Summary

- The British Health Ministry has asked the pharma companies to stock the drugs and medicines to avoid any supply related disruption post Brexit on 31 December 2020.

- As per the UK's Finance Ministry data, the Banks have provided support of close to £50.0 billion to the businesses under the Covid-19 support scheme and £33.8 billion to the furloughed

- Maestrano Group's subsidiary appointed MODUS as the distribution partner in the US.

- Maestrano Group's subsidiary partnered with Esri to provide technology solutions using Esri's software to ARTC in Australia.

- IDE Group fully acquired Nimoveri Holdings Limited in June 2020.

- IDE Group raised £14.6 million in FY19 from existing stakeholders.

Given the above-market conditions, we would review two technology stocks - Maestrano Group PLC (LON:MNO) & IDE Group Holdings (LON:IDE). Based on the 1-year performance MNO and IDE were up by about 410.00 percent and 1.96 percent, respectively (as on 4 August 2020 before the market close at 2:20 PM GMT+1). Let's skim the financial and operational updates of the companies to understand the stock better.

Maestrano Group PLC (LON:MNO)

Maestrano Group PLC is a UK based company that provides a cloud-based platform for business data management and analytics. The Company mainly caters to the transport sector. Nextcore a subsiaidary of the Company manufactures light direction and ranging (LiDAR) enabled UAV drone that has application in the digital survey. Maestrano Group is included on the FTSE AIM All-Share index.

Recent Events

- On 27 July 2020, Nextcore, a subsidiary of the Maestrano Group, appointed MODUS as the distributor of the Company's products in the US. In 2020, the Nextcore partnered with Marvel Geospatial, Intec, Skymec and D1 Store in India, Malaysia, Russia and Australia, respectively for distribution of the Company's products. Corridor Technology, another subsidiary of the Company, completed two initial stages of the pilot project funded by Meitetsu. The Company would proceed for phase 3 of the project after it got a nod from Meitetsu where Corridor Technology would provide machine learning technology models.

- On 6 July 2020, Maestrano Group's subsidiary Corridor Technology partnered with Esri to provide a solution using Esri's software to ARTC. Corridor Technology would replace the manual process of rail track survey and track clearance of ARTC using the machine learning technology. ARTC manages internal rail network in Australia, and it is a client for both Esri and Corridor Technology.

- 29 June 2020, Maestrano Group received a grant of £50,000 from Innovate UK. The grant would be used for the development of remote infrastructure tools. On 25 June 2020, Corridor Technology was selected by the Network Rail for the trial of the automated rail corridor technology.

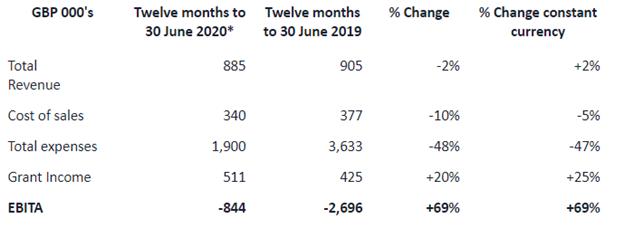

FY2020 Annual results (ended 30 June 2020) as reported on 22 July 2020

In FY20, the Company reported revenue of £885,000, which declined by 2 percent year on year from £905,000 a year ago. The grant income was £511,000, and EBITA loss was £844,000 during the reported period. The EBITA loss was £2,696,000 in FY19. The Company had cash of £1,584,891 as on 30 June 2020. The proforma revenue, including Airsight for full-year from 1 July 2019 to 30 June 2020 was £1,000,000 that was up by 68 percent year on year.

FY2020 Financial results

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on August-4-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Maestrano Group PLC's shares were trading at GBX 8.29 up by about 32.64 percent from the previous closing price (as on 4 August 2020 before the market close at 2:20 PM GMT+1). Stock 52-week High and Low were GBX 8.70 and GBX 1.00, respectively. The Company had a market capitalization of £9.13 million.

Business Outlook

The Company remains confident over the contract opportunities in the pipeline, and the existing contracts would continue until FY21. The acquisition of Airsight has provided robust synergies for the Company, and it is positive over the collaboration with Meitetsu for the machine learning tool. The Company's technologies would have application in Japanese rail network on successful completion of the pilot project. Maestrano Group is also focused on increasing the distribution network of Nextcore.

IDE Group Holdings PLC (LON:IDE) – No external debt on the balance sheet

IDE Group Holdings PLC is a UK based IT solution provider and the Company offers services such as Cloud & Hosting, Network & Connectivity, Collaboration, Managed Services and Device Management. IDE Group is included in FTSE AIM-All Share.

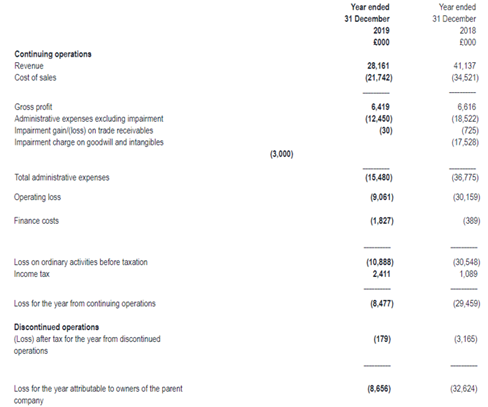

FY2019 Annual results (ended 31 December 2019) as reported on 14 July 2020

In FY19, the Company reported revenue of £28.2 million, which declined from £41.1 million in FY18. The lower revenue in FY19 was mainly due to lower project services revenue of £4.9 million and loss of customer contracts worth £3.7 million. The gross profit was £6.4 million, and adjusted EBITDA was £1.1 million in FY19, both gross profit and adjusted EBITDA benefitted by £0.2 million and £1.1 million, respectively due to adoption of IFRSE-16. The Company reported an after-tax loss from operations of £8.5 million. Under the business category, Manage division reported revenue of £14.7 million, whereas Connect division reported revenue of £14.6 million in FY19. The Company received funding of £11.5 million through the issue of notes for six-years to existing shareholders that were used for debt repayment of National Westminster Bank. As on 31 December 2019, IDE Group had cash of £0.7 million and did not have external debt on the balance sheet. During FY19, the Company won a few new clients in the public sector through the partner channels. On 1 June 2020, the IDE Group completed the acquisition of Nimoveri Holdings Limited for £200,000 of which £100,000 was paid in cash and £100,000 as interest-free secured loan redeemable on 31 December 2021. Nimoveri Holdings is an IT services and cloud firm.

FY2019 Financial results

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on August-4-2020, before the market close (Source: Refinitiv, Thomson Reuters)

IDE Group Holdings PLC's shares were trading at GBX 2.36 up by about 10.80 percent from the previous closing price (as on 4 August 2020 before the market close at 2:20 PM GMT+1). Stock 52-week High and Low were GBX 10.50 and GBX 1.33, respectively. The Company had a market capitalization of £8.52 million.

Business Outlook

The Company is mainly inclined towards customer retention and providing quality service. IDE Group does not have any external debt on the balance sheet, and thus it is confident about the liquidity position. The Company refrained from providing any guidance over short or medium-term following the current economic situation and believes that it is difficult to assess the impact. The Company availed the government facilities to defer the PAYE and VAT payments. In FY20, the Company would focus on cost mitigation and data centre and network consolidation.