Prescient Therapeutics Limited (ASX: PTX) is a clinical-stage oncology company that works on mutation causing cancer. The existing product portfolio of the company includes two drug candidates, PTX 100 and PTX 200, under the development phase.

Both the compounds are focused on turning off master switches by inhibiting the survival pathways of growth molecules that play a key role in multiple cancers. The technology works on a precision medicine approach that takes into account individual tumour variability, given the fact that different tumours have different drivers.

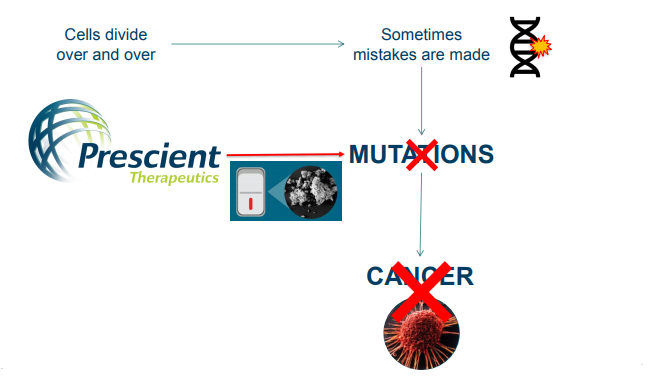

Prescient’s cancer treatment approach (Source: Company Presentation)

Prescient’s cancer treatment approach (Source: Company Presentation)

Let’s travel through the Prescient’s growth journey and developments achieved in 2019:

July 2019- Quarterly Update for three months ended 30 June 2019

On 24 July 2019, Prescient Therapeutics Limited released its quarterly results for three months ended 30 June 2019.

The company reported cash reserves of A$9.64 million as at the end of the June quarter. The cash balance outlines a net cash inflow of A$4.96 million on the back of funds received from the second tranche of share placement and right issue, which closed in April this year.

During the June quarter, Prescient incurred A$1.10 million in research and development mainly in relation to the ongoing clinical trials for PTX-200 and the cost linked with the preparation for the start of unique basket trial of PTX-100. However, the company informed that the costs for the quarter was less than budgeted cost due to the difference in timings.

The company also highlighted some positive developments witnessed in the industry that includes Ras pathway at the centre of biotech’s focus area. One big news to tap on was the first data posted by the biotech major Amgen Inc for a K-Ras inhibitor, which showed that the drug AMG 510 ceased the tumour growth in many patients with non-small cell colorectal cancer and lung cancer. This positive development has resulted in increased focus on Ras as a drug target.

PTX works on precision medicine approach for cancer treatment, with the multiple clinical programs underway in collaboration with some of the leading cancer clinicians across the globe. The capital support from institutional life science investors has strengthened company’s position at the time it enters Phase 1b basket clinical trial for its second targeted anti-cancer drug PTX-100 which targets Ras cancer pathway.

July 2019- Start of a Phase 1b trial of PTX-100

On 11 July 2019, Prescient announced the launch of basket study trial for its targeted anti-cancer drug candidate PTX-100 in Australia. The new study is reportedly designed to bring together the group of patients based on the mutational profile of their tumours and not on the basis of the tumours’ location.

The launch outlines the start of Phase 1b clinical trial following the success of Phase 1 clinical trial of PTX-100 that resulted in a safety profile with well-tolerated and stable disease in patients having advanced solid tumours.

As per the report, the trial would be conducted under the leadership of an internationally famous oncologist Professor H. Miles Prince AM, who is acting as a lead investigator of the study.

PTX 100 is positioned as an only Rho inhibitor in clinical development globally. This drug under investigation blocks geranylgeranyl transferase-1 (GGT-1), an enzyme responsible for cancer growth and activation of Rho, Rac and Ral circuits in cancer cells. PTX-100 disrupts the Ras pathway downstream, which targets cancer with both Ras and Rha mutations, leading to the death of cancer cells.

The company informed that up to 24 patients in this study would be tested to evaluate the efficacy and safety of drugs under two different sets of doses in participants with advanced malignancies including T-cell lymphomas, myeloma, gastric and pancreatic cancers. The drug is to be infused intravenously in a cycle of 14 days for about four cycles unless the toxicity is recorded.

Read more about the Phase 1b clinical trial of PTX 100

May 2019- Canadian Patent received for PTX-200

On 16 May 2019, clinical-stage oncology company notified that Canadian jurisdiction has granted a patent for its novel PH domain inhibitor- PTX-200, which successfully broadens the Prescient’s patent estate for the respective compound.

This patent provides PTX with intellectual property protection for PTX-200 in Canada until 2028. Specifically, it covers protection against taxanes and platinum compounds composed in PTX-200 aimed at the treatment of cancer patients.

PTX-200 is positioned as a highly promising compound that inhibits Akt, an essential tumour survival pathway, that plays a primary role in the development of several kinds of cancers. This compound is currently the focus of three clinical trials underway in breast cancer, Acute Myeloid Leukemia (AML), and ovarian cancer.

March 2019- Capital Raising of $9.1 million

On 25 March 2019, Prescient Therapeutics announced the capital raising of $9.1 million through a share placement and right issue.

Under the share placement program, the company raised $7.0 million in two tranches from Australian and United States’ life sciences institutional investors via the issue of ~140 million shares at a discounted issue price of $0.05 per share. In addition, Prescient announced the issue of one option for every two shares attached with the share placement at an exercise price of $0.0625 with an expiry of 31 March 2023. To oversee the share placement in the United States for the first time, the company appointed Roth Capital Partners, LLC as the US placement agent.

Prescient raised remaining $2.1 million capital through 1-for-5 non-renounceable right issue to existing shareholders at an issue price of $0.05 per share, with an attaching one for two option. The right issue was fully underwritten by Bell Potter, as per the report.

PTX Chairman, Steven Engle stated that this robust support and an extended investment base, particularly from investors with expertise in life science investing, strengthened the company’s ability to progress its two clinical stage oncology compounds (PTX-100 and PTX-200).

Second tranche of the placement offer was completed on 3 May 2019 with the issue of 104.7 million shares at an issue price of $0.05 per share and 52.3 million attaching options.

The company stated the use of the fund to be made in the progress of clinical programs, including clinical trial management and manufacturing of additional drugs. Funds are further to be utilised for working capital and business development purposes.

January 2019- Receipt of R&D Tax Rebate

Prescient Therapeutics Limited received $939,423 rebate from the Australian Government under the Research & Development Tax Incentive Program. The amount had been granted for the fiscal year 2018 which was duly accounted under the head receivable in the Prescient’s 2018 Annual Report and in the operating cash flow statement of March 2019 quarter at the time of receipt.

This tax incentive outlines the government’s program to refund 43.5% of eligible expenditure incurred by the company on research and development activities.

Stock Performance: PTX stock price surged up 4.651% to close at $0.045 on 24 July 2019. The stock has witnessed a positive price change of 10.26% in the past five days.

If you are interested in the personalised medicine space and would like to ensure Prescient Therapeutics keeps you updated on all their company activities and announcements, please update your details here.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.