Highlights

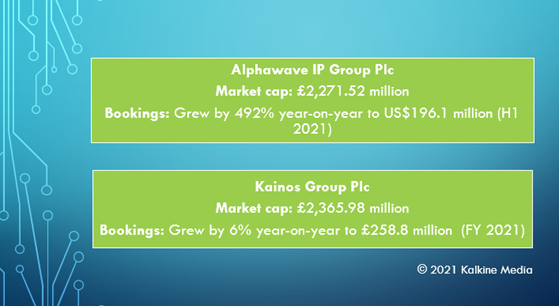

- Alphawave IP Group recorded 492% year-on-year growth in bookings to US$196.1 million in H1 2021 compared to US$33.1 million in H1 2020.

- Kainos expanded its Americas Workday Operations with the acquisition of UNE Consulting SRL and UNE Consulting LLC.

The digital transformation needs of enterprises are boosting demand for technology solutions and services that can help organisations across various sectors maintain the efficiency of operations. The COVID-19 pandemic has been a key accelerator in driving the adoption of advanced software solutions that ensure continuous operations. Robust demand for high-speed and secure solutions can also be attributed to the changing work cultures.

(Data source: Company release & Refinitiv)

Here we take a detailed look at two tech stocks and explore the investment prospect in them.

Alphawave IP Group Plc (LON:AWE)

Alphawave IP Group is an international provider of high-speed connectivity solutions for technology infrastructure. The company recorded 492% year-on-year growth in bookings to US$196.1 million in H1 2021 compared to US$33.1 million in H1 2020.

The shares of Alphawave IP Group Plc last traded at GBX 408.00, up by 19.44% at the close of trade on Tuesday 22 September 2021. The market cap of the company currently stands at £2,271.52 million.

Post its successful IPO launch on the London Stock Exchange (LSE) the company raised net proceeds of £347.1 million (US$492.1 million).

Alphawave IP Group revenues for the period H1 2021 stood at US$27.6 million, up by 140% year-on-year compared to US$11.5 million in H1 2020. Its adjusted EBITDA stood at US$13.9 million in H1 2021 compared to US$6.3 million in H1 2020. The company’s cash and cash equivalents as of 30 June 2021 were US$519.1 million compared to US$8 million as of 30 June 2020.

Kainos Group Plc (LON: KNOS)

FTSE 250 listed Kainos Group is a software firm engaged in developing and providing IT solutions for the healthcare, financial services, and public sectors. Recently, Kainos Group expanded its Americas Workday Operations with the acquisition of UNE Consulting SRL and UNE Consulting LLC.

The shares of Kainos Group last traded at GBX 1,988.00, up by 3.70% at the close of trade on Tuesday 22 September 2021. The market cap of the company currently stands at £2,365.98 million.

For FY 2021, Kainos Group recorded revenue of £234.7 million, up by 31% from the previous year’s £178.8 million, and bookings grew by 6% to £258.8 million from £243.6 million in FY 2020. Its adjusted pre-tax profit rose by 124% year-on-year to £57.1 million compared to £25.5 million in 2020.

Conclusion

Investors seeking to diversify their offerings are investing in technology stocks to leverage the booming demand for tech solutions across all sectors globally. Nevertheless, investors must carefully analyse and evaluate all parameters before investing in these stocks.

.jpg)