Summary

- As per the industry experts, the British economy is expected to shrink by close to 10.1 percent in 2020. Growth of about 7.1 percent is expected next year.

- The Brent crude oil was trading at USD 42.98 per barrel up by 1.46 percent (as on 10 July 2020, before the market close at 4.00 PM GMT).

- IOG gave well management contract for the Phase 1 project at the UK Southern North Sea to Petrofac.

- Jangada Mines received assay results for Pitombeiras North and Goela Targets.

Given the above market conditions, we will review two resource stocks - Independent Oil & Gas PLC (LON:IOG) and Jangada Mines PLC (LON:JAN). The shares of both IOG and JAN were trading up by 14.54 percent and 14.29 percent, respectively (as on 10 July 2020, before the market close at 2.42 PM GMT+1). Let's review their financial and operational updates to understand the stocks better.

Independent Oil & Gas PLC (LON:IOG) - Development and progress on Phase 1 project remained on track

Independent Oil and Gas is a UK based Company, which is engaged in the business of oil and gas development in the UK North Sea. The Company owns and operates a 50 percent stake in gas reserve in the UK Southern North Sea. IOG own reserves at Blythe, Elgood, Southwark, Nailsworth, Goddard and Elland, which are considered as "Core projects".

FY2019 Annual results (for the period ended 31 December 2019) as reported on 26 March 2020

The Company secured funding for development and production of the Core project excluding Harvey through 50 percent farm-out agreement with CalEnergy Resources Limited. The farm-out agreement is for £165 million. Under the contract, CalEnergy has an option to acquire 50 percent license in Harvey for an additional payment of £20 million and some royalty payment. IOG and CalEnergy also signed an agreement for the development of business opportunities in the Southern North Sea region. The Company acquired onshore Thames Reception Facilities at Bacton Gas Terminal from Perenco, Tullow Oil SK Limited and Spirit Energy. The purchase of the facility is a strategic investment as it would be used along with Thames pipeline to transport natural gas. The Company issued five-year senior secured bonds for €100 million to fund the final investment decision of Core projects; the institutional investors subscribed the bonds. The final investment decision was taken over the Core project in Q4 FY2019 with first gas production expected in Q3 FY2021. IOG also raised £18.9 million through the placement of institutional equity; the fund was used for drilling of Harvey well.

Recent Events

- On 1 June 2020, IOG awarded the well management contract to Petrofac for Phase 1 of the Core project in the UK Southern North Sea project. The drilling of five-well for Phase 1 is expected to start from the first half of 2021—Phase 1 consists of the Southwark, Blythe and Elgood fields.

- On 7 May 2020, IOG awarded the engineering, procurement, construction and installation contract for Phase 1 project to Subsea 7. The offshore pipelay is expected to start in the second half of this year.

Key Events in FY19 Period

(Source: Company Website)

Share Price Performance

1-Year Chart as on July-10-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Independent Oil and Gas PLC's shares were up by 14.54 percent against the previous day closing and trading at GBX 13.75 (as on 10 July 2020, before the market close at 2.02 PM GMT+1). Stock 52-week High and Low were GBX 26.00 and GBX 9.32, respectively. The Company had a market capitalization of £57.62 million.

Business Outlook

Despite the impact of Covid-19 on the business, IOG remains confident to deliver first gas production in Q3 FY21. The Company is working closely with the UK Oil and Gas Authority for approval of Phase 1 Field Development Plan. The Company is on track to start laying a 7-kilometre 24-inch pipeline to connect Southwark field to the Thames Pipeline, 24-kilometre 12-inch line to connect Blythe to the Thames Pipeline and 10-kilometre 6-inch line to connect Elgood to Blythe.

Jangada Mines PLC (LON:JAN) – Final assay result received at Pitombeiras North and Goela Targets

Jangada Mines is the UK-based Company which focuses on the natural resource sector. The exploration of Pitombeiras vanadium deposit in Northeastern Brazil is the key activity. Jangada Mines has 24.9 percent ownership in ValOre Metals Corp, which owns Pedra Branca project. The mines explored by the Company have mineral deposits, including vanadium, titanium and iron.

H1 FY20 results (for the period ended 31 December 2020) as reported on 31 March 2020

As on 31 December 2020, the Company had total assets of USD 5.8 million and cash of USD 0.3 million. The Company generated net cash of USD 0.2 million in six months. In February 2020, the Company received a payment of CAD1 million and 500,000 common shares of ValOre. Jangada sold a majority stake in Pedra Branca to ValOre for CAD3 million and 25 million common shares of ValOre.

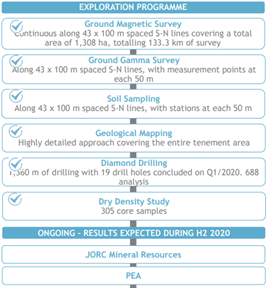

The Company has estimated a JORC exploration target in the range of 40Mt to 60Mt for vanadium oxide, iron oxide and titanium dioxide at Pitombeiras Vanadium Project. At the start of 2020, the Company planned to complete 2,500 metres of drilling at the Pitombeiras North, Pitombeiras South and Goela targets in six months. Still, given the uncertainty over economic conditions and increased safety measures, the drilling target was revised to 1,350 metres.

Advancement at Pitombeiras North and Goela Targets as reported on 10 July 2020

The Company confirmed additional high-grade drilling assay results from the diamond drilling ('DD') programme at the Pitombeiras Vanadium Project in Brazil. The final composition discovered from the Pitombeiras North Target includes vanadium pentoxide, titanium dioxide and ferric oxide. The Company also received the first result from the Goela Target, the last five findings from the Goela Target are expected to be received in the next two to three weeks. The Company completed a total of 19 diamond drilling (DD) in 2020 with total drilling of 1,360.80 metres. Pitombeiras North target was drilled 1,058.85 metres, and Goela target was drilled 301.95 metres. Out of the 19 holes drilled assay results have been received for 11 DD holes.

The Exploration Programme in 2019-2020

(Source: Company Website)

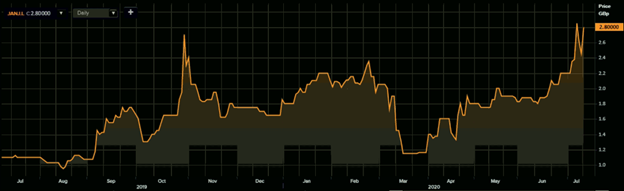

Share Price Performance

1-Year Chart as on July-10-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Jangada Mine PLC's shares were up by 14.29 percent against the previous day closing and trading at GBX 2.80 per share (as on 10 July 2020, before the market close at 2.52 PM GMT+1). Stock 52-week High and Low were GBX 3.30 and GBX 0.90, respectively. The Company had a market capitalization of £5.93 million.

Business Outlook

The Company expects that after receiving assay results from all drill holes, it would have enough data for a mineral resource estimate and it would assign an independent engineering Company for the economic assessment of the project. The existing cash would be sufficient to fund both these activities. The Company has plans to perform geological mapping and rock chip sampling at Mocidade, which is a new tenement added in February 2020.