Highlights

- Avis Budget Group (NASDAQ:CAR, CAR:US) is gaining some traction in the stock markets.

- Stocks of Avis Budget shot up by over seven per cent on Monday, February 14, following its earnings release for the fourth quarter of fiscal 2021.

- The automotive company saw its earnings per share reach US$ 6.63 in the latest earnings, reflecting an increase of 614 per cent YoY.

Avis Budget Group (NASDAQ:CAR, CAR:US) has been gaining some notable traction on the stock markets.

Stocks of Avis Budget shot up by over seven per cent on Monday, February 14, following its earnings release for the fourth quarter of fiscal 2021.

Avis Budget Group is a New Jersey-headquartered company that rents automotive vehicles and offers car-sharing services. The US$ 10-billion market cap company targets both premium and price-conscious customers in the travel industry.

Let us have a close look at the financials of this American automobile rental company.

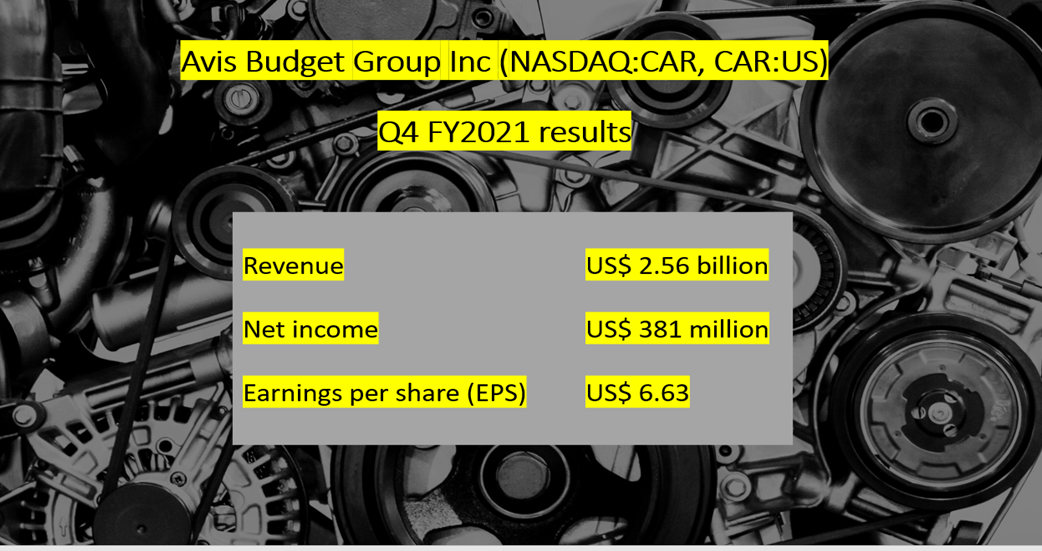

Avis Budget (NASDAQ:CAR, CAR:US) Q4 FY2021 results

The automotive rental company said that its top line increased 90 per cent year-over-year (YoY) to US$ 2.56 billion in the latest quarter. The company added that the “demand” for its fleet continued to drive up its “revenue per day and rental days” in Q4.

Also read: Enbridge (ENB) & Suncor (SU): 2 TSX energy stocks to bag in 2022

Avis Budget recorded a net income growth of 523 per cent YoY to US$ 381 million in Q4 FY2021, considerably up from a loss of US$ 90 million a year ago.

The automotive company saw its earnings per share reach US$ 6.63 in the latest earnings, reflecting an increase of 614 per cent YoY.

In Q4 FY2021, the company also repurchased 2.6 million of its common stock at US$ 170 per share as an average cost.

Image source: © 2022 Kalkine Media®

Data source: Avis Budget Group Inc

Avis Budget stock performance

Following the positive Q4 results, the automotive stock closed higher at US$ 194.71 apiece on Monday, with 2.2 million shares exchanging hands.

Avis Budget scrip skyrocketed by over 335 per cent in the last 12 months.

Currently, this automobile rental stock is down by over 64 per cent from its 52-week high of US$ 545.11 (November 2, 2021).

Bottomline

Avis Budget’s CEO Joe Ferraro said that the company continued its “strong performance” in Q4 despite the omicron outbreak, with all of its “key metrics beating pre-pandemic levels” in the Americas.

The automotive company also stated that it held a liquidity position of about US$ 757 million at the end of the fourth quarter of FY2021, with an additional fleet funding capacity of US$ 2.6 billion.

Also read: Global Water (GWR) & TransAlta (RNW): 2 TSX renewable stocks to own

Please note, the above content constitutes a very preliminary observation or view based on industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.