Highlights

- Booking Holdings Inc. (NASDAQ:BKNG) revenue surged over 77% YoY in Q3, FY21.

- Marriott International (NASDAQ:MAR) revenue rose around 75% YoY in Q3, FY21.

- Expedia Group, Inc. (NASDAQ:EXPE) revenue for Q3 of FY 2021 increased by 97% YoY.

Experts have a bullish outlook for travel stocks despite the omnipresent Omicron threat. Although countries have ruled out a full-scale lockdown, nothing can be said how long that decision would hold, given the fact-changing nature of the pandemic situation.

The US travel spending declined more than 40% YoY in 2020. Generally, it sees an annual growth of 2% to 4%.

According to data up to October last year compiled by the US Travel Association, travel spending dropped by about 12% to US$88 billion in the month from the same period in 2019.

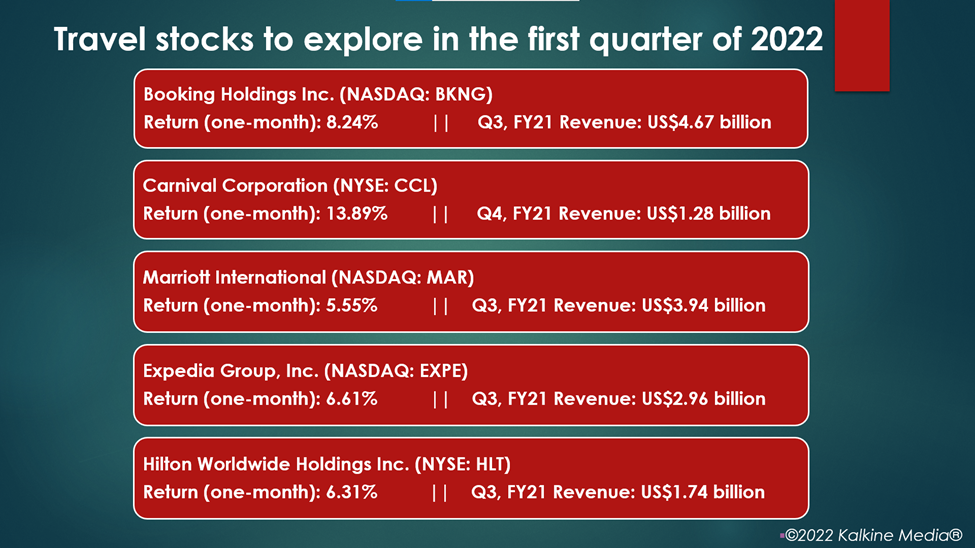

Here we explore five travel stocks and their performance.

Also Read: Vigil Neuroscience (VIGL) IPO: VIGL is set to debut today

Booking Holdings Inc. (NASDAQ:BKNG)

Booking Holdings is a travel technology company based in Norwalk, Connecticut. It offers online reservation services to restaurants and other sectors.

Its shares traded at US$2441.27 at 2:24 pm ET on January 7, up 0.47% from their previous close. The stock value increased by 8.24% over the last 30 days.

It has a market cap of US$100.20 billion, a P/E ratio of 266.41, and a forward P/E one year of 57.73. Its EPS is US$9.16. The 52-week highest and the lowest stock prices were US$2,687.29 and US$1,860.73, respectively. Its trading volume was 247,228 on January 6.

The company's revenue was US$4.67 billion in Q3, FY21, up 77.12% YoY. Its net income came in at US$769 million, or US$18.60 per diluted share, against an income of US$801 million, or US$19.49 per diluted share in Q3, FY20.

Also Read: CinCor Pharma IPO today: pricing, total shares - all you need to know

Source: ©2022 Kalkine Media®

Also Read: TrumpCoin (TRUMP) gets a thumbs-up on meme contest

Carnival Corporation (NYSE:CCL)

Carnival Corporation is a cruise line operator and leisure travel firm based in Miami, Florida. It operates in various geographical locations, including Asia, North America, and Europe.

The stock was priced at US$21.93 at 2:26 pm ET on January 7, up 3.59% from its previous closing price. The CCL stock rose 13.89% over the last 30 days.

The market cap of the company is US$25.65 billion, and the forward P/E one year is -44.83. Its EPS is US$-8.44. The stock saw the highest price of US$31.52 and the lowest price of US$16.32 in the last 52 weeks. Its share volume on January 6 was 31,459,850.

The company's revenue was US$1.28 billion in Q4, FY21, compared to US$34 million in the year-ago quarter. It reported a net loss of US$2.62 billion, or a loss of US$2.31 per diluted share, against a loss of US$2.22 billion, or a loss of US$2.41 per diluted share in Q4, FY20.

Also Read: Nexo (NEXO) token falls 14% after Uniswap (UNI) added to its platform

Marriott International (NASDAQ:MAR)

Marriott is one of the leading hotel chain operators based in Bethesda, Maryland. It operates, franchises, and licenses hotels, residential, and timeshare properties and offers accommodation for its customers.

The shares of the company traded at US$166.95 at 2:27 pm ET on January 7, up 1.05% from their closing price of January 6. Its stock value surged 5.55% over the last 30 days.

The firm has a market cap of US$54.55 billion, a P/E ratio of 117.97, and a forward P/E one year of 56.97. Its EPS is US$1.42.

The 52-week highest and lowest stock prices were US$171.68 and US$115.50, respectively. Its trading volume was 1,421,790 on January 6.

The company's revenue increased by 75.07% YoY to US$3.94 billion in Q3, FY21. Its net income came in at US$220 million, or US$0.67 per diluted share, compared to US$100 million, or US$0.31 per diluted share in Q3, FY20.

Also Read: Five bank stocks to explore as rate hike prospects grow

Expedia Group, Inc. (NASDAQ:EXPE)

Expedia is an online travel shopping firm that offers its services to consumers as well as to small businesses. It offers a travel fare aggregator website and is based in Seattle, Washington.

The stock of the company was priced at US$180.34 at 2:28 pm ET on January 7, up 1.55% from its previous closing price. The EXPE stock soared 6.61% over the last 30 days.

The market cap of the company is US$27.40 billion, and the forward P/E one year is -257.36. Its EPS is US$-6.82.

The stock saw the highest price of US$191.85 and the lowest price of US$118.30 in the last 52 weeks. Its share volume on January 6 was 1,872,383.

The company's revenue rose 97% YoY to US$2.96 billion in Q3, FY21. Its net income attributable to common shareholders came in at US$362 million, against a loss of US$221 million in Q3, FY20.

Also Read: France’s privacy watchdog fines Google, Facebook over ‘cookies’

Also Read: Global NFT market topped US$40 billion in 2021: Report

Hilton Worldwide Holdings Inc. (NYSE:HLT)

Hilton Worldwide is a hospitality firm based in McLean, Virginia. It focuses on managing and franchising a range of hotels and resorts.

The shares of the company traded at US$152.45 at 2:29 pm ET on January 7, up 0.43% from their closing price of January 6. Its stock value ticked up 6.31% over the last 30 days.

The firm has a market cap of US$42.69 billion, a P/E ratio of 1178.38, and a forward P/E one year of 71.78. Its EPS is US$0.13.

The 52-week highest and lowest stock prices were US$159.21 and US$98.57, respectively. Its trading volume was 1,782,303 on January 6.

The company's total revenue increased by 87.45% YoY to US$1.74 billion in Q3, FY21. Its net income came in at US$240 million, against a loss of US$81 million in the comparable quarter of the previous year.

Also Read: Why is SuperFarm (SUPER) crypto drawing attention?

Bottomline

According to US Travel Association, domestic business travel spending would likely surge by 76% in 2022 from the 2019 levels. It is expected that the sector will not fully recover until 2024. However, the travel stocks’ steady gains reflect investors’ confidence in the industry.