Highlights

- Empire Resources (ASX:ERL) has made notable progress amid challenging times and has continued to deliver results across its projects

- ERL plans to return to its Penny’s Gold Project to follow up on the success of recent AC drilling

- ERL also noted a steady development of the Penny’s Find Gold Mine and looks to fast-track progress in 2023

Empire Resources Limited (ASX:ERL) is a gold- and copper-focused explorer and developer engaged in building value through exploration. ERL’s exploration project portfolio comprises significant tenement holdings located in Western Australia. These are prospective for gold, copper and base metals that are in high demand.

The company has made notable progress across these projects in the financial year ended 30 June 2022.

Drilling undertaken during the year

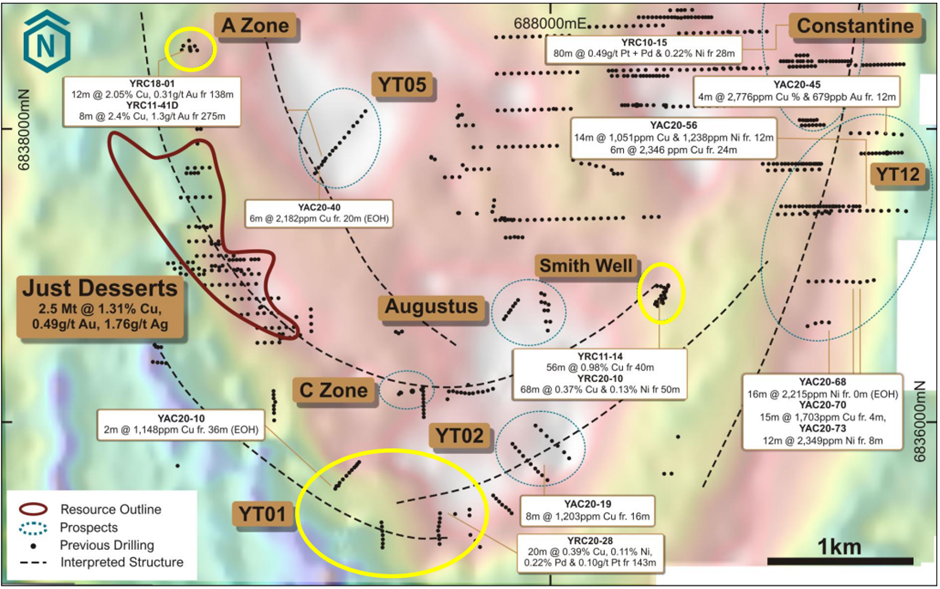

ERL finalised 8,212 metres of drilling during the year, which included 2,923 metres of diamond drilling at its flagship Yuinmery project. This drilling delivered highly encouraging results and ERL has now planned exploration programs to continue to advance these exciting prospects in 2023.

Source: ERL

ERL’s upcoming exploration plans include returning to its Penny’s Gold Project to follow up on the success of the recent aircore (AC) drilling of historical targets. Strongly anomalous and high-grade gold results were delivered from over half of the 69 holes drilled during the program.

The company also arrived at an outstanding outcome that highlights the prospectivity for the project to host undiscovered gold deposits similar to the nearby Penny’s Find Gold Mine.

Advancements at Penny’s Find Gold Mine

During the period, ERL also noted the steady development of Penny’s Find Gold Mine. The work at this project is managed by Horizon Minerals Limited (ASX:HRZ). HRZ delivered an updated JORC-compliant resource for the project, and intends to undertake the underground development of Penny’s Find Gold Mine in tandem with other underground gold projects in the short term.

Source: ERL

ERL retains an attractive royalty entitlement on the gold extracted from Penny’s Find Gold Mine plus milestone development payments of up to AU$400,000.

Managing finances and cash position

The ERL management has been prudent in managing the company’s finances throughout the period amid rising global costs. During such challenging times, ERL has continued to deliver across all its exploration objectives with 77% of all spending directed towards direct exploration expenditure.

The company recently declared a 1:5 Non-Renounceable Rights Issue that is intended to top up the available funds by around AU$1.45 million. This is based on the issuance of 207.7 million shares at 0.7 cents per share, and the capital raising will help in financing the upcoming exploration programs ERL looks forward to undertaking in 2023.

ERL’s cash on hand at the September quarter-end stood at AU$1.64 million.

Going forward, the company looks forward to fast-tracking its progress across its project portfolio in 2023 with a broader exploration program across its exciting portfolio of prospects.

ERL’s stock was noted at AU$0.007 on 15 November 2022.