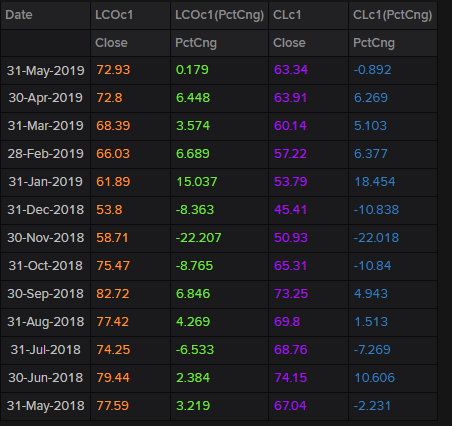

Crude oil future prices further inched up in April 2019. The benchmark Brent Crude Futures settled at US$72.80 in April 2019, up by almost 6.45% as compared to the previous month close of US$68.39. The WTI Crude followed the same footprints, and the prices settled at US$63.91, up by 6.26% as compared to its previous month close of US$60.14.

Source:: Thomson Reuters ; Monthly Close

The relative gains in the crude oil prices and returns generated by the commodity is now making energy investors to look at the oil prospects to generate healthy returns. The increase in oil prices marked a fourth consecutive uprise in April, and the prices approached almost to its six months high during the month.

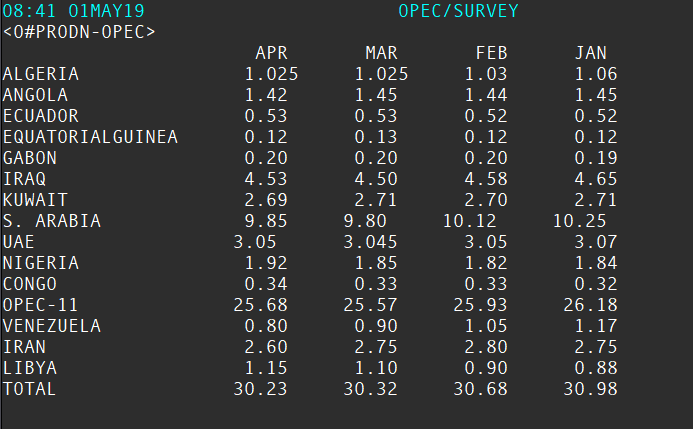

Price increase during the month marked a decline in global oil inventories during the first four months of the year amid voluntary production cut from OPEC and various other macro factors, which led to a heightened market perception of oil supply risk and supported the prices in the global market. The middle east angst is also pulling strings of crude oil.

Monthly OPEC Production (Source: Thomson Reuters; OPEC Production Survey)

Monthly OPEC Production (Source: Thomson Reuters; OPEC Production Survey)

On 22nd April 2019, the United States mentioned that the waiver of 8 countries, which allows them to import Iranian oil, would not pass its deadline of 2nd May 2019, which further inched up the crude prices.

And, now the energy investors are eyeing for further forecasts to reckon the crude direction ahead. One such forecast is provided by the United States Energy Information Administration (EIA) in its recent short-term energy outlook. The forecast suggests that EIA is expecting the crude oil production and export in Iran and Venezuela to decline; although the production from other OPEC members is expected by the EIA to partially indemnify the production shortage and export decline.

However, it is also to be noted that the OPEC cartel is due to meet in July and as per the EIA estimation, the kingpin Saudi Arabia, the United Arab Emirates, Kuwait and Russia would likely to inch up the production to backfill the Iranian oil production post the monthly meeting, where pivotal decision could be taken up by the consortium over the production guidance for coming months.

As per the EIA estimation, the crude oil production from OPEC would average at 30.3 million barrels a day in the year 2019, which is still down, as compared to the OPEC average production of 32 million barrels a day in the year 2018. The association further expects a production fall from the Organisation of Oil Exporting Counties, by 0.4 million barrels per day to average at 29.8 million barrels per day in the year 2020.

The export loss from Venezuela and Iran is estimated to be the substantial reason for the projections; however, as mentioned above, production from other cartel members are expected to offset the loss partially.

Inventories are expected to decline by 0.2 million barrels per day by 2019 globally and is expected to inch up by 0.1 million barrels per day in 2020. As per the EIA estimations, the global demand for oil surpasses the supply in the year 2019.

However, the EIA revised the production level for the United States amid an increase in drilling activities and rigs to 13.4 million barrels a day, up by 0.3 million barrels a day projected previously by the EIA.

In a nutshell, the energy sector is expected to get dominated by the shortage in supply and high demand of oil, however, the energy investors should keep a hawk-eye on the United States, which is strengthening its drilling capacity and acting as a significant contributor towards the crude fall time to time.

On the demand front, the energy investors should watch over the development in the U.S-China trade war, which contains the potential to hamper the global economic conditions, and in a cascade, ability to hamper the energy demand in the global economy.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.