Highlights:

- Tesla, Inc. (NASDAQ:TSLA) revenue surged 65% YoY in Q4, FY21.

- Ford Motor Company's (NYSE:F) revenue surged 7% YoY in fiscal 2021.

- Lucid Group, Inc. (NASDAQ:LCID) revenue was US$27.11 million in fiscal 2021.

The electric vehicle industry has seen strong momentum, with global warming threatening to render the plant unhabitable. Governments around the world are making major policy changes to usher in a new era of sustainable development with clean energy at the helm. Experts say clean energy will become the driving force of global economies in future.

The climate issue has been drawing attention as the world observes Earth Day on Friday, April 22, which seeks to remind us about the urgency to mitigate climate change and the dangers that lay await if people continue on the path of reckless living.

According to a study by Zero Emission Transportation Association (ZETA), driving a gasoline vehicle is about three to six times more costlier than driving an electric vehicle. So, there is also a significant economic benefit to adopting clean energy.

A survey conducted by Edmunds.com Inc., an online resource provider for the automotive industry, showed that around 25% of consumers considered a hybrid, plug-in, or electric vehicle. The survey revealed a 40% jump in the number of people exploring clean energy vehicles in the week ended March 13 from the prior week and an over 80% increase from March.

The following are some of the top EV stocks to explore this year.

Also Read: Why is Animal Concerts (ANML) crypto rising?

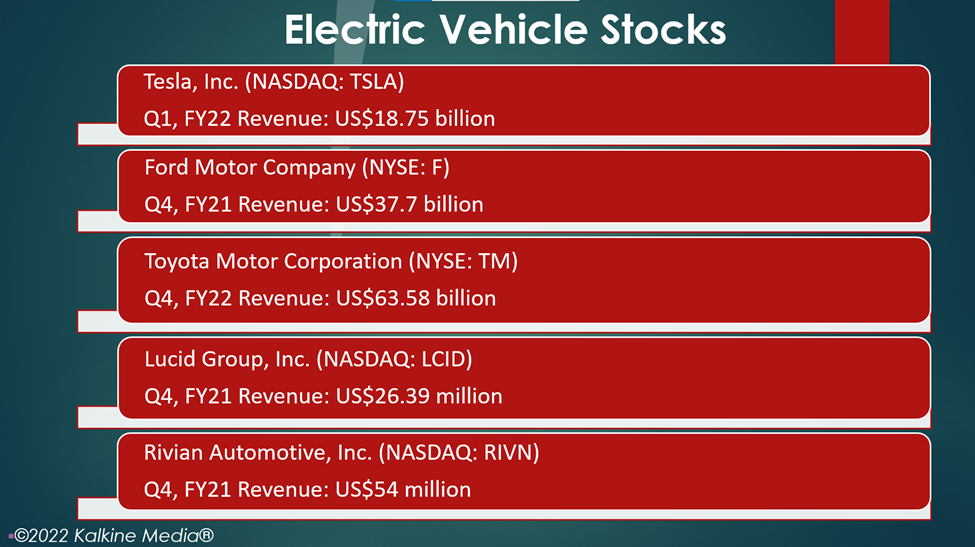

Tesla, Inc. (NASDAQ:TSLA)

Tesla is one of the leading electric vehicle companies based in Austin, Texas. It specializes in designing and manufacturing electric vehicles, batteries, energy storage systems, etc.

Its shares closed at US$1008.78 on April 21, up 3.23% from their previous close. The stock declined 18.55% YTD. Tesla has a market cap of US$1.04 trillion, a P/E ratio of 136.88, and a forward one-year P/E ratio of 129.83. Its EPS is US$7.37.

The 52-week highest and lowest stock prices were US$1,243.49 and US$546.98, respectively. Its trading volume was 35,138,780 on April 21.

The company's total revenue increased by 81% YoY to US$18.75 billion in Q1, FY22. Its GAAP net income attributable to common stockholders came in at US$3.31 billion, or US$2.86 per diluted share, as compared to US$438 million, or US$0.39 per diluted share in Q1, FY21.

Also Read: GameStop (GME) plans stock split. Are meme stocks back in the game? Source: Pixabay

Source: Pixabay

Ford Motor Company (NYSE:F)

Ford is an automobile manufacturing company based in Dearborn, Michigan. It specializes in manufacturing electric commercial vehicles like trucks, utility vehicles, etc.

The stock closed at US$15.70 on April 21, down 2.18% from its previous closing price. The stock fell 26.27% YTD. Its market cap is US$63.09 billion, the P/E ratio is 3.54, and the forward one-year P/E ratio is 8.40. Its EPS is US$4.43.

The stock saw the highest price of US$25.87 and the lowest price of US$11.14 in the last 52 weeks. Its share volume on April 21 was 49,898,530.

The company will release its first-quarter fiscal 2022 results on April 27, after the market close.

Ford's revenue increased by 5% YoY to US$37.7 billion in Q4, FY21, while its GAAP net income came in at US$12.3 billion, or US$3.03 per diluted share. For fiscal 2021, the company's net revenue surged 7% YoY to US$136.3 billion.

Also Read: Why is STEPN (GMT) crypto gaining attention?

Toyota Motor Corporation (NYSE:TM)

Toyota Motor is a Japanese automotive manufacturing company based in Toyota City, Aichi. Besides manufacturing vehicles and auto components, it also provides finances. The company also has an information communication business.

The shares of the company closed at US$173.67 on April 21, down 1.01% from their closing price of April 20. Its stock value declined 5.82% YTD. It has a market cap of US$239.28 billion, a P/E ratio of 8.61, and a forward one-year P/E ratio of 9.72. Its EPS is US$20.17.

The 52-week highest and lowest stock prices were US$213.74 and US$149.90, respectively. Its trading volume was 189,501 on April 21.

The company’s sales revenue was 7.78 trillion Yen (US$63.58 billion) in Q3, FY22, compared to 8.15 trillion Yen (US$66.56 billion) in the year-ago quarter. Its attributable net income came in at 791.7 billion Yen (US$6.47 billion) compared to 838.6 billion Yen (US$6.85 billion) in Q3, FY21.

Also Read: Why is Chainlink (LINK) crypto gaining attention?

Lucid Group, Inc. (NASDAQ:LCID)

Lucid is an electric vehicle manufacturer. It manufactures electric cars, powertrains, and other related products and services. It is based in Newark, California.

The stock closed at US$19.55 on April 21, down 6.32% from its previous close. The LCID stock tumbled 49.01% YTD. The market cap of the company is US$32.32 billion, and the forward one-year P/E ratio is -15.64.

The stock saw the highest price of US$57.75 and the lowest price of US$16.12 in the last 52 weeks. Its share volume on April 21 was 23,924,850.

The company will report its first quarter fiscal 2022 results on May 5, after the closing bell.

It reported revenue of US$26.39 million in Q4, FY21, while its net loss attributable to common stockholders came in at US$1.04 billion, or US$0.64 per diluted share. For fiscal 2021, the company's revenue was US$27.11 million.

Also Read: Why is Kava (KAVA) crypto gaining attention?

Rivian Automotive, Inc. (NASDAQ:RIVN)

Rivian Automotive is an electric vehicle manufacturer based in Irvine, California. Its IPO was one of the biggest stock market debuts in the US in 2021. The company is backed by Amazon.com. Rivian is currently building utility vehicles and pickup trucks.

The shares of the company closed at US$33.76 on April 21, down 6.82% from their closing price of April 20. Its stock value plummeted 64.73% YTD.

The firm has a market cap of US$30.40 billion, and a forward one-year P/E ratio of -5.35. The 52-week highest and lowest stock prices were US$179.47 and US$33.38, respectively. Its trading volume was 21,534,460 on April 21.

The company will release its first quarter fiscal 2022 earnings report on May 11, after the market close.

Rivian reported a revenue of US$54 million in Q4, FY21, while its net loss came in at US$2.46 billion, or US$4.83 per share. In fiscal 2021, the company’s total revenue was US$55 million.

Also Read: Why is DeFi Kingdoms (Jewel) crypto rising?

Bottom line:

The EV industry has been grappling with high production costs this year. They also face a significant challenge in keeping the vehicle prices budget-friendly. But experts say that the industry has managed to tackle these issues to a large extent in recent years. Besides an ongoing semiconductor shortage, the Russia-Ukraine war has further disrupted an already fragile global supply chain, leading to significant production cuts in the industry. However, the EV sector is positive about a quick recovery by next year.