Highlights

- Private equity focused investment trust Electra Private Equity said on Thursday that it would soon begin the formal process of moving from the LSE’s main market to AIM.

- The company aims to rebrand to a digital lifestyle platform, Unbound and plans to build on the existing business of Hotter shoes

- The company expects the transition to be completed in early 2022.

UK based private equity focused investment trust, Electra Private Equity Plc (LON:ELTA) said on Thursday that it would soon begin the formal process of moving from the LSE’s main market to its junior market AIM.

The move of the company is aimed at rebranding itself into a digital lifestyle platform called Unbound PLC upon its transition into AIM and cease being an investment trust.

Electra’s transition to Unbound PLC

Unbound will look to build on the existing business of shoemaker Hotter Shoes. It aims to sell various products and services targeted towards the active lifestyle of those aged 55 years and over.

The company expects the planned transition to be completed early next year, subject to shareholders approval.

Hotter Shoes’ H1 2022 (for the six-month period ending on July) earnings before interest, tax, depreciation and amortisation (EBITDA) stood at £2.5 million. And its H1 2022 revenue was at £25 million.

The company anticipates that Unbound’s first revenues from sales (from its own platform of products other than Hotter footwear) will be in Q2 2022

The group has a medium-term goal of having over 50 per cent of Unbound's profits come from non-Hotter products.

Demerger from Hostmore

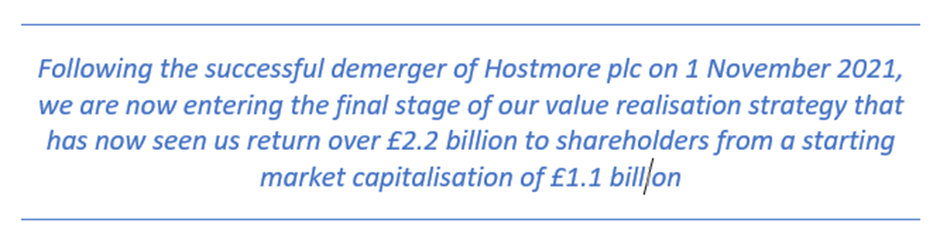

Electra had announced successfully demerger of its portfolio company Hostmore Group on 1 November, which helped the company in applying for its change of listing name as well as status.

Hostmore now trades as a separate entity on the main market under the ticker name ‘MORE’.

The chairman at Electra, Neil Johnson said:

Electra’s net asset value as of 30 September

The company’s net asset value (NAV) per share as of 30 September stood at 525.9 pence, of which 107.0 pence was attributed (on a notional basis) to its upcoming Unbound business.

Electra’s NAV as of 30 September (considering the impact from demerger and removal of various discounts included in the NAV) stands at 835.2 pence per share.

Electra stated that Unbound’s value, considering the aforementioned discount removal and demerger, is 173.2 pence per share.

Electra Private Equity Plc (LON: ELTA) share price performance

Electra’s shares were trading flat at GBX 65.00 on 2 December at 10:20 AM BST, while the FTSE All-Share index stood at 4,058.44, down by 0.75 per cent.

Image source: Refinitiv

The company’s market cap stands at £25.33 million as of Thursday. It’s year-to-date shareholder return stands at 33.83 per cent, and its one-year return is at 50.27 per cent as of 2 December.