Mcmillan Shakespeare Limited

McMillan Shakespeare Limited (ASX:MMS), based out of Melbourne, offers vehicle leasing administration, salary packaging, fleet management, and retail financial services to customers located in the United Kingdom, Australia, and New Zealand. It operates via three key business divisions- Asset Management, Group Remuneration Services and Retail Financial Services.

With a market capitalisation of AUD 1.1 billion and around 83.2 million outstanding shares, the MMS stock closed the market trading on 16th May 2019 at AUD 12.670, diving 4.02% by AUD 0.530. Around 955.7k shares were traded through the day. The company has an annual dividend yield of 5.61% (As per ASX). Recently, Credit Suisse Holdings (Australia) Limited became a major shareholder in the company upon purchase of 4,310,956 common stock shares, representing 5.18% voting power.

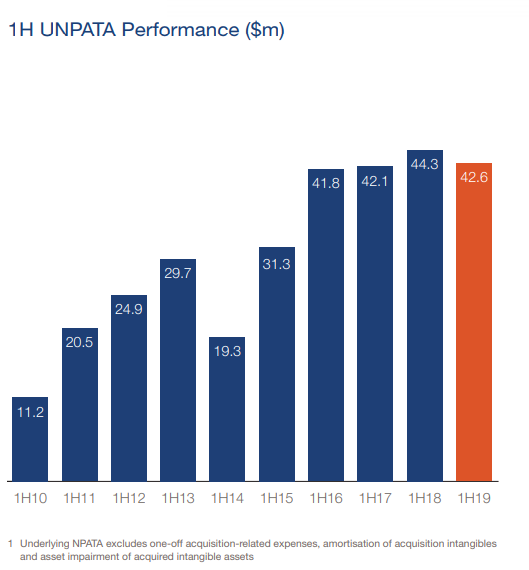

Mcmillan Shakespeare reported the revenue from ordinary activities at $ 273.1 million, up 1.2% on pcp with an NPAT of $ 34.5 million (down 1.2%) for the half year ended 31ST Decemberâ18. The company also declared a fully franked dividend of AUD 0.34 per share related to the six-month period. The UNPATA was down 3.9% to $ 42.6 million and the trend for the same is illustrated below.

Source: Half year 2019 results PresentationÂ

Westpac Banking Corporation

Westpac Banking Corporation (ASX:WBC) offers a diverse lot of banking and financial services to customers located in Australia, New Zealand, Asia, the Pacific region, and other places worldwide. The financial sector company has a market cap of around AUD 92.71 billion with ~ 3.45 billion outstanding shares. At the close of the market session on 16th May 2019, the WBC stockâs last trading price stood at AUD 25.850, down 3.87% by AUD 1.040 with ~12.22 million shares traded. Westpac Banking Corporationâs annual dividend yield stands high at ~ 6.99%. Besides, the WBC stock has also generated a positive YTD return of 9.89%.

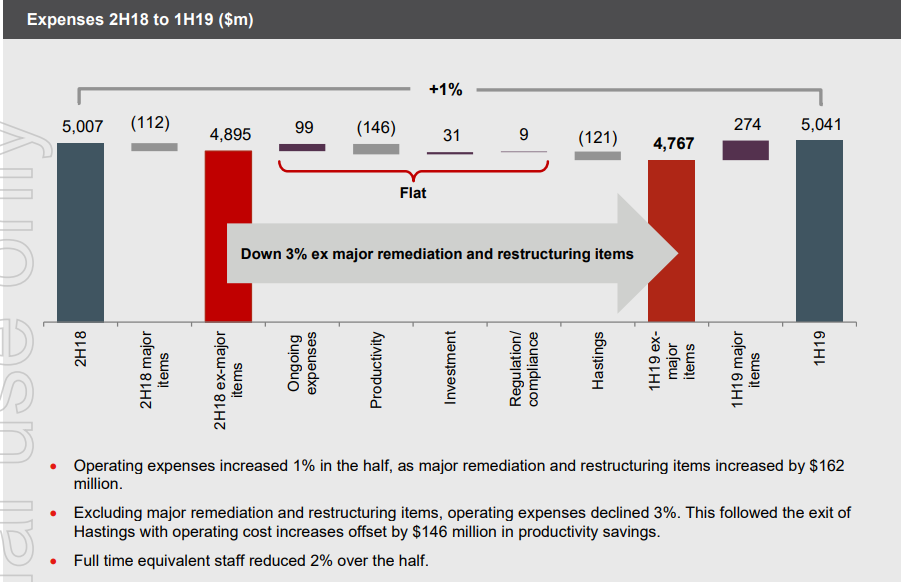

In its half yearly report for the six months to 31st December 2018, Westpac reported a slightly weak performance amidst soft business conditions with the bank dealing decisively with outstanding issues, including remediation and resetting the wealth strategy. The statutory net profit was posted at $ ~ 3,173 million, down 24% while the cash earnings also reduced by 22% to ~ $ 3,296 million. The trend for companyâs expenses from the prior half (2H18) to the first half is as follows:

Source: 2019 Half Year Result

Source: 2019 Half Year Result

However, the half-year results confirmed the strength of companyâs balance sheet and the common equity Tier 1 capital ratio of 10.64% also remained consistent in a low growth environment.

Afterpay Touch Group Limited

The technology driven Afterpay Touch Group Limited (ASX:APT) provides payment services (Buy Now Pay Later) through the payments platform for apparels, automotive parts, personal care, sports, shoes, watches, foods, beverages, and many other varieties of products.

On 3rd May 2019, the company announced to have signed a USD 300-million receivables funding facility with Citi to support the expansion plans for Afterpayâs business at the United States. This is a key component of the companyâs capital management strategy. According to the information, the US facility will operate as a warehouse funding facility with a term of 24 months.

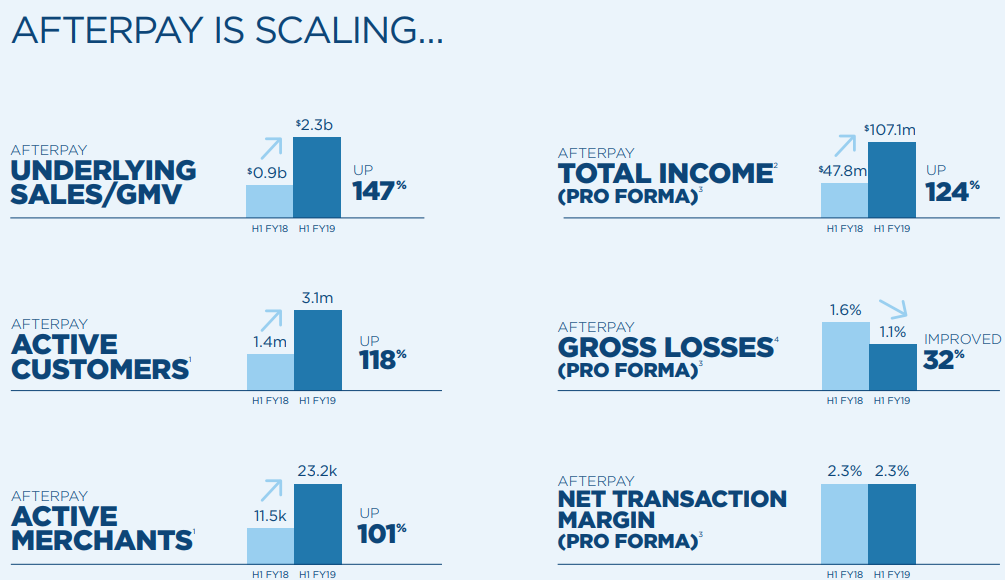

A snapshot of Afterpayâs half-yearly results for six months to 31st Decemberâ18 is as follows:

Source: Companyâs H1 FY19 Results Presentation

Source: Companyâs H1 FY19 Results Presentation

With a market capitalisation of AUD 6.24 billion, the APT stock settled the dayâs trading at AUD 25.460, down 2.6% by AUD 0.680 with ~ 1.98 million shares traded through the day. Besides, APTâs YTD return stands high and positive at 117.83%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.