Summary

- Bad debts and loan loss picture for banks continues to remain uncertain due to rapidly evolving pandemic and its impact on economic activity.

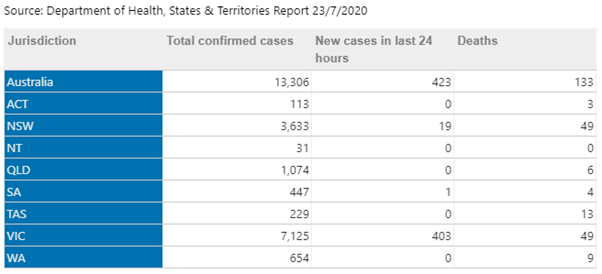

- COVID-19 outbreaks remain largely in Victoria, while all other states have proved to be resilient in containing the spread of infection.

- Lower interest rates and legacy issues associated with the Royal Commission have been detractors in banks’ performance over the recent years.

Australian Treasury’s economic forecast has reminisced the state of economic dislocation in the country. With Government policy initiatives in the wake of pandemic hitting $289 billion or around 14% of GDP, they have indeed cushioned the blow.

PM Morrison Government has been striking reforms like bushfire fund and first deposit scheme since late last year when it also banned travel to China – which was among the reasons why Australia contained initial outbreaks efficiently.

A quick containment effort was followed with gradual re-opening to limit the deterioration in economic output. Excluding Victoria, all states are effectively managing the pandemic, and new infections are muted in most of the states.

After re-opening in May, there were signs of improvement in economic activity, but unemployment is expected to remain higher this year, forecast at 9.25% in December quarter 2020.

Also read: V-shaped trajectory for economy unlikely while stocks approach closer to reporting season

Perhaps leading indicators were supportive recently, but increasing outbreaks in a few states have changed the scenario since early this month. The potential of further virus outbreaks until any vaccine is accessible remains a major uncertainty for the economy as well as the banking sector.

Any downgrades to Australia’s AAA rating on sovereign paper will have repercussions for the domestic bond market and yields across private and public debt. Concurrently, it would also impact credit ratings of the banks.

Prior to entering this crisis, Australia was better-positioned on fiscal terms with budget returning to balance for the first time in 11 years, and debt-to-GDP being lower compared to peers. Australian Treasury is expecting net debt to be 24.6% of GDP for 2019-20 and 35.7% for 2020-21.

Treasury is expecting deficit of $85.8 billion for 2019-20 and $184.5 billion for the next fiscal year. The Australian economic output is forecast to contract by 0.25% in 2019-20 and 2.5% in the current fiscal year. On a calendar-year basis, the economy is forecast to shrink by 3.75% in 2020, bouncing back to a growth of ~2.5% in 2021.

Bad debts, loan losses and credit provisions

Most of the Australian banks have not been able to pay dividend largely due to credit loss provisions. The process of incurring these provisions requires forecasting of credit events that may be triggered due to contraction in economic output and its impact on industries and households or customers of banks.

Given the uncertainty, rapidly evolving pandemic and economic damage, the provisions made by banks will likely fluctuate over the near term. Loan holidays for consumers are being extended by banks selectively, and conclusion of economic support like JobKeeper will provide better inputs for forecasting model scenarios and stress levels in credit portfolios.

It may take some time for consumers to embrace insolvency and trigger losses for banks – should the economic condition worsen further over the future. Likewise, if credit portfolios were to exhibit resilience, there remains an equal possibility that credit provisions could be redundant.

Incurring provisions means need of capital to maintain regulatory requirement. Although the Australian Prudential Regulation Authority (APRA) has allowed banks to breach required levels, the capital loss would need to be recovered over time.

Not paying dividends also mean keeping more capital in place for meeting provisions or capital requirements. The other option is to raise capital through the sale of new shares. A vaccine would clear the uncertainty associated with forecasting stress scenarios.

More clarity on actual loan losses will arrive once loan deferrals end and consumers return to normal repayment cycles. Consequently, banks would be able to accurately forecast capital needs and declare dividends when possible.

Related: ASX Banks Losing their Mojo, what are Investors Moot Point?

Legacy issues and challenges

In addition to credit provisions, Australian banks continue to struggle with the outcomes of Haynes Royal Commission, social pressure, and reputational damage. But banks are equipped with new management teams with a focus on reinventing business models.

In the wake of COVID 19, banks have extended strong support to customers, backed by collaborations with policymakers. Class actions, enquiries, and investigations have continued to date after the Royal Commission gave its final report last year.

Big four banks have divested substantial businesses, as they look to focus on core banking services, and delivering better consumer as well as shareholder outcomes. Moreover, the business models may become more lean and agile with emphasis on the core aspects of banking.

One silver lining in these legacy issues is that they have forced Boards of banks to address non-financial risks efficiently. With technological advancements and ongoing wave to digital, there remain ample opportunities for the management teams to lay the foundations for the next decade.

Lower interest rates

Lower interest rate is another income influencing factor that has contributed to lower income for banks. Given the global economy is on a shrink mode, the cushion of higher interest rate environment for banks is expected to remain far.

The Reserve Bank of Australia has noted that interest rates would remain lower until there are any vulnerabilities in achieving its mandate of maximum employment and price stability. Interest rate hikes usually come into when prices are not looking stable anymore, which happens during recovery.

Economic recovery is inevitable, so is better income for banks

As humans have evolved and overcome pandemics, hazards and wars over the centuries, this pandemic shall pass too. An economic recovery would also mean better outcomes for banks, but it may take some time, given that this recession has been quite damaging in record time.

Investors are likely to stick to businesses that could sustain the crisis. Perhaps conservative capital decisions of banks, including dividends, are meant to sustain the crisis and sail to the other side of the crisis with a maximum position of strength.

Good Read: 3 Signs you should look around Economic Recovery

(Note: All currency in AUD unless specified otherwise)

_06_30_2023_10_37_44_979056.jpg)