Highlights

- Calix, Inc (NYSE:CALX) is to join the S&P MidCap Index 400 on Jan 4, 2022.

- The company will replace CIT Group Inc. (CIT) in the index.

- Its stock gained 168.15% YTD.

The Calix, Inc (NYSE:CALX) stock jumped more than 16% on Wednesday after it said it would join the S&P MidCap 400 Index, replacing the CIT Group Inc. (CIT), on Jan 4, 2022.

The CALX stock was trading US$79.685, up 16.48% at 11:32 am ET. Also, the trading volume rose to 2,261,739 compared to its 90-day average volume of 538,722.

The San Jose, California-based technology company said it will join the S&P MidCap 400, replacing CIT Group Inc. (CIT) on the index, on Jan 4, 2022.

The S&P Dow Jones Indices, a division of S&P Global, is the global resource for data, index-based concepts, and home-to-financial market indicators. The S&P DJI works across asset classes and develops indices, helping investors understand and trade in the markets.

The inclusion in the S&P MidCap 400 index is a major achievement for the 22-year-old company. It had launched its IPO in March 2010.

Also Read: These 5 US stocks returned between 500% and 5,000% in 2021

Also Read: Yearender: Top 5 healthcare stocks that grabbed limelight in 2021

What does Calix do?

The California-based technology company provides cloud and software platforms with real-time data and insights to improve the clients’ businesses and subscriber experiences.

Its current market capitalization is US$5.01 billion, with a P/E ratio of 21.91 and a forward P/E one year of 68.41. The stock traded in the range of US$76.60 to US$28.58 in the last 52 weeks.

Also Read: Best US ETFs that returned over 55% in 2021

Financials

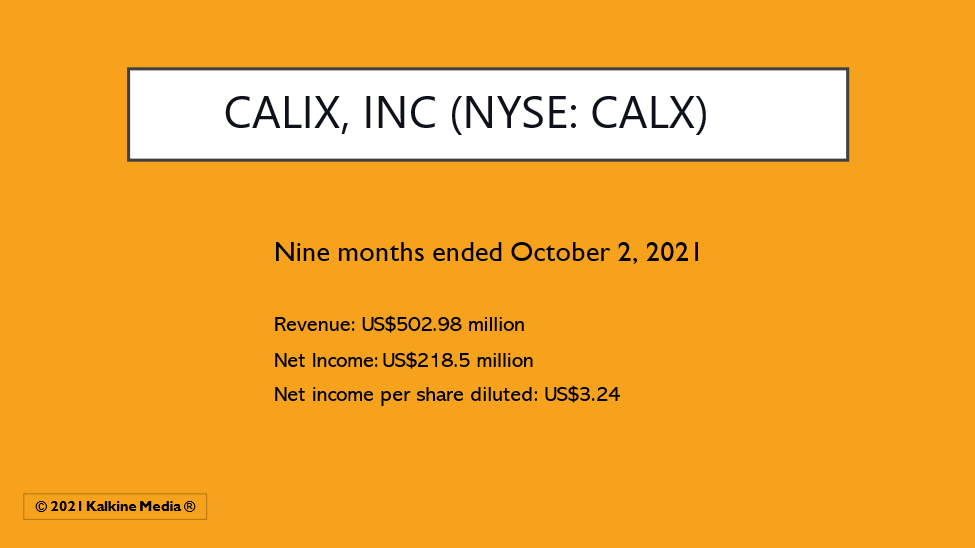

The company earned revenue of US$502.98 million for the nine months ended Oct 2, 2021, compared to US$371.21 million in the corresponding period of 2020.

The net income was US$218.5 million or US$3.24 per share diluted in the nine months ended Oct 2, 2021, compared to US$9.38 million or US$0.16 per share diluted a year ago. Its cash and equivalents were US$60.2 million as of Oct 2, 2021, against US$80.8 million as of Dec 31, 2020.

Also Read: Yearender: Top EV stocks that continue to hog limelight

Bottomline

The S&P 400 MidCap Index grew 23.32% YTD. By contrast, Calix stock gained 168.15% in the same period. Technology companies may remain volatile in the short term, given some uncertainties in the macro-economic outlook. Hence, investors must evaluate the companies carefully before investing.