Highlights

- CML Microsystems would pay a final special dividend of 50 pence per ordinary share.

- Electrocomponents’ revenues rose by 2.5% year-on-year to £2,002.7 million for the full year ended 31 March 2021, compared to £1,953.8 million in 2020.

Chip shortage has been indicative that Europe and the US are heavily dependent on Asia to address their chip-making needs. Microchips are essential components in several products ranging from cars to electronics but have been in short supply due to surging supply chain issues and high demand.

Intel, a US-based chip manufacturer, announced that it is no longer planning to construct a production facility in the UK due to Brexit. Apart from boosting its US output, Intel announced an investment of up to £70 billion ($95 billion) for the opening and upgradation of semiconductor manufacturing facilities in Europe over the coming decade. Intel is currently considering options in the EU and has received over 70 proposals for sites from 10 different European nations. The company aims to raise its production amidst the rising global chip shortage that is impacting the supply of cars and other products.

(Data source: Company release and Refinitiv)

Let us explore the investment prospect in 2 semiconductor chip stocks listed on the LSE.

CML Microsystems Plc (LON: CML)

CML Microsystems is a designer, manufacturer, and marketer of semiconductors for the communications industry. For the year ended 31 March 2021, CML Microsystems recorded revenue of £12.5 million compared to £15.0 million in 2020, reflecting the impact of COVID-19.

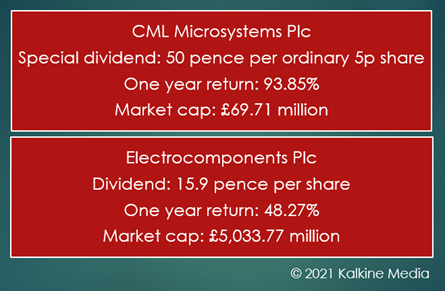

At the close of the day’s trade on 6 October 2021, the shares of CML Microsystems were at GBX 420.00, and the market cap stood at £69.71 million. In the last one year, the shares of CML Microsystems returned 93.85% to shareholders.

CML Microsystems’ profit before tax was £0.01 million in FY 2021 compared to £1.18 million in the previous year. The company’s gross profit was £9.27 million compared to £11.70 million in 2020. The board announced a final special dividend of 50 pence per ordinary 5p share.

Electrocomponents Plc (LON: ECM)

Electrocomponents plc is a UK-based distributor of industrial and electronics products such as semiconductors and electromechanical components. For the Q1 ended 30 June 2021, Electrocomponents revenue grew by 37% year-on-year.

At the close of the day’s trade on 6 October 2021, the shares of Electrocomponents were at GBX 1,069.00, and the market cap stood at £5,033.77 million. In the last one year, the shares of Electrocomponents returned 48.27% to shareholders.

For the full year ended 3 March 2021, Electrocomponents’ revenues rose by 2.5% to £2,002.7 million compared to £1,953.8 million. Its adjusted profit before tax for FY 2021 was £181.7 million compared to £215.0 million in 2020.

Electrocomponents announced a dividend of 15.9 pence per share for the year ended 31 March 2021, up by 3.2% year-on-year from the previous year’s 15.4 pence per share.