2O Innovation’s President and CEO Frédéric Dugré said that the company remained focused on its business growth despite pandemic setbacks, including labor shortages, increasing raw material costs and supply chain worries. The latest earnings release indicates that the company is executing its “3-Year Strategic Plan”, he added.

Also read: Corby (CSW.B) & Rogers (RSI): 2 TSX stocks that can be your Valentine

Please note, the above content constitutes a very preliminary observation or view based on industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.