Summary

- Quickstep Holdings, an advanced composite solutions provider, reported robust financial results with sales up by 12%, statutory NPAT up by 44% and EBITDA of $8.3 million for FY20.

- Overall performance of QHL demonstrated that the business remained resilient throughout FY20 in a COVID challenged industry segment.

- QHL plans further technology deployment, process improvements and numerous key efficiency initiatives to enhance competitiveness while its core defence programs are expected to remain highly resilient.

- In FY21, Quickstep anticipates customer revenues to increase by 5-10% and EBITDA to improve year-on-year, backed by the implementation of efficiency initiatives.

Quickstep Holdings Limited (ASX:QHL) is Australia’s leading independent carbon fibre composites manufacturing company, catering to the defence and commercial aerospace and advanced industry sectors. Recently, the Company released its performance report for FY20 ended 30 June 2020, registering a 44% increase in statutory NPAT to $3.9 million, up from $2.7 million in the prior year. The NPAT figure comprised a net incremental charge of $0.7 million, as a result of AASB16.

COVID-19 has caused a significant level of disruption for businesses across industries. QHL deployed a comprehensive risk management process while successfully implementing and maintaining COVID-19 control measures across both Australian sites in New South Wales and Victoria.

Backed by these measures, the Company ensured providing a safe and secure work environment for all its employees. Quickstep Holdings also well-managed supply chain challenges, notwithstanding extensive disruptions due to COVID-19. This further allowed the Company to maintain pace with volume growth and progress for the delivery of high-quality on-time performance to customers.

Interesting Read: Lens on Defence and Aerospace Sector Players: OEC, QHL, XTE, EOS

In essence, Quickstep Holdings highlighted to have exhibited a very high level of resilience throughout FY20.

The credibility of QHL in the market and customer confidence in QHL’s product have been validated through the extremely well-executed delivery performance of 10 new F-35 parts to Northrop Grumman to-date and volume growth on C-130J and F-35 vertical tail.

QHL’s work with Boeing has progressed across F-15, F/A-18 and AV-8B aircraft platforms. Moreover, the Company anticipates significant expansion of the business relationship in the forthcoming year.

Financial Score Card

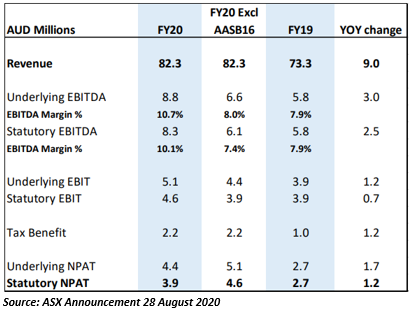

Over the year to 30 June 2020, sales revenue increased by 12% year on year to $82.3 million, on the back of all key contracts achieving revenue growth, including significant growth from the F-35 program, new commercial business for its Geelong site and an escalation in volumes for C-130 wing flaps.

The Company is at full-rate production for the present Northrop Grumman F-35 scope. Moreover, enlarged market share on the Marand F-35 vertical tail work generated greater volume.

Snapshot of QHL’s year-on-year financial performance:

Statutory EBITDA margin of 10.1% saw improvements compared to the prior year on a comparable basis. Modest price decreases on key contracts were compensated by effective cost control. This also offset the costs related to delivering initial articles of the 10 new parts awarded by Northrop Grumman late-2019. QHL anticipates moving these to full-rate production in FY21.

Furthermore, QHL reported an improvement of $0.7 million on FY19 in statutory EBIT of $4.6 million after taking into account a one-off restructuring charge of $0.5 million and net favourable EBIT impact from AASB16 of $0.7 million.

For the 12-month period to June 2020, the Company noted a net cash from operating activities of $0.2 million. The figure was unfavourable when compared with FY19, owing to a reversal of deferred income on the C-130J contract of $3.2 million, compared to a $0.8 million increase in deferred income in FY19.

Net bank debt of QHL grew by $6.1 million over the year to 30 June 2020 to finance the capital expenditure of $6.0 million towards new capability.

Additional Tailwinds for Quickstep

Potential significant additional tailwinds for Quickstep are indicated by the expansion to Commonwealth defence expenditure, and changes to procurement regulations. QHL believes that the opportunity space for its business in unmanned aircraft, guided weapons and aircraft maintenance, repair and overhaul would be boosted through an additional 35% budget growth over the coming 10 years.

As a result of this, QHL looks forward to making additional investments in domestic business development.

Moreover, growing existing order book and product development discussions with existing customers indicate incremental revenue opportunities for QHL within its core customer group. A significant component of QHL’s business development activity is its Boeing relationship, which is anticipated to expand in due course.

Significantly, QHL’s development programs with AMSL, Spirit Aerosystems and others place the Company well for a substantial move into the commercial aerospace segment, further leveraging its proprietary technology.

The Company believes that this strategy is generating benefits ahead of the plan through a compelling technology and value proposition, while judiciously consuming a notable amount of executive time.

Outlook

Given the backdrop of demonstrated resilience in a COVID-19 challenged industry segment, Quickstep believes that its outlook for FY21 is strong, with the following expectations:

- Growth of 5%-10% expected in customer revenues over FY20, not including any new contract wins

- Improvement in EBITDA anticipated over FY20, as efficiency initiatives are implemented, despite a material increase in R&D expenditure

- $1.5 million in annualised savings are forecast to be delivered through headcount reductions applied in June 2020

- Significant growth is expected in operating cash flow over FY20, as a result of enhanced profitability and growth in cash receipts from the C-130 contract

Most importantly, QHL is optimistic that opportunities would emerge in the post-COVID-19 era in the aerospace and defence sector, and this is expected to stay as a key feature of its strategic planning process.

Moreover, QHL believes that the impact of COVID-19 shall stay for some time, and the uncertainty is expected to reside in the increasingly competitive aerospace market. QHL’s core defence programs are anticipated to remain highly resilient while the Company plans to undertake further process improvements, technology deployment and several key efficiency initiatives to fast track the enhancement of its competitiveness over the coming months.

Related: ASX Defence-related Stocks and Investors’ Delight - ASB, XTE, DRO

QHL stock traded downward by 1.163% to settle at $0.085 on 31 August 2020.