Summary

- Goodwin Plc had reported a decline of 11.0% in its revenue during H1 FY21.

- The Company will repay its Bank of England CCFF loan before the end of the current financial year.

- The order book of the Company was robust at £174.0 million as of 31 October 2020.

- The Company had not declared any interim dividend due to continuing uncertainties.

Goodwin Plc (LON:GDWN) is the FTSE All-Share listed industrial stock. The Company is a well-established engineering player. Based on its 1-year performance, shares of GDWN have generated a return of about negative 11.30% Shares of GDWN were down by close to 3.69% from the last closing price (as on 18 December 2020, before the market close at 08:35 AM GMT).

Goodwin Plc is the FTSE All-Share listed engineering-based company having its focus on mechanical engineering and refractory engineering. The mechanical engineering division deals with casting, machining and general engineering and refractory engineering division deals in powder manufacture and mineral processing. The Company was incorporated in 1883 and currently has over 1190 employees.

Business Model

Mechanical Engineering – The Group has its speciality in supplying industrial goods on a project basis and rendering the services without taking any assistance from the other Company of the same specialization. The projects encapsulate various stages such as -

- International procurement

- High integrity castings

- Forgings or wrought high alloy steels

- Precision CNC machining

- Complex welding

- Fabrication

Apart from the specialist projects the Company also manufactures and sells a diverse category of dual plate check valves, axial nozzle check valves and axial piston control and isolation valves cater to the needs of several industries like the oil, petrochemical, gas, liquefied natural gas (LNG), mining, nuclear power generation, nuclear waste treatment and water markets.

Refractory Engineering - Under this particular division, Goodwin Refractory Services (GRS) designs, manufactures and sells investment casting powders and waxes to the jewellery casting industry. The Company also manufactures and sells investment casting powders to the tyre and aerospace industries. The Refractory Engineering Division is present across five other companies located in China, India and Thailand, which are engaged in the sale of casting powders directly and through distributors to the jewellery sector.

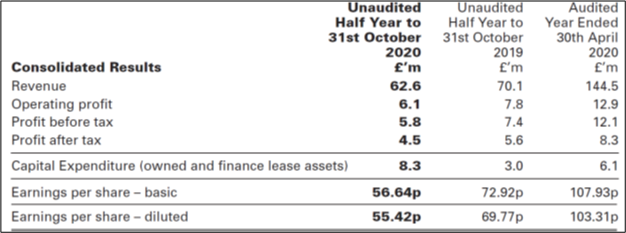

H1 FY21 results (ended 31 October 2020) as reported on 16 December 2020.

(Source: Company result)

- The Company had reported a decline of 11% in revenue to £62.6 million during H1 FY21 ended on 31 October 2020 from £70.1 million achieved in H1 FY20. The decline was attributed to Covid-19 pandemic worries, the downturn of the oil and gas industry and the delay of several capital projects.

- Similarly, the profit before tax also went down by 22% from £7.4 million during H1 FY20 to £5.8 million for H1 FY21 due to adverse effect of Covid-19 pandemic.

- The diluted earning per share also dropped to 55.42 pence per share during H1 FY21.

- The Company had not declared any interim dividend due to continuing uncertainties.

- The Company had strengthened its balance by increasing its closing cash balance from £9.41 million as of 31 October 2019 to £10.91 million as of 31 October 2020.

- The order book of the Company was robust at £174.0 million as of 31 October 2020.

- The net debt of the Company stood at £31.1 million as of 31 October 2020, while it was £27.2 million as of 31 October 2019.

Recent News

On 11 December 2020, the Company had updated regarding the retirement of Mr S. C. Birks from the position of the Director. Mr Nigel Brown has been appointed as an executive director with effect from the same day.

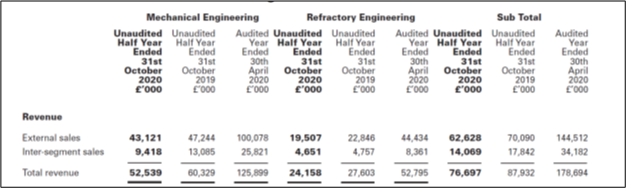

Operational Segments review

(Source: Company result)

Mechanical Engineering – External sales and Inter-segment sales were declined by 9% and 28%, respectively. Total revenue for this segment was declined by 13% from £60.32 million during H1 FY20 to £52.54 million for H1 FY21.

Refractory Engineering – The current activity levels across this segment had reached similar levels as it was during pre-covid period. The Company had updated regarding the Castaldo silicone rubber technology and plant, which was purchased last year had been now successfully commissioned and installed in Thailand, Siam Casting powders. External sales and inter-segment sales were dropped by 15% and 2%, respectively. Total revenue for this segment was declined by 12% from £27.60 million during H1 FY20 to £24.15 million for H1 FY21.

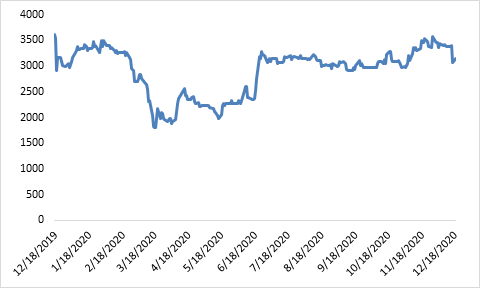

Share Price Performance Analysis of Goodwin Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of Goodwin Plc were trading at GBX 3,024 and were down by close to 3.69% against the previous closing price as on 18 December 2020, (before the market close at 08:35 AM GMT). GDWN's 52-week High and Low were GBX 3,660 and GBX 1,730, respectively. Goodwin Plc had a market capitalization of around £236.33 million.

Business Outlook

The Company is expecting to deliver similar pre-tax profits during the second half of the year for its Refractory Engineering Division as various developments like upcoming completion of several radar systems in East Asia, and initiation of manufacturing works across the nuclear contracts will take place. The upcoming increase in military expenditure and nuclear-related casting requirements will benefit the foundry despite having challenging conditions as it is drifted away from its historic baseload of petrochemical related work. The Company has mentioned that it would require additional time to complete the design and procurement of components. With the postponing of some capital projects and the downfall of the Oil & Gas industry, the Company has become more cautious of Covid-19 pandemic.

The trading condition will continue to remain weak for Refractory Engineering Division as several industries are getting adversely impacted by the government-imposed restrictions with reduced confidence in consumer spending. The Company has made it clear that the medium-term recovery will depend on consumer behaviour during these challenging times. The Company maintain its gearing ratio by efficient management of its working capital and level of expenditure. The Company will repay its Bank of England CCFF loan before the end of the current financial year. The Company has taken this loan as an insurance cover against traumatic situation caused due to Covid-19 pandemic.