Highlights

- General Logistics Systems (GLS), a subsidiary of the Royal Mail Group, entered into an agreement to take over Mid-Nite Sun Transportation Ltd, a Canada-based logistics firm.

- Wincanton’s board announced a final dividend of 7.50 pence per share for the year ended 31 March 2021.

Several containers are sitting empty at ports, delaying goods from reaching the shelves for the upcoming Christmas and holiday season. The huge cargo build-up has resulted in shipping firms to divert their carriers away from ports in the UK so that they can be unloaded in other European nations. Maersk announced diverting its carrier vessels from Felixstowe (the largest commercial port in the UK) to Europe and also reported the use of smaller ships to deliver goods to the UK. Ports in the country were impacted by major Brexit border changes and high global demand for goods transported, thereby adding immense pressure on the system.

Several other shipping firms are taking necessary measures to lower yard congestion, reduce the impact of the HGV driver shortage, increase rail network usage, and divert traffic to alternate ports in the UK, aimed at minimising the impact on supply chains as businesses gear up for the holidays. According to the Road Haulage Association (RHA), there is a shortage of nearly 100,000 HGV drivers in the UK. Businesses are also considering the use of air freight solutions to lower the impact on consumers in these circumstances. Let us explore the investment prospect in two logistics stocks – Royal Mail Group & Wincanton.

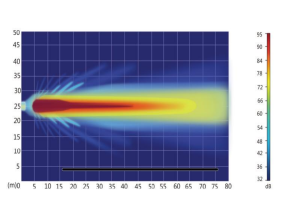

(Data source: Refinitiv)

Royal Mail Group Plc (LON: RMG)

Royal Mail Group is a multinational courier and postal service that operates through the Parcelforce Worldwide and Royal Mail brands. Recently, General Logistics Systems (GLS), a subsidiary of the Royal Mail Group, entered into an agreement to take over Mid-Nite Sun Transportation Ltd, a Canada-based logistics firm.

Royal Mail Group’s shares were trading at GBX 419.00, up by 0.65% at 8:46 AM BST on 15 October 2021. The shares of Royal Mail Group gave a return of 74.28% in the last one year to shareholders, and the market cap of the company is £4,166.00 million as of 15 October 2021.

For the quarter ended 30 June 2021, Royal Mail’s revenue, parcel volumes and parcel revenues grew by 12.2%, 13% and 3.4%, year-on-year, respectively. The company’s revenue for the quarter was £2,126 million. The group revenue grew by 12.5% year-on-year in the quarter ended 30 June.

Wincanton Plc (LON: WIN)

Wincanton is a provider of logistics and transportation services, including supply chain management, automated high bay, and warehouses. In September, Wincanton inked an agreement to acquire a 100% stake in Caledonia Bidco Limited, a company that specialises in e-commerce and multichannel fulfilment, from Crescent Capital.

Wincanton’s shares were trading at GBX 366.00 at 8:27 AM BST on 15 October 2021. The shares of Wincanton gave a return of 72.51% in the last one year to shareholders, and the market cap of the company is £455.83 million as of 15 October 2021.

Wincanton’s revenue for the year ended 31 March 2021 was £1,221.9 million representing an increase of 1.7% year-on-year compared to £1,201.2 million in 2020. Its underlying profit before tax was £47.2 million in 2021 compared to £52.8 million in 2020, representing a decline of 10.6% year-on-year.

Wincanton’s board announced a final dividend of 7.50 pence per share for the year ended 31 March 2021.