Highlights

- A Cu-Zn zone was identified in initial sampling at Remorse Target.

- During the reported period, TEM confirmed a silver occurrence in rock chips at the Calais Target.

- At the Range Project, anomalous gold results were obtained from rock chip samples from a number of outcrops.

- TEM boosted its project portfolio with the acquisition of Five Wheels and Elephant projects.

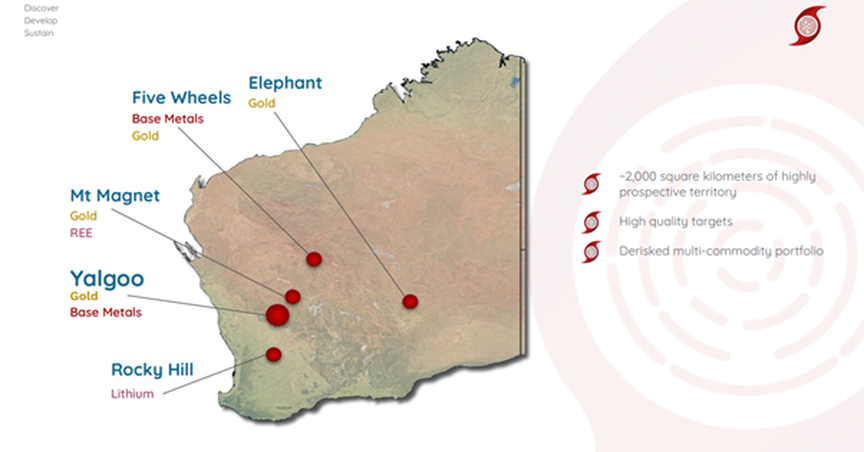

Tempest Minerals Limited (ASX: TEM) has a diversified project portfolio focused on base, energy, and precious metals. The company is committed to harnessing technology and approaching projects in new ways, aiming at making world-class discoveries at its project sites.

Recently, the firm released its first-half report for the period ended 31 December 2023. Read about the key developments that took place during the half year below.

Image source: Company presentation

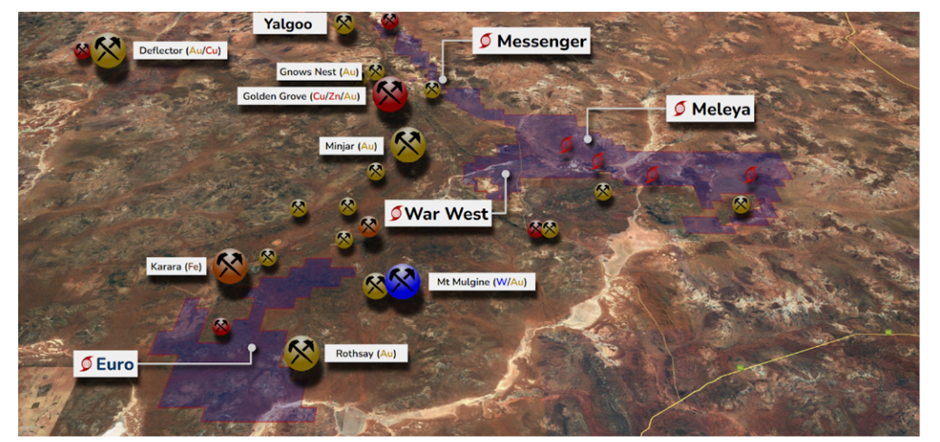

High-priority drill targets across Yalgoo Region

Tempest’s flagship project is its holding in the Yalgoo region of Western Australia, totalling over 1,000km2.

During the reported period, the company received regional electromagnetic survey results, covering over 2,000km of line survey measurements. Importantly, geophysical surveys revealed a significant EM anomaly coinciding with the promising 4km-long "Remorse" base metal target, previously identified in the area.

Overview of TEM Yalgoo projects

Image source: company update

Project Areas

- Remorse Target

Initial geochemical surveys identified a zone enriched in copper and zinc at this target. Notably, the distribution of these metals exhibits a "layered" pattern, with copper predominantly concentrated in the NorthEast quadrant, while zinc shows a more intense and dispersed anomaly extending towards the SouthWest. - Sanity Target

This target is 2km south of the Remorse Target. Analysis of geochemical data revealed strong, coherent zones enriched in specific elements. Soil samples from these zones exhibit peak concentrations >80 ppb. The rock chips in the same geology trends have delivered results of <7gpt Au and 0.2% Cu and >60% Fe and are along strike from and likely part of a broader mineralised system at the Barron Rothchild deposit. Read more here. Tempest is looking forward to advancing surface works and approvals with the potential for drilling in the second quarter of the year 2024.

- Calais Target

During the reporting period, TEM confirmed a silver occurrence in rock chips at the target.

In order to take forward these targets, Tempest is planning and implementing further programs, including work on regulatory approvals for potential drilling. Also, a heritage survey and multiple field programs are being conducted by TEM in this direction.

- Anomalous gold results at Range Project

The Range Project is located in the heart of the Mount Magnet mineral field and 5km along strike of the prolific multi-million ounceMount Magnet Operations.

TEM has outlined a hypothesis based on the review and re-interpretation of the project: ‘Key geology in the mineralised zone of the Britannia Well pit and other mining centres in Mt Magnet may persist in a newly recognised orientation’. Also, anomalous gold results were obtained from field verification of rock chip samples from a number of outcrops.

Acquisition of Five Wheels and Elephant Projects

In July 2023, TEM acquired the Five Wheels Project, with initial exploration kicked off in October. The project is near to the world-class Rumble Resources Ltd (ASX:RTR) and the emerging Strickland Metals Ltd (ASX:STR) zinc-lead-copper discoveries.

Tempest completed the acquisition of the Elephant Project in January 2024. The project comprises over 190 square kilometres of highly prospective exploration leases nearby the Tropicana Mine in the Fraser Range province.

TEM shares traded at AU$0.008 on 12 March 2024.