Highlights

- VKA shares surged 50% following an update on the First Hit Gold Project.

- A comprehensive strategic review has commenced at the company’s First Hit Gold Project.

- This review seeks to leverage the inherent value and exploration potential within the company’s tenure amid record gold prices.

- The First Hit Project is located along the Ida Fault and Zuleika Shear, known for significant gold deposits.

- VKA intends to undertake a drilling program, expected to commence in the December quarter.

Shares of Viking Mines Limited (ASX:VKA) experienced a significant rise on Thursday (10 October 2024), following an important update on the company’s First Hit Gold Project in Western Australia.

The company has initiated a comprehensive strategic review to assess the gold potential and opportunities at its 100%-owned First Hit Project. This review is driven by the substantial inherent value and exploration potential within the company’s tenure, aiming to maximise the benefits of current favourable market conditions.

The project is located along the Ida Fault and Zuleika Shear, areas known for significant gold deposits. It is positioned adjacent to ASX-listed Ora Banda Mining’s Riverina deposit and the Davyhurst mill. At its core, the tenement features a 25km strike length that fully covers the Zuleika Shear, which has seen minimal modern exploration and limited bedrock drilling.

VKA holds granted tenure in the district of approximately 283km2 and is pursuing additional tenement applications for a land package of around 480km2.

Strategic Review to Evaluate Mineral Resource Potential

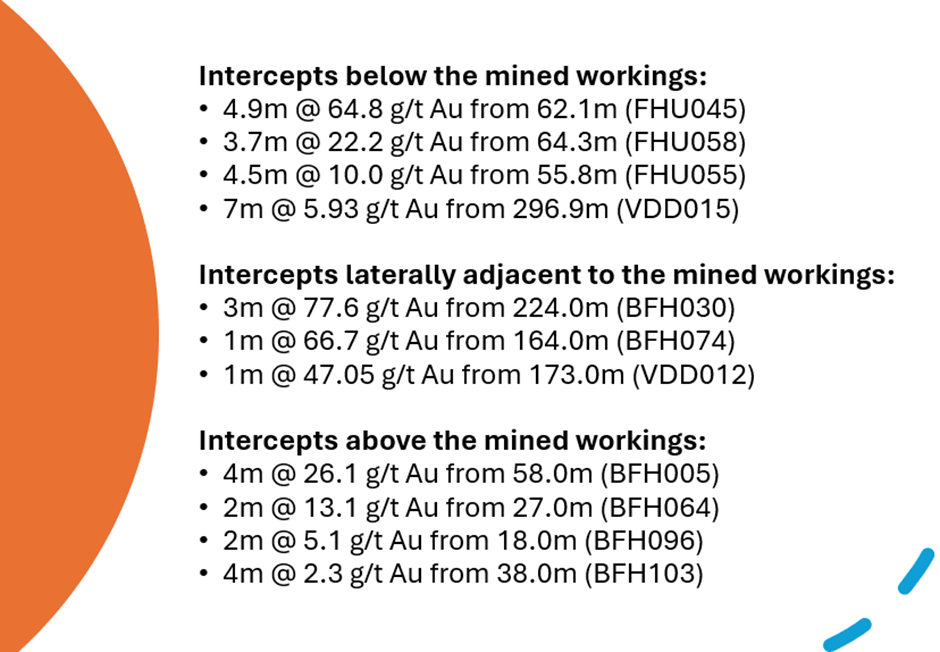

The review aims to assess the feasibility of establishing a mineral resource through further exploration. Past activities from 2021-22 uncovered unmined high-grade intercepts along the strike, and new drill results from Viking’s exploration efforts indicated promising potential for mineral resource expansion.

Image source: Company update

The review will also focus on the viability of mining operations, using existing underground infrastructure. Additionally, the option of using nearby third-party processing facilities, such as Ora Banda Mining's Davyhurst mill, will be analysed to minimise start-up costs and expedite production.

Technical data, including soil sampling, geophysics, historical drilling, and underground face sampling, will be thoroughly examined. Previous drilling targets will be reassessed, and follow-up exploration work will be planned accordingly.

Gold prices transform project economics

When the mine was last operational in 2002, gold prices were around US$325 per ounce. Today, with prices nearing US$1,870 per ounce, the project’s potential profitability has dramatically increased. This rise in gold prices will be a central consideration in Viking’s evaluation of the project’s long-term viability.

Near-Term Drilling to Target High-Priority Areas

Upon completing the review, which is expected to begin immediately, the company plans to outline a detailed exploration program, focusing on near-term drilling to test high-priority targets. The drilling is expected to commence in the December quarter.

VKA shares surge 50%

Following the update, VKA’s share price soared by 50% to trade at AU$0.012 apiece at the time of writing on 10 October 2024.