Summary

- Nostrum Oil & Gas reported revenue of USD 92.6 million in H1 FY2020.

- Nostrum Oil & Gas sold 22,624 boepd of products in H1 FY2020.

- Nostrum Oil & Gas has paused all the drilling activities.

- Petrotal's Bretana oil field was closed on 9 August 2020 after the civil unrest outside the premises.

- Petrotal's average oil production was 4,185 barrels per day in Q2 FY2020.

- Petrotal received covid-related financial aid of total USD 3.2 million from the US and Peruvian government.

Nostrum Oil & Gas PLC (LON:NOG) & Petrotal Corporation (LON:PTAL) are two energy stocks. NOG and PTAL with a market capitalization of around £20.16 million and CAD 162.91 million, respectively. Based on the last 1-year performance NOG and PTAL was down by about 71.36 percent and 24.67 percent, respectively. NOG and PTAL were down by close to 0.83 percent and 2.84 percent, respectively (as on 19 August 2020, before the market close at 2:00 PM GMT+1).

Nostrum Oil & Gas PLC (LON:NOG) – Used the grace period for interest payment on Notes

Nostrum Oil & Gas PLC is a UK based Energy Company that is engaged in the exploration and development of oil & gas projects. The Company has exploration and production license for the Chinarevskoye field in Kazakhstan with a production sharing agreement with the Government of Kazakhstan.

H1 FY2020 results (ended 30 June 2020) as reported on 18 August 2020

(Source: Company website)

In H1 FY20, the Company reported revenue of USD 92.6 million, which declined by 46.8 percent year on year from USD 174.2 million in H1 FY19. The average Brent rate at which revenue was achieved was USD 40 per barrel. The EBITDA declined from USD 110.2 million in H1 FY19 to USD 38.7 million in H1 FY20. EBITDA margin was 41.8 percent during the reported period. The net operating cash flow declined to USD 47.0 million in H1 FY20 from USD 116.9 million in H1 FY19. As on 30 June 2020, Nostrum had cash of USD 75.7 million and net debt of USD 1,063.9 million. The Company had total debt of USD 1,139.7 million with an accrued interest of USD 35.6 million. The Company had 46 wells in production that includes 21 oil wells and 25 gas condensate wells.

Sale of products in H1 FY2020

The Company sold 22,624 barrels of oil equivalent per day (boepd) that includes the sale of crude oil & stabilized condensate, LPG and dry gas. The average production of the product mix stood at 23,528 boepd in H1 FY20. Crude oil & stabilized condensate contributed 39.7 percent of the total product mix sale, and it was 8,991 boepd. LPG sales volume was 2,995 boepd, and Dry gas was 10,768 boepd in H1 FY20.

Interest payment update on Notes

On 24 July 2020, the Company stated that it would use the grace period for interest payments due on its 8 percent Senior Notes due in 2022 and 7 percent Senior Notes due in 2025. The grace period is for 30 days. Both Notes have semi-annual interest payment. 2022 Notes has interest payment on 25 January and 25 July, whereas 2025 Notes has interest payment on 16 February and 16 August of each year. Nostrum has appointed Rothschild & Cie as financial advisers and White & Case as legal advisers for the restructuring of Notes.

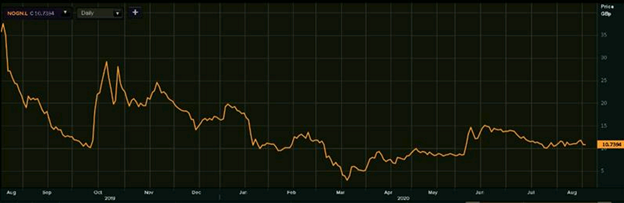

Share Price Performance Analysis

1-Year Chart as on August-19-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Nostrum Oil & Gas PLC's shares were trading at GBX 10.7394 and were down by 0.74 percent against the previous closing price (as on 19 August 2020, before the market close at 2:00 PM GMT+1). NOG's 52-week High and Low were GBX 37.89 and GBX 3.00, respectively. Nostrum Oil & Gas has a market capitalization of around £20.16 million.

Business Outlook

Nostrum paused all the drilling activities in 2020 and expected the production to be close to 20,000 boepd and sales volume to be 19,000 boepd in FY20. The Company expects the price of Dry gas to remain low in the current year. It is also looking to utilize the spare capacity by processing the third party volumes.

Petrotal Corporation (LON:PTAL) - Fall in energy prices affected the revenue

Petrotal Corporation is a Canada based company that is engaged in the exploration and development of oil and gas projects. The Company operates and manages assets in Peru, and it is developing the Bretana oil field.

Q2 FY2020 results (ended 30 June 2020) as reported on 18 August 2020

The Company reported revenue of USD 9.8 million in Q2 FY20, which was down from USD 41.8 million generated in Q1 FY20. The revenue declined mainly due to a fall in oil prices and the effect of the covid-19. The revenue was earned at an average realized price of USD 22.87 per barrel. The average Brent oil price was USD 29.19 per barrel in Q2 FY20, which declined from USD 50.14 per barrel in Q1 FY20. In Q2 FY20, the average oil production was 4,185 barrels per day, and the average sale was 4,729 barrels per day. Petrotal paid royalties to the Peruvian government of close to USD 0.1 million in Q2 FY20 that was approximately 1.3 percent of the total revenue. The operating cost declined from USD 6.0 million in Q1 FY20 to USD 2.4 million in Q2 FY20. The variable costs dependent on the production declined during the quarter following lower production in Q2 FY20. The net operating income was USD 2.8 million that declined from USD 17.8 million in Q1 FY20. The cash flow from operations was USD 0.9 million in Q2 FY20. As on 30 June 2020, Petrotal had cash of USD 20.4 million. The Company received covid-19 related financial aid of USD 3.2 million, of which USD 2.9 million was from the Peruvian government and USD 0.3 million was received under the US paycheck protection programme. The financial support from the Peruvian government is at an interest rate of 1.12 percent and would be repaid over the three years. No repayment is required for financial assistance under the US scheme.

Bretana Oil Field

As reported on 10 August 2020, the Bretana oil field in Peru was closed due to the civil unrest. The area is expected to remain closed until an inquiry is conducted. Some communities created the disorder against the government for the covid-related crisis. In July 2020, the Bretana oil field supplied 40,000 barrels of oil to Iquitos refinery and Saramuro.

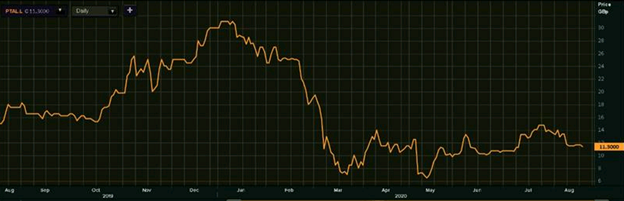

Share Price Performance Analysis

1-Year Chart as on August-19-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Petrotal Corporation's shares were trading at GBX 11.30 and were down by close to 2.84 percent against the previous closing price (as on 19 August 2020, before the market close at 2:00 PM GMT+1). PTAL's 52-week High and Low were GBX 32.90 and GBX 5.50, respectively. Petrotal Corporation had a market capitalization of around CAD 162.91 million.

Business Outlook

Petrotal acknowledged the challenging macroeconomic conditions and its effect on business activity. The Company expects to pay for future expenses from the revenue generated from oil fields and internal cash resource. Petrotal has also hedged the crude oil price. The Company expects to recommence operations at the Bretana oil field by the end of August 2020 as it is currently closed due to civil unrest outside the oil field.