Summary

- Falanx Group reported strong sales order book for the Cyber division in July 2020.

- Falanx Group launched Triarii, an enhanced Managed Detection and Response (MDR) service.

- Ormonde Mining divested the ownership in Barruecopardo Tungsten Mine.

- Ormonde Mining is exploring opportunities to invest in new projects.

FLX is an industrial stock, whereas ORM is a basic materials stock. Based on 1-year performance, both FLX and ORM were down by about 25.94 percent and 74.60 percent, respectively. FLX and ORM were up by close to 24.39 percent and 14.29 percent, respectively from the previous closing price (as on 6 August 2020 before the market close at 2:30 PM GMT+1). Let's walk through the financial and operational updates of the companies to understand the stock better.

Falanx Group Limited (LON:FLX) – Moved the headquarter to Reading

Falanx Group Limited provides intelligence and cybersecurity services. Falanx Assynt provides the intelligence consultancy services, and Falanx Cyber provides services to detect and eliminate security threats. Falanx Group is based in the Virgin Islands, and it is listed on the FTSE AIM All-Share index.

Trading Update as reported on 5 August 2020

For Q1 FY21 ended 30 June 2020, Falanx stated that the revenue was up by 5 percent year on year. The Company experienced lower sales in April and May 2020; however, the sales picked in June 2020. The business witnessed upbeat demand for cybersecurity as people started to work from home, and the Assynt strategic intelligence business was buoyed as the division generates close to 94 percent of the total revenue as recurring revenue. The Company faced headwinds due to the pandemic that affected the consultancy work. Falanx Group stated that the EBITDA loss in Q1 FY21 declined by 60 percent year on year. The Company moved the headquarter to Reading after the lease for the Sussex and London office expired in July 2020. The Company took measures to bring down the cost such as putting some of the workforces on furlough, and it has slashed the operating expense by about 30 percent each month as compared to the same period last year. As on 30 June 2020, Falanx had cash of £0.75 million and an unused debt facility of £0.50 million. For FY20 ended 31 March 2020, Falanx expects to generate revenue of approximately £5.8 million, which was £5.2 million a year ago. In FY20, the Cyber division of the business won 42 new clients, whereas the commencement of the major contracts underpinned the performance of Assynt strategic intelligence division. The Company divested Furnace, a cloud technology platform, in December 2019 and a significant portion the Company's investment plan was completed in 2019. The sale of Furnace was supportive in bringing down the cash expense as the platform incurred a loss of £193,000 and capital investment of £218,000 for the first eight months of FY20.

Launched Triarii, an enhanced Managed Detection and Response (MDR) service

Falanx Group launched Triarii, an MDR service, that was developed using enterprise-class external components. MDR identifies the security threat and removes the risk across the entire environment. The Cyber business was providing the MDR service, and the launch of Triarii would strengthen the position as it has already undergone trials. A few partners have shown interest in using Triarii.

Share Price Performance Analysis

1-Year Chart as on August-6-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Falanx Group PLC's shares were trading at GBX 1.21 up by about 24.39 percent from the previous closing price (as on 6 August 2020 before the market close at 2:30 PM GMT+1). Stock 52-week High and Low were GBX 2.35 and GBX 0.51, respectively. Falanx Group had a market capitalization of £4.40 million.

Business Outlook

The Company highlighted that the strong momentum witnessed in June 2020 continued in Q2 FY21. The sales order book for the Cyber division in July 2020 was more than the total sales order in Q1 FY21. The pipeline of the business remains robust. The cash expense would be lower due to the mitigating measures taken by the Company and the sale of the Furnace platform.

Ormonde Mining PLC (Ireland) (LON:ORM) – Received cash of €6 million from the sale of Barruecopardo Tungsten Mine

Ormonde Mining PLC is a mining company with operation in Spain. The Company is engaged in the exploration and development of projects in Salamanca and Zamora Gold Projects and La Zarza Copper-Gold Project. The Company is included in the FTSE AIM All-Share index.

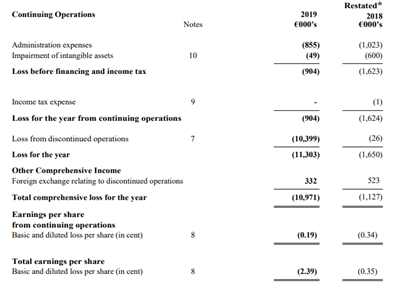

FY2019 Annual results (ended 31 December 2019) as reported on 29 June 2020

(Source: Company Website)

In FY19, the Company's loss after tax widened to €11.3 million from the loss of €1.65 million in FY18. The loss from the continued operations was €0.9 million, whereas loss from the discontinued operation was €10.4 million. The discontinued operation comprised of the Company's stake in Barruecopardo Tungsten Mine. In FY19, the Company recorded an impairment charge of €7.6 million related to the outstanding loan. As on 31 December 2020, Ormonde Mining had cash of €0.1 million and total assets of €9.3 million. In February 2020, the Company the sale of its stake in Barruecopardo Tungsten Mine in Spain due to the operational hurdles faced in ramping-up of the project. Ormonde Mining owned 30 percent of the project, whereas the remaining stake was held by Oaktree Capital Management. The project required increasing financing arrangements to cover the operations, although the Company provided €10 million capital that was financed by Oaktree. The Company estimated that close to €12-15 million additional funding was required by the Barruecopardo project in 2020. Ormonde Mining received cash of €6 million from selling the stake. The Company highlighted that one of the permits out of the three in Salamanca is unlikely to renew in July 2020. On 25 June 2020, the Company appointed Brian Timmons as the non-executive director of the Company.

Business Update as reported on 9 June 2020

The Company reported that it plans to advance the work at the gold projects. The Company discovered high-grade intersection from previous diamond drilling and expected to have gold in the range of 11.4 grams per tonne to 65.8 gramme per tonne. During the lockdown, the Company performed an internal desktop survey of gold projects in Salamanca and Zamora and concluded that shallow-level drill intercepts were found at two locations.

Share Price Performance Analysis

1-Year Chart as on August-6-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Ormonde Mining PLC's shares were trading at GBX 0.80 up by about 14.29 percent from the previous closing price (as on 6 August 2020 before the market close at 2:30 PM GMT+1). Stock 52-week High and Low were GBX 3.60 and GBX 0.42, respectively. Ormonde Mining had a market capitalization of £3.54 million.

Business Outlook

The Company highlighted that the decision to sell the ownership in Barruecopardo Tungsten Mine was in favour of the shareholders as the Spanish mines were currently experiencing temporary closedown. The Company is exploring potential investment opportunities, and there are close sixty projects that the Company has reviewed.