Summary

- The UK government mandated two weeks quarantine for travellers returning from Spain.

- The Gold prices touched an all-time high, and it was trading close to USD 1,937.65 per ounce (as on 27 July 2020, before the market close at 3:00 PM GMT+1).

- Bilby secured new financing facility of £9.8 million from the HSBC bank.

- Bilby has visibility of revenue of close to £172.1 million over the next three years.

- Zinc Media Group expects to be profitable in 2021 and cash generative by the second half of 2021.

- Zinc Media Group launched a new branded content segment for creating programmes and contents.

Given the above-market conditions, we would review two stocks - Bilby PLC (LON:BILB) & Zinc Media Group PLC (LON:ZIN). Bilby PLC is a industrial stock, whereas Zinc Media Group is a media stock. Let's walk through the financial and operational update to understand the stocks better.

Bilby PLC (LON:BILB) - Resolved the claim proceedings with East Kent Housing and Carillion Amey

Bilby PLC is a UK based company engaged in providing gas heating services, electrical services and building maintenance services. Bilby has four subsidiaries, namely R Dunham, Purdy, DCB and Spokemead. The customers of the Company are housing associations and large-scale organizations. The Company is included in the FTSE AIM All-Share index.

FY2020 Annual results (ended 31 March 2020) as reported on 27 July 2020

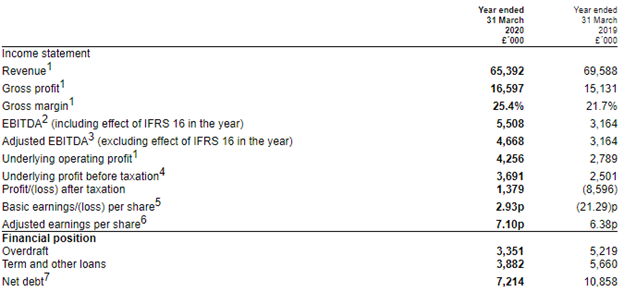

The Company reported revenue of £65.4 million, which was down from £69.6 million in FY19. However, the adjusted EBITDA increased by 48 percent year on year to £4.7 million. The adjusted cash generation from operating activities was £5.0 million. The basic earnings per share improved to 2.93 pence per share from a loss of 21.29 pence per share. The Company raised £1.8 million through the issue of new shares. The revenue of building services division declined from £39.2 million in FY19 to £31.0 million in FY20. The gas maintenance and electrical services divisions generated revenue of £11.8 million and £22.4 million, respectively in FY20. Bilby resolved the claim proceedings with East Kent Housing and Carillion Amey, both the contracts were loss-making. The Company won new contracts worth £49.1 million in FY19 and has visibility of revenue of close to £172.1 million over the next three years. As on 30 June 2020, the Company had net debt of £7.3 million. The unaudited revenue and adjusted EBITDA performance until 30 June 2020 after FY20 year-end, was at 62 percent and 75 percent compared to the last year.

New Banking facilities secured as reported on 26 May 2020

The Company secured new financing facilities of £9.8 million from HSBC, which includes a term loan facility of £7.3 million and an overdraft facility of £2.5 million. The Company withdrew the new term loan facility to improve the cash by £4.0 million. The loan facility requires quarterly payment of £0.5 million starting August 2020 and the facility would expire in September 2022.

FY2020 Financial Summary

(Source: Company Website)

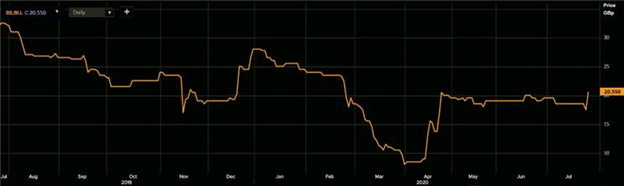

Share Price Performance Analysis

1-Year Chart as on July-27-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Bilby PLC's shares were trading at GBX 20.55 and were up by 17.43 percent against the previous closing price (as on 27 July 2020, before the market close at 2:10 PM GMT+1). Stock 52-week High and Low were GBX 32.95 and GBX 7.00, respectively. The Company had a market capitalization of £10.28 million.

Business Outlook

After lockdown, the Company's workers faced a challenge in entering some of the properties as residents were reluctant in providing access. The Company engaged actively to outline new plans for resumption of work and discussed with the customers regularly. The Company is confident about the current liquidity position to deal with economic uncertainty. The Company's primary focus would be providing top-notch customer service. The services provided by the Company are considered at an essential service.

Zinc Media Group PLC (LON:ZIN) – Won new contracts and resumed production

Zinc Media Group PLC is a UK based group engaged in producing content for the TV and multimedia platforms. The Group has three operating divisions, including TV, Publishing and Communication. The Group is included in the AIM All-Share index.

Trading update as reported on 27 July 2020

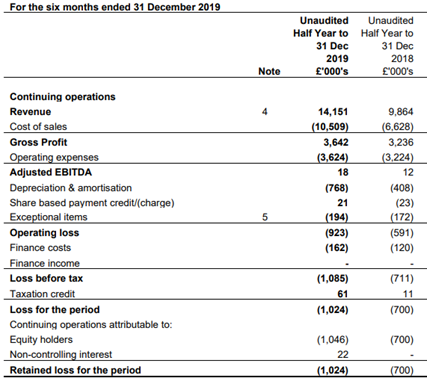

The Group resumed production of new series for the Smithsonian Channel and production of few ongoing series. It is expected that production of £1.5 million could continue by August. The production of total £2 million that was closed due to the pandemic, The Group, won contracts of new production worth £2.7 million since May 2020, and it is in advanced discussion for new business of close to £6.0 million. The new business won includes two series for Channel 5. The Group is resuming paused production faster than expected. Following the disruption caused due to the Covid-19, the Group took some cost mitigating actions that are expected to generate annual cost saving of approximately £0.7 million. The cost in June 2020 was 20 percent lower than the pre-Covid level. The recent cost reduction actions combined with the improving television segment margins could make the Group profitable from 2021 and cash generative from the second half of 2021. The margins of the Television division are currently close to 4.7 percent. The Group has closed the CSR business that was loss-making and has launched a newly branded content division. The branded content business would create programmes and contents for brands and advertisers.

H1 FY2020 Results

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-27-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Zinc Media Group PLC's shares were trading at GBX 76.00 and were up by 78.82 percent against the previous closing price (as on 27 July 2020, before the market close at 2:10 PM GMT+1). Stock 52-week High and Low were GBX 182.60 and GBX 38.00, respectively. The Company had a market capitalization of £3.36 million.

Business Outlook

The Group highlights to generate improved revenue better than the previous estimates between July 2020 to December. The Group expects it to be profitable in 2021 and cash generative by the second half of 2021. The branded content division is anticipated to combine well with the TV business, and it would provide better opportunities. As on reported date, the Company had cash of £3.7 million. The Group has programmes in the pipeline, and the majority of that could be produced under social distancing guidelines. The Group's Publishing business is expected to perform better than previous guidance.