Highlights:

- Exxon Mobil Corporation has a dividend yield of 3.394 per cent.

- Occidental Petroleum paid a quarterly dividend of US$ 0.13 per share.

- Bloom Energy Corporation (NYSE:BE) has a market cap of US$ 4.28 billion.

The US energy sector is a much-preferred one for investors as it comprises some really big names worldwide. However, are they still profitable during the current market scenario when the global economy has been braving a host of headwinds since the past year? The slowing economy in the US, the fastest inflation in decades, and the Fed Reserve’s hawkish monetary policies to curb it has sent the equity market into a trench. Investors lost money in stocks that made them millions earlier. So, some sectors appears to be balanced in the stock market.

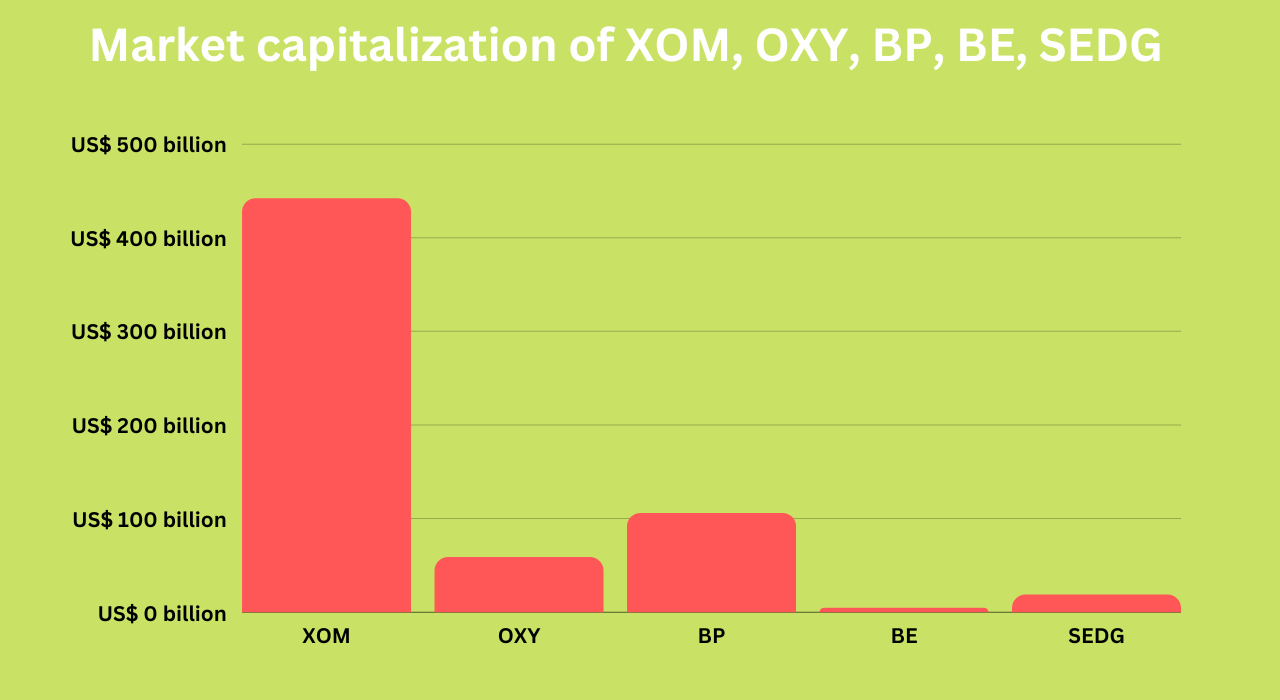

Meanwhile, the US energy sector includes companies like- Exxon Mobil Corporation (NYSE:XOM), Occidental Petroleum Corporation (NYSE:OXY), BP p.l.c. (NYSE:BP), Bloom Energy Corporation (NYSE:BE), SolarEdge Technologies Inc. (NASDAQ:SEDG).

Here, we look at these five companies and analyze their performances in recent quarters:

Exxon Mobil Corporation (NYSE:XOM)

ExxonMobil Corporation is the largest oil refiner in the world. The Irving-based oil & gas corporation company produces 4.6 million barrels of oil every day.

With a dividend yield of 3.394 per cent, ExxonMobil paid a dividend of US$ 0.91 per share. It has an EPS of 12.25, while its P/E ratio was 8.70.

In Q3 2022, ExxonMobil’s earnings rose to US$ 19.66 billion compared with US$ 17.85 billion in the second quarter of the current fiscal.

The oil exploring company’s cash increased by US$ 11.6 billion in the third quarter of 2022. Meanwhile, the free cash flow in the reported quarter was US$ 22 billion.

Occidental Petroleum Corporation (NYSE:OXY)

Occidental Petroleum Corporation has a market cap of US$ 58.42 billion. Based out of Houston, it is involved in manufacturing petrochemicals in the US, Canada, and Chile.

Occidental Petroleum paid a quarterly dividend of US$ 0.13, which is next payable on January 17, 2023. The dividend yield of the company is 0.809 per cent.

In Q3 2022, Occidental posted earnings per diluted share of US$ 2.52 and adjusted earnings per diluted share at US$ 2.44.

The company reported US$ 4.3 billion in cash flow from continuing operations for the third quarter of fiscal 2022.

Occidental's OxyChem and midstream and marketing segments did better than its guidance and posted pre-tax earnings of US$ 580 million and US$104 million, respectively.

BP p.l.c. (NYSE:BP)

BP p.l.c. is a US$ 105.59 billion market valuation company with a dividend yield of 4,117 per cent. It paid a quarterly dividend of US$ 0.36 per share. Headquartered in London, the oil & gas company is a global market leader in the sector.

In Q3 2022, BP posted US$ 3.5 billion in surplus cash flow in comparison to US$ 933 million in Q3 2021.

BP p.l.c’s net debt came to US$ 22 billion at the end of the third quarter of fiscal 2022. It was US$ 22.8 billion at the end of the second quarter of the same fiscal.

The company’s loss, attributable to bp shareholders in Q3 2022, was reported at US$ 2.2 billion compared with a loss of US$ 2.5 billion in the year-ago quarter.

Bloom Energy Corporation (NYSE:BE)

Bloom Energy assists clients in on-site power generation with its own energy servers (solid-oxide fuel cell systems), which are fuel-flexible.

The US$ 4.28 billion market cap company posted a revenue of US$ 292.3 million in the third quarter of 2022 compared to US$ 207.2 million in the year-ago quarter.

Bloom reported a gross margin of 17.4 per cent in Q3 2022, compared to a gross margin of 17.8 per cent in the third quarter of the previous year.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

SolarEdge Technologies Inc. (NASDAQ:SEDG)

SolarEdge Technologies deals in DC-optimized inverter systems utilized in solar photovoltaic installations. The company also builds indigenous inverter systems.

The US$ 18.31 billion company has an EPS of 2.03, while it has a P/E ratio of 155.190. The company reported record revenues of US$ 836.7 million in Q3 2022. Meanwhile, the GAAP net income of SolarEdge in the reported quarter was US$ 24.7 million.

Its GAAP operating income soared to US$ 84.4 million in Q3 2022, 134 per cent up compared to US$ 36 million in the previous quarter.

The company said it shipped 320.7 MWh of batteries in the third quarter of FY22. Its cash, equivalents, and other assets in the reported quarter were US$ 937.6 million. In its outlook for the last quarter of fiscal 2022, it expects the revenues to be in the range of US$ 855 million to US$ 885 million.

Bottom line

Energy stocks may be popular among investors in the stock market. However, it is difficult for market participants as the year continued to be volatile and investor sentiments seemed to have taken the beating. The first two quarters of this fiscal were dismal for trading, with the third quarter somewhat managing to offset the damage. So, do your market research properly before putting your bets on any sector or stock. Adopt a long-term strategy to stay invested for the long run so that you can avoid losing money in the short term.