Over the past few years, fashion retailing industry across the globe has undergone a magical transformation, backed by customersâ emphasis on fashion. Shift in consumer behaviour, technological advancements and emergence of online platform are among the various factors that are transforming the industry.

Fashion retailing serves as an intermediary between manufacturers and customers. Let us discuss two fashion retailers - Noni B Limited and City Chic Collective Limited, which are listed on ASX and focus on women's fashion products.

Noni B Limited (ASX: NBL)

As a ladiesâ fashion retailer, Noni B Limited focuses on superior service, style and fit. The retailer grew from two stores in Belmont and Swansea in the Australian state of New South Wales to more than 200 stores across the country.

With a market cap of $ 264.58 million and 96.91 million shares outstanding, the stock settled the dayâs trading session at $ 2.690 on 12 July 2019, down 1.47 % from its previous close. It has generated a YTD return of 0.74%, while its annual dividend yield stands at 4.76% (as per ASX).

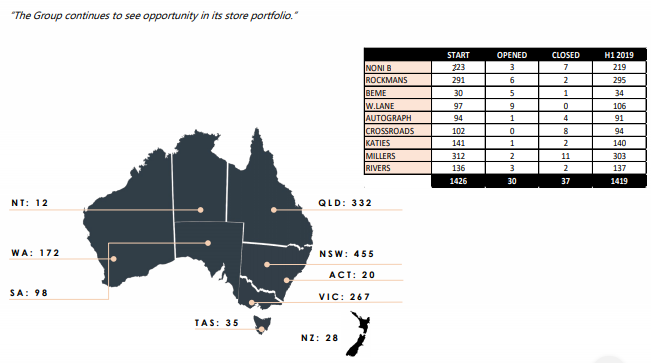

Combined Portfolio Footprint (Source: Investor Presentation)

Combined Portfolio Footprint (Source: Investor Presentation)

FY2019 Trading Update:

In an ASX release on 12 July 2019, the retailer provided its trading update for the financial year 2019. NBL reported that its total sales grew to nearly $ 864 million at the end of the 12 months to 30 June 2019, while its store network stood at 1,379 after a net movement of -47 stores.

During the period, the retailerâs online sales as a proportion of total sales continued to grow and accounted for 9.8% of its total sales. Its like-for-like sales were in line with the management and integration plan expectations, reaching -4.3%.

Owing to all these figures, which are preliminary and subject to finalisation and review by its auditors, Noni B expects to report $ 45 million in underlying earnings before interest, tax, depreciation and amortisation (EBITDA) for the financial year 2019, up circa 21% year-on-year from $ 37.2 million registered during the same period a year ago. The estimated underlying EBITDA is in accordance with the retailerâs guidance.

The retailer expressed its content towards NBLâs performance during the year, specifically the sales performance through the key trading periods of Christmas and Motherâs Day.

Director Appointment:

During the month of May, Noni B announced Jacqueline A Frank as a Non-Executive Director of the company. Holding a deep understanding of the Australian retail and fashion sector, Jacqueline is expected to make valuable contributions towards the companyâs goal of becoming one of the pre-eminent womenâs apparel retailers in the country, Richard Facioni, Chairman of Noni B, commented on the new director appointment.

Dividend Distribution:

In February 2019, NBL announced a dividend of $ 0.09 on fully paid ordinary shares. The dividend, related to a period of six months ended 30 December 2018, was paid on 22 March 2019.

H1 2019 Investor Presentation:

NBL gave its investor presentation for the first half of 2019 in February 2019, under which the company discussed its trading performance, 2019 half year review, integration & growth plan, online growth, and other aspects of its business.

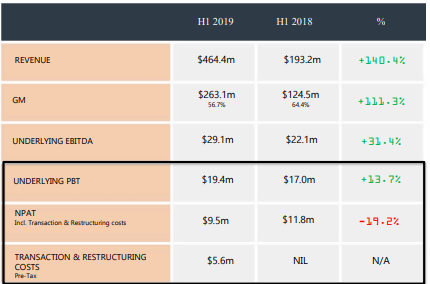

It was reported that during the first half of the financial year 2019, the total revenue stood at $ 464.4 million, representing a 140.4% increase. Moreover, the retailerâs underlying EBITDA was up 31.4% to $ 29.1 million and underlying pre-tax profit increased by 13.7% to $ 19.4 million.

Figure below depicts the companyâs performance during the first half of FY19.

2019 Half Year Review (Source: Investor Presentation)

City Chic Collective Limited (ASX: CCX)

Targeting sizes 14-24 and women aged 18-35, City Chic Collective Limited is a premium brand, which caters to its customers in more than 200 global locations. The company has partnerships with designers including Ed Hardy and Damn You Alexis. The multi-channel retailer got listed on ASX in May 1998 and is headquartered in the Australian state of New South Wales.

City Chic Snapshot (Source: Companyâs Report)

With a market cap of $ 346.03 million and 192.24 million shares outstanding, the stock was trading at $ 1.800 by the end of trading session on 12 July 2019. It has given a positive YTD return of 88.73%, while its annual dividend yield stands at 1.39% (as per ASX).

On 9 July 2019, the company gave a market update related to the ceasing of a substantial holder, Pendal Group Limited (ASX:PDL) & its Associates, Pendal Fund Services Limited.

Divestment Finalisation and Trading Update:

In late June 2019, City Chic updated the market that independent experts have favoured the sale of its Millers, Katies, Crossroads, Autograph and Rivers businesses in July 2018. The experts were in discussions concerning the post completion limited working capital adjustment under the business sale agreement for the sale.

The company will finalise the completion adjustment, in addition to other non-recurring expenses associated with the divestment, under the net profit after tax from discontinued operations for the financial year 2019.

Additionally, the company expects to report underlying earnings before interest, taxation, depreciation and amortisation (EBITDA) from continuing operations for FY19 in line with analyst consensus. Its underlying EBITDA is anticipated to be in the range of $ 24 million - $ 25 million.

Goldman Sachs Conference Presentation:

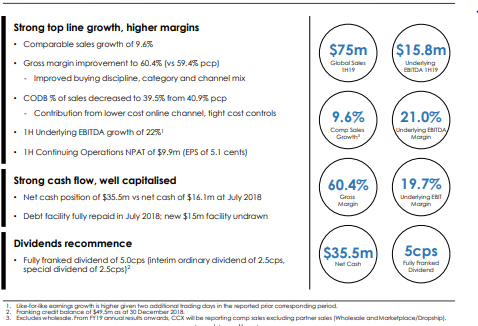

CCX, in April 2019, presented at Goldman Sachs Conference, giving details related to the company, its global, multi-channel business, store portfolio, online business, partners, 1H FY19 financial highlights and other business aspects.

The company reported that its online sales channel accounts for 40% of the total sales and is the most profitable channel, while its Bricks and Mortar business contributes towards half of total sales.

Chic City also unveiled a 9.6% comparable sales growth during the first half of FY19, while its underlying EBITDA stood at $ 15.8 million, representing a 22% increase from the same period a year ago. Moreover, the companyâs first half continuing operations NPAT reached $ 9.9 million. It also reported to have paid a fully franked dividend of $ 0.05 per share including an interim ordinary dividend of $ 0.025 per share and a special dividend of $ 0.025 per share, for the period on 19 March 2019.

1H FY19 Financial Highlights (Source: Companyâs Report)

City Chic plans to focus on boosting its global presence. The company intends to grow its website in the United States by offering new lifestyles and broader range, as well as focusing on targeted customer acquisition and improved customer touchpoint. It plans to enter into new partnerships with entities in the United States and Europe / UK, as well as explore new disruptive retail models and collaboration opportunities, as part of its continued efforts towards growing its international presence. Additionally, the company will continue European trial through wholesale.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.