Highlights

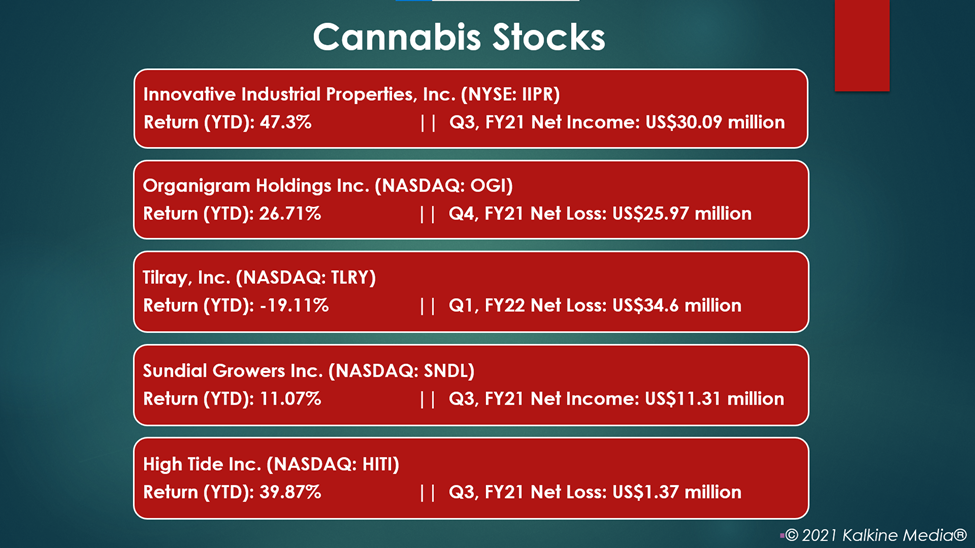

- Innovative Industrial Properties, Inc. (NYSE:IIPR) revenue rose 57% YoY in Q3, FY21.

- Tilray, Inc. (NASDAQ:TLRY) will report its second-quarter results for FY22 on Jan 10.

- High Tide Inc. (NASDAQ:HITI) revenue jumped 99% YoY in Q3, FY21.

The cannabis sector has gained significant traction in the North American market after the US administration signaled plans to remove marijuana from its federal banned substance list.

Analysts forecast the sector’s rapid growth in the coming years, driven by demand for both recreational and medicinal consumption of marijuana. The administration is close to passing a bill to federally decriminalize cannabis use that will allow the interstate trade in marijuana.

On Dec 4, 2020, the House voted in favor of removing marijuana from the Controlled Substances Act of 1970. The President now must sign the legislation after Senate approval before it becomes a law.

Here we explore five cannabis stocks that saw considerable gains this year.

Also Read: How to buy BarnBridge (BOND) token?

Innovative Industrial Properties, Inc. (NYSE:IIPR)

Innovative Industrial Properties is a real estate investment trust (REIT) that acquires, owns, and manages state-licensed medical use cannabis properties. It is based in San Diego, California.

The shares of the company traded at US$262.20 at 7:49 am ET on Dec 29, up 0.28% from their previous close. The stock gained 47.3% YTD.

It has a market cap of US$6.25 billion, a P/E ratio of 60.38, and a forward P/E one year of 40.73. Its EPS is US$4.33. The 52-week highest and the lowest stock prices were US$288.02 and US$160.91, respectively. Its trading volume was 181,938 on Dec 28.

Its total revenue jumped 57% YoY to US$53.85 million in Q3, FY21. Its net income was US$30.09 million, or US$1.20 per diluted share, against US$19.21 million, or US$0.86 per diluted share in Q3, FY20.

Also Read: How to buy Harvest Finance (FARM) crypto?

Source: Pixabay

Also Read: When is the Reddit IPO coming?

Organigram Holdings Inc. (NASDAQ:OGI)

Organigram is a Canadian firm based in Moncton, Canada. It operates as a licensed producer of cannabis and extract-based products.

The stock closed at US$1.85 on Dec 29, down 4.64% from its previous closing price. The OGI stock rose 26.71% YTD.

Its market cap is US$574.87 million, and the forward P/E one year is -20.56. The EPS is US$-0.43. The stock saw the highest price of US$6.45 and the lowest price of US$1.31 in the last 52 weeks. Its share volume on Dec 28 was 3,124,926.

The company's net revenue rose 22% YoY to US$24.86 million in Q4, FY21. It reported a net loss of US$25.97 million against a loss of US$38.59 million in Q4, FY20.

Also Read: What is Paribus Crypto? How to buy it?

Tilray, Inc. (NASDAQ:TLRY)

Tilray is a pharmaceutical and cannabis firm based in Toronto, Canada. The cannabis-lifestyle consumer packaged goods firm has operations in various geographical locations.

Its shares traded at US$7.27 at 7:58 am ET on Dec 29, down 0.14% from their previous close. Its stock value decreased by 19.11% YTD. The firm has a market cap of US$3.24 billion, and a forward P/E one year of -26.96. Its EPS is US$-1.93.

The 52-week highest and lowest stock prices were US$67.00 and US$7.25, respectively. Its trading volume was 18,199,260 on Dec 28.

The company will report its second-quarter results for fiscal 2022 on Jan 10, 2022, before the opening bell. Tilray's revenue was US$168 million in Q1, FY22, up 43% from the same quarter of the previous year. It reported a net loss of US$34.6 million, against a loss of US$21.7 million in Q1, FY21.

Also Read: Yearender: Top EV stocks that continue to hog limelight

Sundial Growers Inc. (NASDAQ:SNDL)

Sundial Growers is based in Calgary, Canada. It produces and sells cannabis products in Canada.

The stock was priced at US$0.6064 at 8:18 am ET on Dec 29, down 0.74% from its previous close. The SNDL stock rose 11.07% YTD.

Its market cap is US$1.25 billion, and the forward P/E one year is -7.64. Its EPS is US$-0.18. The stock saw the highest price of US$3.96 and the lowest price of US$0.45 in the last 52 weeks. Its share volume on Dec 28 was 75,823,750.

The company's net revenue from the cannabis segment was US$14.4 million in Q3, FY21, up 12% from the year-ago quarter. Its net income from continuing operations came in at US$11.31 million compared to a loss of US$71.39 million in Q3, FY20.

Also Read: How to buy Dent (DENT) token?

Also Read: Top 2 cloud computing stocks to watch in 2022

High Tide Inc. (NASDAQ:HITI)

High Tide is based in Calgary, Canada, and is a retailer of recreational cannabis.

Its shares traded at US$4.355 at 8:35 am ET on Dec 29, up 0.11% from their previous close. Its stock value soared 39.87% YTD.

It has a market cap of US$249.40 million, a forward P/E one year of -8.70, and an EPS of US$-0.06. The 52-week highest and lowest stock prices were US$9.90 and US$4.30, respectively. Its trading volume was 211,831 on Dec 28.

Its revenue increased by 99% YoY to C$48.06 million (US$37.52 million) in Q3, FY21. It reported a net loss of C$1.75 million (US$1.37 million), or C$0.03 (US$0.023) per share, against an income of C$3.82 million (US$2.98 million), or C$0.25 (US$0.20) per share a year ago.

Also Read: Top 5 retail stocks to keep an eye on in 2022

Bottomline

Experts estimate that the marijuana industry’s market capitalization may double by 2025, noting that the loan facility for cannabis companies is also growing, a positive indicator of its future. Besides more available lenders, the terms have also improved. However, cannabis stocks can be volatile. Hence, investors should closely evaluate the companies before investing.