The ongoing earnings season is important being the financial year ending for many companies in Australia. We are discussing three financial companies/bank which came out with their results for full year or with important financial updates.

Australia And New Zealand Banking Group Limited

Australia And New Zealand Banking Group Limited (ASX: ANZ) provides banking and financial products and services to ~8 million customers with footprints in approximately 34 markets. Recently, the regulatory authority, the Australian Prudential Regulation Authority (APRA), decided to lower the limit for Australian Authorised Deposit-taking Institutionsâ (ADI) exposures to related entities from 50% of Level 1 Total capital to 25% of Level 1 Tier 1 capital. The implementation will be effective from January 2021.

The bank recently completed its 55% stake sale in Cambodian Joint Venture (JV) ANZ Royal Bank to J Trust which was in-line with bankâs strategy to simplify the business with key focus on institutional business in the region.

As per the recently release of Pillar 3 for June quarter, total provision charge amounted to $209 million for the quarter were almost flat as compared to H1FY19 whereas the individual provision rose to $258 million. Total loss rate at 13bp was in-line with the loss rate of 13bp in H1FY19.

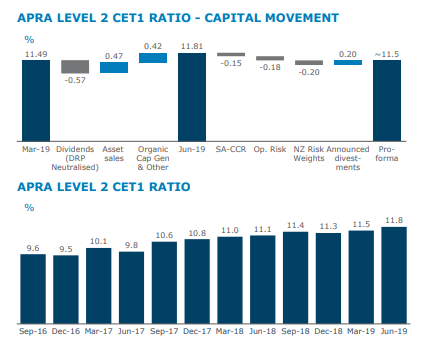

At the end of June quarter, Group Common Equity Tier 1 (CET1) (Level 2) ratio stood at 11.8%, am improvement of 30bp during the quarter. On a pro-forma basis, ANZâs Level 2 CET1 ratio was 11.5% at the end of the period, after inclusion of announced divestments and capital changes.

Capital and Funding (Source: Company Reports)

In-line with the anticipation, housing portfolio posted a decline of 0.7% in 3QFY19 with owner occupied loans and investor loans witnessing downtick of 0.2% and 1.8%, respectively, as compared with March 2019. Since 1HFY19 earnings, the bank has taken actions to provide more transparency and consistency with regards to home loan application and assessment process. Consequently, home loan applications witnessed some signs of improvement in July 2019.

1HFY19 Results Highlights: The bank reported a statutory net profit after tax (NPAT) of NZ$929 million, a decline of 4% over the corresponding prior-year period. Cash NPAT at NZ$1,114 million witnessed a growth of 18% on account of one-time gain from the sale of life insurance company OnePath Life (NZ) Limited and a 25% stake sale in Paymark Limited. Expenses for the period witnessed a decline of 1% amid divestment impact of OnePath Life (NZ) Limited. Customer deposits and gross lending posted a growth of 7% and 4%, respectively during the period. The bank witnessed low levels of credit losses, indicating the improvement in credit quality and benign credit environment.

At the current market price of $26.610, the stock is trading at price to earnings multiple of 26.610x with annual dividend yield at 5.99% and market capitalization at $75.74 billion. 52-week trading range stands at $22.980 to $30.350. The stock has gained ~12% on YTD basis.

Money3 Corporation Limited

Money3 Corporation Limited (ASX: MNY) is engaged with the provision of finance specialising in the delivery of secured automotive loans as well as secured and unsecured personal loans in Australia and New Zealand.

The company recently announced 100% franked, ordinary fully paid dividend of AUD 0.05000 with ex and payment date of September 23, 2019 and October 22, 2019, respectively.

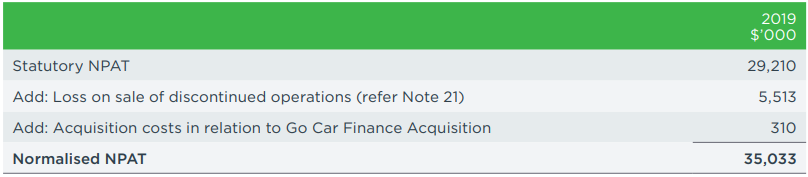

Key Highlights of FY19 Performance: The company posted total revenue of $91.7 million, posting a y-o-y growth of 24.6% during the period. Normalised Net Profit After Tax (NPAT) for FY19 came in at $35 million as compared to $32 million in FY18, in-line with the guidance. The statutory NPAT for the period stood at $29.2 million. The period saw a 48.1% increase in gross loan book to $374 million as compared to $ 252.54 million in FY18.

Reconciliation of the normalised NPAT (Source: Company Reports)

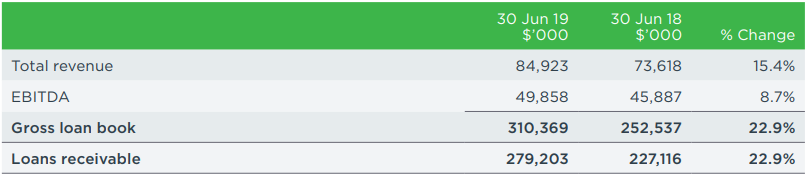

On segment performance front, Broker Division (Australia) which consists of secured automotive loans up to $35,000 with terms up to 60 months, posted a record growth of loans settled, loan book and revenues. During the period, company settled more than 19,000 loans, representing a y-o-y growth of 24.6% against FY18. Total revenue, gross loan book and loan receivable at 84.9 million, 310.4 million and 279.2 million posted a y-o-y growth of 15.4%, 22.9% and 22.9%, respectively. The segment inked the partnerships with more than 150 accredited independent brokers in Australia and accounted for ~70% of the new originations.

Broker Division (Australia) (Source: Company Reports)

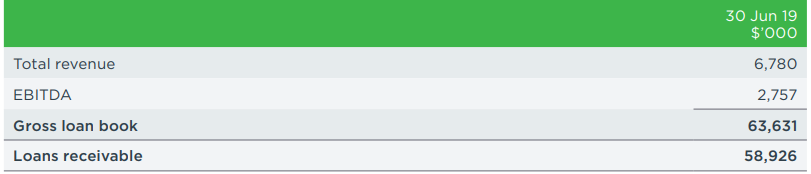

International (Go Car Finance, New Zealand) segment posted total revenue of $6.78 million with EBITDA and gross loan book at $2.575 million and $63.6 million, respectively. As per the Groupâs long-term strategy, the company had acquired Go Car Finance business, a provider of secured automotive loans, on 12 March 2019 which is operated across New Zealand. Post-acquisition, the business saw a y-o-y growth of 17.1% in gross loan book.

International (Go Car Finance, New Zealand) (Source: Company Reports)

Branch and Online segment (Discontinued) segment during the year contributed positively to the growth of the Group with total revenue and EBITDA growth coming in at 5.8% and 15.4% on y-o-y basis. The numbers from the segment is included for the period of 1 July 2018 to 20 May 2019 as the business was sold-off.

The company continues its focus to increase market share of its existing, highly profitable portfolio of vehicle receivables with launching a new suite of products broadening the market appeal. With approximately $100 million in funding available, the group is aiming loan book growth by ~30% for FY20.

At the current market price of $2.190, the stock is available at the price to earnings multiple of 10.53x with market capitalization at $382.46 million and annual dividend yield at 4.76%. The stock is currently trading towards the higher end of its 52-week trading range of $1.50 to $2.310. The stock has gained ~28% on YTD basis.

AUB Group Limited

AUB Group Limited (ASX: AUB) is the largest equity-based insurance broker network in Australasia with ~A$3.2 billion GWP across its network of 93 businesses. Australia contributes approximately 20% of the market share related to commercial SME insurance broking. In New Zealand, the Group has partnerships and holds equity stakes in 7 prominent insurance brokers.

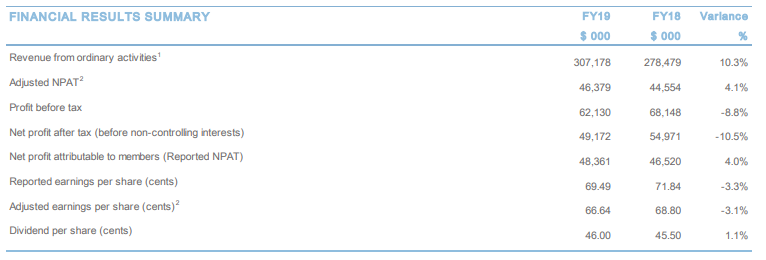

The company declared a 100% franked, final dividend of 32.5 cents per share which brought the total announced dividend for FY19 at 46.0 cents per share, a rise of 1.1% on 45.5 cents per share in FY18.

The Group recently released its results for financial year 2019 with net profit after tax (Reported NPAT) at $48.4 million, posting a rise of 4% on $46.5 million in FY18. The growth was seen primarily on account of underlying performance of the business as reflected in the increase in Adjusted NPAT. On an Adjusted basis, earnings per share (EPS) saw a y-o-y decline of 3.1% to 66.64 cents per share due to equity capital raising in November 2018.

Financial Summary (Source: Company Reports)

The Group was benefited from the hike in the stake in Australian broking businesses (44% of Adroit Holdings, 17% of Northlake Holdings) and New Zealand broking businesses (50% of BrokerWeb Risk Services) along with an acquisition within the underwriting agency business (50% of Cinesura Pty Ltd).

The group kept a keen eye to manage its corporate costs which resulted in an improvement of corporate cost-to Adjusted PBT ratio of 16.5% during the period as compared with 17.4% in FY18.

Net assets at the end of the period stood at $483.4 million as compared to $357.2 million in the corresponding prior-year period. Look through gearing posted a decline of 22% at the completion of FY19 as compared with 31% in FY18 on account of partial repayment of loan facility.

Outlook: Going forward, the company expects above-average growth from Insurance Broking in New Zealand and Australia along with the Underwriting Agencies. However, this will be impacted by various factors such as changes in lease accounting, fall in interest rates, decline in revenues from Canberra post restructuring, legal and financing costs related to acquisition, lag to benefit from cost-out activities, etc. Considering all the above factors, the Management expects to achieve adjusted NPAT growth in the range of 4% - 6% in FY20. The projection does not include the favorable impact arising from new acquisitions or shareholding increases.

At the current market price of $11.00, the stock is available at the price to earnings multiple of 16.23x with market capitalization of $784.27 million and annual dividend yield of 4.26%. The stock has corrected ~14% on YTD basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.