Summary

- Shares of Fortescue Metals Group are near to its 52-week high level and have been market favourites over the recent past, driven by a sustained increase in iron ore prices and a robust demand for the commodity from China.

- Vale S.A. noted that outlook for iron ore remains weak from ex-China nations due to the economic contraction. Given the rapidly evolving virus spread, there remains an uncertainty on the scale of contraction.

- On 5 August 2020, the market capitalisation of Fortescue was around $56 billion compared to approximately $55 billion of National Australia Bank Limited.

Shares of Fortescue Metals Group Ltd (ASX:FMG) are marching higher as economic activity is picking up in China with muted supply pressures from Brazilian iron ore. In fact, the strength in iron prices has allowed the Australian Government to post better than expected revenues.

This year might be the second year in a row – when Australian iron ore miners edge past their Brazilian counterparts. Last year, it was the dam collapse in Brazil that forced its super producer – Vale S.A. to put restrain on volumes, and this year, the COVID 19 pandemic has jammed iron ore supplies from the South American nation.

But the Brazilian iron ore giant is not sleeping, as prices continue marching higher. Chinese media reports suggest that Vale is in talks with a port operator, which could host Chinamax and Valemax carriers to increase shipments towards China.

Related: Iron Ore- The Rally From 15-Week High to a 52-Week High

The reports suggested that China is looking to diversify its sources of the critical commodity for its infrastructure ambitions. Recently, the Brazilian mining company stated that it is considering expansion of the flagship S11D mine on strong Chinese demand.

A consistent pressure on supply has helped iron ore prices to hover around elevated levels. With higher raw material costs, steel producers may be passing the effect to customers and running mills at maximum capacities.

Vale S.A. Second Quarter Commentary on Iron Ore

In its 2Q20 update, Vale S.A. stated that 62% Fe iron ore reference price average was US$93.3/dmt for the three-month period to June 2020, up 5% from the first quarter price. The increase was driven by robust steel production and lower inventory at iron ore ports in China.

Despite the pandemic, Chinese steel production was up by 1.4% in 1H20 compared to same period last year. Although iron demand was impacted due to the pandemic-related shutdown, iron ore consumption hit record in 2Q20, driven by Government stimulus for infrastructure spending.

It also noted that supplies from major producers did not increase as proportionately to the increase in demand during the quarter, causing continued destocking of iron ore at ports. This perhaps indicates the reluctance of major producers to ramp-up production, which would eventually hurt elevated prices.

Related: Iron Ore Futures At 15-Week High, FMG Hits All time High- ASX Iron Ore Stocks on Upswing

During the concerned period, iron ore markets, excluding China, were struggling with the spread of virus, resulting in subdued demand for iron ore driven by manufacturing shutdowns, falling capital expenditure, and supply chain issues. As the lockdowns peaked during April 2020, steel mills across the regions halted production. However, according to Vale, bottom has passed, and demand is recovering from lows with China leading the gains in steel production.

Outlook for global demand for the commodity remains weak from ex-China world. It would also be dependent on level of contraction in global economy, especially of iron ore consuming nations. Meanwhile, the rapidly evolving virus spread continues to threaten output.

Fear of Missing Out

In a world of dividend cuts, it seems investors see light in iron ore stocks and dividends. After paying bumper dividends last year, strength in the share price partly reflects an expectation of healthy dividend pay-out.

This year has been extremely challenging for income-savvy investors. The acceptable yields on fixed income assets come with decent risk, and yields on Government bonds continue to hover around historically lower levels.

Related: BHP Shares Sore High On Share Buyback And Special Dividend Announcement

ASX has disappointed in terms of dividends over the recent past, given the precipitate shock to cash flows. Cyclical businesses that were conducting buybacks in the pre-COVID world are regretting their decisions.

But not every corner of ASX is starved of cash flows, there are number of businesses that are perhaps flooded by incoming cash in the wake of pandemic-related effects. And, iron ore stocks also find their place among these businesses with expected high cash.

Fortescue’s Last Quarter Production Report Gives Visibility

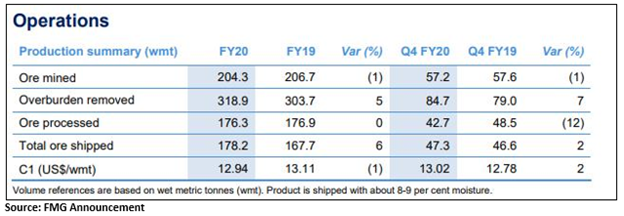

Fortescue has surpassed the top end of shipment guidance for FY20, clocking 178.2mt and increasing shipment by 6% over the previous year. The company continues to participate with Government programs for early detection of infections across its operational sites.

In the last quarter, the company continued momentum of the last nine months, and its supply chains helped to deliver a record shipment of 47.3mt. COVID 19 related expenses increased the C1 costs by 2% in 4Q over the same period last year.

C1 costs during the quarter were US$13.02/wmt, and full year costs were US$12.94/wmt, including COVID expenses. The company stated that the demand for its products was robust and supplies were delivered to China and other markets.

In FY20, the company realised average revenue of US$78.62/dmt, capturing 84% of the average Platts 62% CFR Index of US$93.23/dmt. Its revenue/tonne was up by 21% on FY19 compared to 16% gain in average Platts 62% CFR Index.

At the end of the quarter, FMG had cash of US$4.9 billion while gross debt was US$5.1 billion after drawing US$1 billion from revolving credit facility. Its net debt was US$0.3 billion and revolving credit facility was repaid in July with the tenor extended to July 2023.

Related: Iron Ore Prices Poised to Weather the Supply Normalcy Storm?

The company incurred capital expenditure of US$2 billion in FY20 with US$700 million in the last quarter. It noted that balance sheet is structured on low cost investment grade bonds with flexibility and capacity.

In FY21, the company is expecting iron ore shipments of 175-180mt at C1 costs of US$13-13.5/wmt assuming AUD FX rate of $0.70. Major capital expenditure of up to US$2.3 billion is anticipated on projects with a total capital expenditure between US$3 billion and US$3.4 billion.

On 5 August 2020, FMG moved upward by 0.771% to settle the day’s trade at $18.300.

(All currencies in AUD unless or otherwise stated)