Highlights

- The Canadian market has been declining for the past few trading sessions.

- Growth stock investing has suffered as investors seek to avoid riskier investments.

- The stock markets have endured a terrible three months.

2022 has not been a good year for the stock markets as several macroeconomic issues sparked a severe decline in every market. Growth stock investing has suffered as investors seek to avoid riskier investments. Also, due to the extreme panic brought on by the challenging economic climate, stock market investors appear to have oversold some stocks.

The Canadian market has been declining for the past few trading sessions, and on July 14, the S&P/TSX Composite was down by 1.5 per cent and closed at 18,329.06 points.

The stock markets have endured a terrible three months. Smart investors could try to buy on the dip and they have many options because there are so many cheaply priced equities. Hence, we have shortlisted five undervalued stocks that are now trading on the TSX:

Calian Group Ltd. (TSX:CGY)

The company has diversified business interests in healthcare, cybersecurity solutions, communications, and education. In Q2 2022, the company announced record margins on revenue of C$ 142 million.

Calian achieved a record gross margin of 28 per cent, and its adjusted EBITDA was C$ 16.5 million, up by 18 per cent year-over-year (YoY).

Notably, Calian's adjusted net profit jumped 28 per cent YoY to C$ 13.3 million.

Jamieson Wellness Inc. (TSX:JWEL)

Jamieson specialises in health and wellness and creates, produces, and distributes a variety of natural health goods, such as vitamins, nutritional supplements, and other things.

The company seems to be among the undervalued stocks listed on the TSX, and you might consider exploring the JWEL stock during this correction. On Thursday, the JWEL stock closed at C$ 34.63 per share, slightly above the 52-week low of C$ 32.02 apiece.

Jamieson Wellness' growth strategies feature acquisitions, and in June, it announced to acquire Nutrawise Health & Beauty Corporation.

In the first quarter, the health and wellness company's revenue increased by 5.5 per cent YoY to C$ 103.7 million.

Northland Power Inc. (TSX:NPI)

If you think renewable energy is a sure thing, in the long run, you might consider exploring the stock of Northland Power. Governments are working to reduce their reliance on other nations for their energy demands because the global energy situation is precarious.

Independent and diverse energy producers like Northland could see this as an opportunity to grow their business operations.

In Q1 2022, Northland's sales amounted to C$ 695 million, reflecting an increase from C$ 613 million in the first quarter of 2021. Also, the net income jumped 90 per cent YoY C$ 288 million.

Toronto-Dominion Bank (TSX:TD)

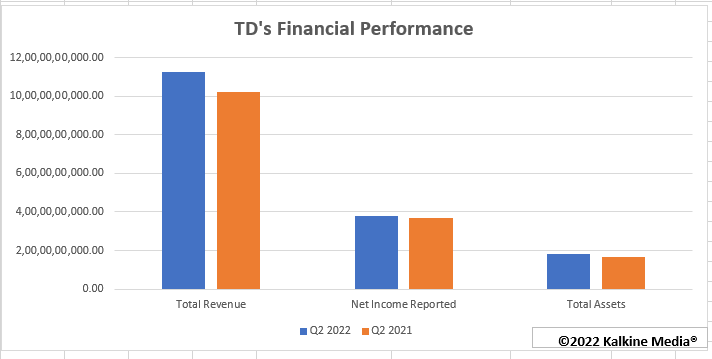

As it is one of the largest banks in Canada, Toronto-Dominion has made it to this list because of a significant decline in its stock price. The TD stock closed at C$ 78.17 apiece, significantly lower than its 52-week high of C$ 109.08 per share.

Toronto-Dominion's assets and financials indicate that the stock might be undervalued. The bank said its net income jumped to C$ 3,811 million in the second quarter compared to C$ 3,695 million.

The bank distributes dividends frequently, which could be another reason to explore the TD stock.

Bank of Montreal (TSX:BMO)

One of Canada's Big Six banks, the international financial organisation with its headquarters in Montreal, has recently seen the effects of the market correction.

However, the Canadian bank has performed very well over the past few quarters. In Q2 2022, the net income jumped to C$ 4,756 million from C$ 1,303 million.

The BMO stock closed at C$ 119.35 per share on July 14.

Please note, the above content constitutes a very preliminary observation or view based on digital trends and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.