National Storage REIT

National Storage REIT (ASX: NSR) focusses on driving organic growth across its 146 storage centres and executing a strong pipeline of acquisition and development opportunities. The company offers services like self-storage, climate-controlled wine storage, business storage, vehicle storage, packaging, insurance, vehicle and trailer hire and other value-added services.

The company announced an update on the distribution of interim dividend on 27th Feb 2019. The dividend was related to a period of six months, equivalent to AUD 0.045. The company notified that 100 per cent of the dividend would be unfranked one. NSR also informed about the Dividend reinvestment plan (DRP) under which the DRP price would be AUD 1.818, which is at 2 per cent discount rate. The company kept cash payment as an alternate option if security holders donât want to participate in the DRP.

The annual dividend yield of the company currently stands at 5.4%.

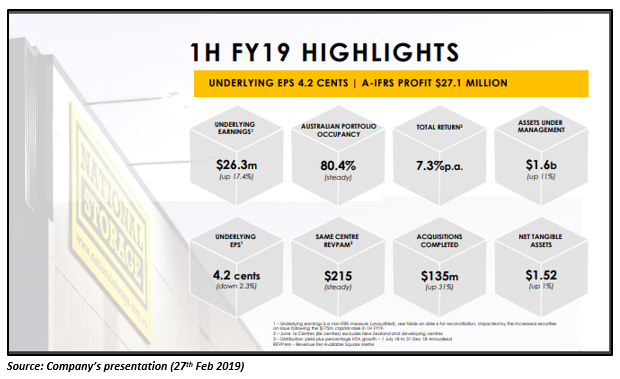

The company also published its financial results for the half year ending 31st December 2018 on 27th Feb 2019. NSR reported its International Financial Reporting Standards (IFRS) profit after tax of $27.1 million and underlying earnings of $26.3 million in 1H FY19. The company confirmed the interim distribution of 4.5 cps for the period 1H FY19.

The companyâs stock closed the day lower at AUD 1.735 (As on 17th May 2019), down by 0.28 per cent relative to the last close. Around 1,236,212 number of NSR shares were in trade today. The market capitalisation of the stock was recorded at AUD 1.17 billion today. The stock reported a 52-week high and low value of AUD 1.907 and AUD 1.518, respectively.

Rural Funds Group

Headquartered in Australian Capital Territory, Rural Funds Group (ASX: RFF) holds a varied portfolio of premium quality agricultural assets of Australia that are rented to skilled agricultural operators or tenants. The company derives revenue from long-term leases across six sectors including poultry infrastructure, almond orchards, cotton assets, cattle assets, vineyards and macadamia orchards.

In an announcement on 1st March 2019, the company announced the distribution of ordinary dividend related to a period of one quarter. The declared dividend was payable on 30th April 2019 with the ex-date and record date of 28th March 2019 and 29th March 2019 respectively. The total dividend amounted to AUD 0.02607500, and the 100 per cent dividend was unfranked. The dividend reinvestment plan was also applicable at a DRP discount rate of 1.5 per cent.

The Distribution Reinvestment price was announced in another update by the company on 10th April 2019. The DRP price was AUD 2.24000 that was calculated by taking the arithmetic average of volume weighted average price of units traded on ASX during the 20 trading days before the Record Date (29th March 2019). The company confirmed the payment of distribution on 30th April 2019.

The annual dividend yield of the company currently stands at 4.63%.

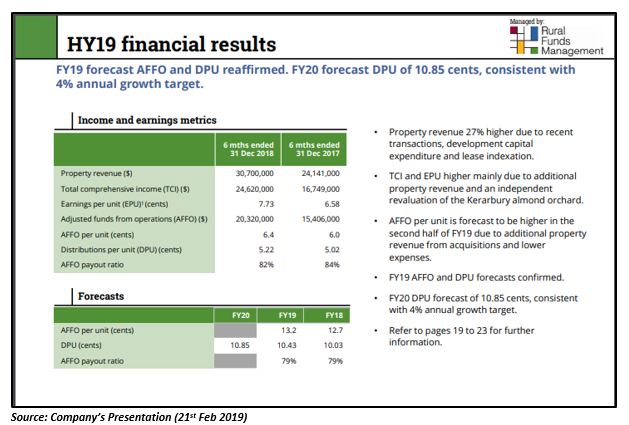

The company released the presentation of its financial results for the half year ending 31st December 2018 on 21st Feb 2019. The earnings of the company rose 17 per cent to 7.73 cents per unit (cpu) in comparison to the prior corresponding period. The Adjusted funds from operations (AFFO) stood at 6.4 cpu during the period. The Distributions per unit (DPU) rose by 4 per cent in comparison to the prior corresponding period to 5.22 cents.

The companyâs stock advanced 1.794 per cent on 17th May 2019 and closed higher at AUD 2.270. The market cap of the company was recorded at AUD 745.41 million at the time of writing the report. There were several troughs and crests in the stock today. The stock fluctuated between a high and low value of AUD 2.27 and AUD 2.24, respectively. The stock has generated a YTD return of 1.83 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.