Benchmark US indices closed mixed on Wednesday, December 29, after a choppy trading session as traders took a breather ahead of the New Year holidays.

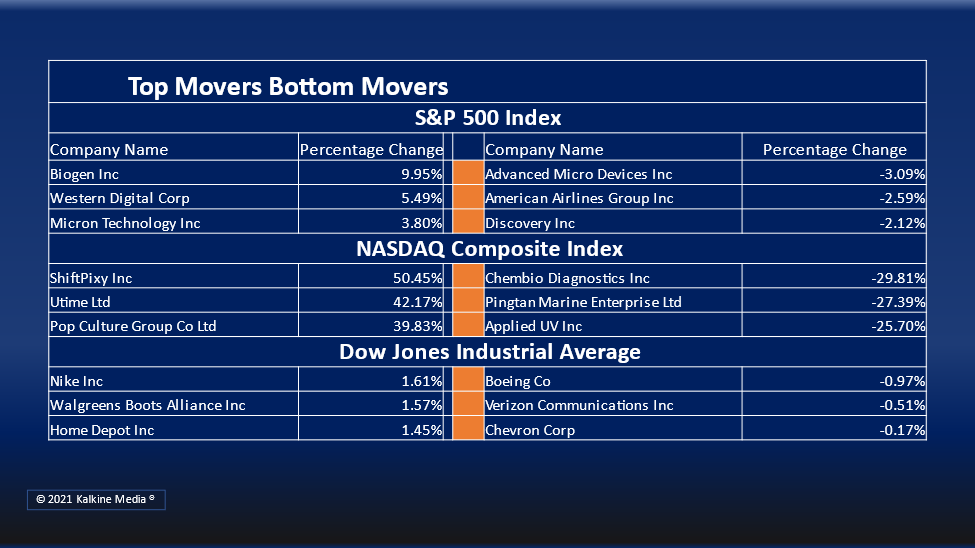

The S&P 500 climbed 0.14% to 4,793.06. The Dow Jones rose 0.25% to 36,488.63. The NASDAQ Composite fell 0.10% to 15,766.22, and the small-cap Russell 2000 was up 0.07% to 2,248.18.

Omicron’s less-severe symptoms have rekindled optimism in the markets. But traders seemed to have paused their bullish trading activities as the New Year nears.

Nine of the 11 sectors of the S&P 500 stayed in the green. Healthcare, consumer staples, and real estate sectors were the top gainers. Energy and technology stocks were the laggards.

Tesla, Inc. (TSLA) stock was up 0.40% after CEO Elon Musk exercised his final batch of stock options that were due to expire in 2022. He sold around US$15.7 million shares since Nov 8.

Micron Solutions Inc (MICR) stock jumped over 9% in intraday trading after its rival Samsung Electronics announced to suspend production in China factory amid surging Covid-19 cases.

Calix, Inc (CALX) stock rose more than 15% on inclusion in the S&P MidCap 400 index from Jan 4. The TuSimple Holdings Inc (TSP) stock fell over 10% after completing its first test drive of its fully autonomous semi-truck on public roads without human invention.

In the healthcare sector, UnitedHealth Group Incorporated (UNH) climbed 0.69%, Johnson & Johnson (JNJ) rose 0.86%, and Eli Lilly and Company (LLY) gained 0.92%. Thermo Fisher Scientific Inc (TMO) and Abbott Laboratories (ABT) surged 1.37% and 0.64%, respectively.

In the consumer staples sector, Procter & Gamble Company (PG) stock gained 1.17%, Walmart Inc. (WMT) gained 0.12%, and Coca-Cola Company (KO) rose 0.28%. Costco Wholesale Corporation (COST) and PepsiCo Inc. (PEP) increased by 0.61% and 0.56%, respectively.

In the energy sector, Exxon Mobile Corporation (XOM) plunged 0.51%, Chevron Corporation (CVX) declined 0.15%, and Schlumberger N.V. (SLV) fell 1.16%. Marathon Petroleum Corporation (MPC) and Phillips 66 (PSX) were down 0.54% and 1.08%, respectively.

The global cryptocurrency market was down 0.97% to US$2.24 trillion in market capitalization, according to coinmarket.com. Bitcoin (BTC) fell 1% to US$47,545.59 at 3:45 pm ET.

Also Read: Victoria's Secret (VSCO) stock rallies after share buyback plan

Image description: Healthcare and consumer staple sectors were the top movers in the S&P 500 index on Wednesday.

Also Read: Yearender: A look at top 5 technology ETFs of 2021

Also Read: Yearender: Top EV stocks that continue to hog limelight

Futures & Commodities

Gold futures declined 0.29% to US$1,805.65 per ounce. Silver futures decreased by 1.05% to US$22.878 per ounce, while copper declined 0.39% to US$4.4158.

Brent oil futures increased by 0.60% to US$79.14 per barrel and WTI crude futures were up 0.64% to US$76.47.

Bond Market

The 30-year Treasury bond yields increased 3.21% to 1.963, while the 10-year bond yields were up 4.52% to 1.548.

US Dollar Futures Index declined 0.33% at US$95.885.