Highlights:

- Enphase Energy, Inc. (NASDAQ:ENPH) reported revenue of US$ 530.2 million.

- Ceridian HCM Holding Inc. (NYSE:CDAY) shares gained over 42 per cent in the past month.

- Autodesk, Inc. (NASDAQ:ADSK) posted revenue of US$ 1,170 million in Q1 2023.

The US stock market ended its worst first half of a year in more than 50 years, and all major indexes plummeted this year. The S&P 500 also declined close to 20 per cent this year. However, few of the companies did well in S&P 500.

Here, we explore four S&P 500 companies along with Kalkine Media® and look at their performances:

Enphase Energy, Inc. (NASDAQ:ENPH)

Enphase manufactures and sells solar micro-inverters. With over 2,000 employees, Enphase has a market cap of US$ 40.8 billion.

ENPH stock surged over 63 per cent year-to-date. Shares of Enphase Energy grew close to 80 per cent over the past year.

In Q2 2022, Enphase achieved a revenue of US$ 530.2 million. The company said it shipped 3,348,553 microinverters in the reported quarter and 132.4-megawatt hours of Enphase IQ Batteries.

Its GAAP net income for the second quarter of 2022 was US$ 77.0 million, while non-GAAP net income was US$ 149.9 million.

Ceridian HCM Holding Inc. (NYSE:CDAY)

Ceridian HCM is a US company that provides human resources software services and has a market cap of US$ 10.8 billion.

CDAY stock gained over 42 per cent in the past month. In the last six months, shares of Ceridian dropped over one per cent.

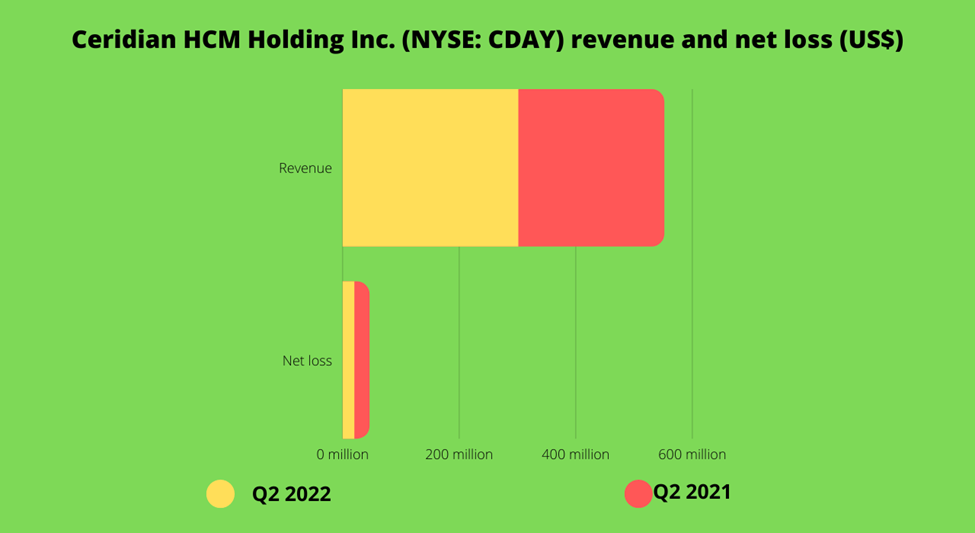

Ceridian reported its second-quarter results for fiscal 2022 early this month, on August 3. Its Q2 2022 revenue galloped 20.3 per cent year-over-year to US$ 301.2 million. It was US$ 250.4 million in the year-ago quarter.

Ceridian posted a net loss of US$ 19.8 million in Q2 2022 compared to US$ 25.8 million in Q2 2021.

As of August 16, 2022, CDAY stocks have a Relative Strength Index of 76.77 as per Refinitiv data. It implies that the stock is in a stable zone currently.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Autodesk, Inc. (NASDAQ:ADSK)

Autodesk is a US multinational software company that provides software products to a slew of industries and it has a market cap of US$ 50.9 billion.

The ADSK stock rose 0.12 per cent in the past six months. However, it soared over 32 per cent in the past month.

In its fiscal 2023 Q1 results, Autodesk earned a total net revenue of US$ 1,170 million, an increase of 18 per cent from US$ 989 million in the previous quarter of the last year.

Autodesk registered cash flow from operating activities of US$ 434 million in Q1 2023, an increase of US$ 98 million relative to the first quarter of 2022.

Arista Networks Inc. (NYSE:ANET)

Arista Networks is a computer networking corporation and has a market cap of US$ 39.17 billion. Over the past year, shares of Arista Networks increased close to 41 per cent. ANET stock jumped almost 28 per cent over the past month.

In its Q2 2022 results, declared on August 1, Arista posted a revenue of US$ 1.052 billion, a growth of 20 per cent from the previous year’s comparable quarter.

It reported a net income of US$ 0.299 billion in Q2 2022, compared to US$ 0.196 billion in Q2 2021.

Bottom line:

Although the S&P 500 performed very low in 2022, with most of its components hitting the bottom, these are a few companies that did better than the rest. Yet, investors should do their analysis well before picking stocks as the market this year has been volatile.