Summary

- The online fashion retailer posted a record jump in pretax profit.

- The British fashion giant’s profits were up because it could cut costs of around £50 million.

- During the pandemic-induced lockdown period, the online retailer’s saw a surge in sale of casual wear and beauty products.

- Asos feared that it could face a £25 million hit from tariffs in the wake of a no-deal Brexit, despite customers preferring to shop online during the pandemic.

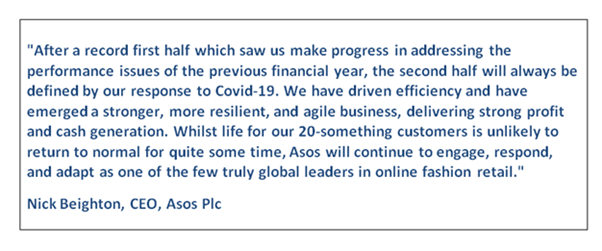

The share prices of Asos Plc (LON:ASC) fell around 10 per cent on 14 October even after the company registered more than three times growth in its profits. The British online fashion major released its final results for the year till 31 August.

The company recorded a total revenue of £3,263.5 million in the year to August as compared to £2,733.5 million in 2019, a rise of 19 per cent. However, the cautious outlook presented by the fashion retailer regarding consumer demand from its target customers in the 20-30 age group did not seem to go well with the investors.

Asos feared that their target group was besieged economically and demand would remain under caution until there is financial stability.

Given the rise in online shopping accelerated considerably due to the pandemic, it seemed that Asos had a significant rise in business activities. During the lockdown period, Asos saw a rise in sale of casual wear and beauty products. The retailer also initiated several cost-cutting measures. The whopping jump of 329 per cent in pretax profit was mainly due to cost cutting measures, including operational efficiency and financial discipline that led to around £50 million.

Of the total retail sales of £3,171 million, the UK accounted for £1,175.9 million (2019: £993.4 million). This was an increase of almost 18 per cent. The international retail at £1,995.1 million was a jump of 20 per cent from £1.664.3 million recorded for the same period last year. These sales numbers showed that the fast fashion online retailer continued to have a strong popularity outside Britain.

There was a rise of more than 22 per cent in the EU, 18 per cent in the US and 18 per cent for the rest of the world. The fashion retailer’s total revenue was £3,263.5 million, out of which the revenue from the UK was £1,214.1 million. The revenue from other markets such as the EU and the US were posted at £1,030.2 million and £415.3 million.

Also read: Stock performance of Tesco and Sainsbury amid surge in UK grocery sales

Also read: Quick Insights on Two FTSE Listed Retail Stocks - NEXT PLC & Marks and Spencer Group PLC

Asos said that the earnings from the US were mostly driven mainly by the retailer’s health during the pre-pandemic times. The spending in the US did not recover much as compared to the company’s other geographical markets. It could be because the American customers received less financial assistance from their government as the ones in Europe. Due to reduced commercial flight operations in the wake of pandemic-led restrictions, Asos faced challenges in transporting goods to the US. Some of the key product segments for the US ranged from occasion wear for weddings, proms, and parties.

Asos stated that the capacity of its warehouse has returned to normal levels and the fashion retailer was well prepared for the peak trading period during the upcoming holiday season. Despite an uncertainty in the short-term, the British online fashion giant is positioned to capture the market share in the UK as well as overseas. The retailer would develop the Asos brands, the Asos platform, and the Asos customer experience. The online fashion retailer would continue to invest in technology and infrastructure. The investment would comprise of a new fulfillment centre that would assist in growing the UK market, besides helping to deliver capacity prior to planned requirements for peak financial year 2023.

A £25 million hit

In another development, Asos feared that it could face a £25-million hit in terms of tariffs in case of a situation leading if there is no trade deal in Brexit, despite the online fashion retail major performing well due to surge in online shopping during the pandemic. However, the retailer is yet to decide if such costs would be passed on to the customers.

In a poll conducted on 14 October, over a third of British retailers remained unaware and ignorant of things that their businesses required to do while preparing for the end of the Brexit transition period. The UK Department for Business, Energy, and Industrial Strategy hosted a Brexit preparation webinar and the poll was conducted among the participants.

A new brand

Asos stated that though its underlying profits are expected to increase in the current year, it remained cautious of the decline in purchasing from its sore segment of consumers – the young shoppers in their 20s. The online fashion company will come up with a new brand called AsYou in a few weeks. The products in this new brand would be in the price range of £8 - £28. With such a price range there would be an additional increase in competition from rival fashion retailer, Boohoo Group, known for selling fashionable clothes starting from £5.

Share performance

On the London Stock Exchange (LSE), Asos is a part of the FTSE AIM UK 50 index. On 15 October at 11.21 AM, the company’s stock (LON:ASC) was trading at £4,677.00 down 3.07 per cent from its previous day’s close of £4,825.00. The 52 week low high range was recorded as 1,050.00 and 5,438.00. With a market capitalisation of £ 4,813.65 million, the stock provided a positive return on price, which was plus 45.29 per cent on a year to date (YTD) basis. The total volume of shares traded at the time of reporting was recorded at 232,557.