The rising coronavirus cases worldwide dampened the market sentiments. Consequently, the FTSE-100 and Euro Stoxx 50 retreated 1.58 percent and 1.00 percent and were trading at 6,186.92 and 3,316.66, respectively (as on 7 July 2020, before the market close at 3.27 PM GMT+1).

Summary and some critical factors to watch out:

- The British house prices continue to fall for the fourth consecutive month as house prices declined by 0.1 percent in June. The house price was down by 0.2 percent in May.

- The British finance minister Rishi Sunak announced a package of £3 billion on energy efficiency. The £2 billion of the package will be spent on households for insulation and double-glazing of windows, whereas £1 billion will be used for greenhouse gas reduction in public buildings.

- The acquisition of the assets of CEMEX in the UK would strengthen Breedon Group position in the underrepresented markets.

- Breedon Group is likely to declare dividends starting from 2021 interim results.

- Renew Holdings PLC sets optimism on Government announced infrastructure investments.

Given the above market conditions and business updates, we will review two Industrials stocks - Breedon Group PLC (LON:BREE) and Renew Holdings PLC (LON:RNWH). The share price of both BREE and RNWH were down by 1.37 percent and 1.82 percent, respectively (as on 7 July 2020, before the market close at 1.10 PM GMT+1). Let’s walk through their financial and operational updates to understand the stocks better.

Breedon Group PLC (LON:BREE) – CEMEX’s asset acquisition in the UK would strengthen the position

Breedon Group is a Construction Materials Group in the UK and Ireland. The core products of the Group are cement and aggregates, which is used in infrastructure, housing and commercial projects. The Group has nearly 900 million tonnes of mineral reserves and resources. The Group classifies the business into three divisions: Great Britain, Ireland and Cement. The Group is listed on FTSE AIM 100 Index.

FY2019 Annual Results (ended 31 December 2019) as reported on 11 March 2020

The Group reported revenue of £929.6 million, which increased by 8 percent year on year. The underlying EBIT increased by 13 percent to £116.6 million. The profit before tax was up by 18 percent to £94.6 million. The Great Britain operations revenue was up by 1 percent to £615.1 million whereas the underlying EBIT increased by 2 percent to £62.8 million. The Great Britain business operates quarries and downstream operations. The Ireland operations revenue increased by 29 percent to £202.0 million. Under Ireland operations, there are two brands Whitemountain in Northern Ireland and Lagan in the Republic of Ireland.

As on 30 April 2020, the cash balance was £79 million with an additional undrawn committed facility of £222 million. The Group had deferred a term loan amortization of £35 million to April 2022 and also got relaxed covenants till 30 June 2020. In January 2020, the Group announced the acquisition of assets of CEMEX in the UK for £178 million. The acquisition would strengthen Group’s position in six primary regions of Great Britain, adding mineral reserves and resources close to 170 million tonnes.

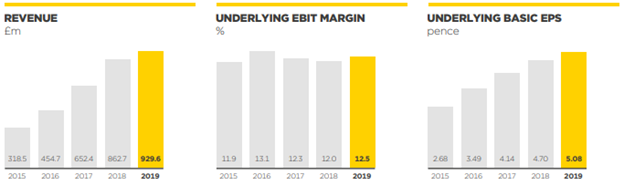

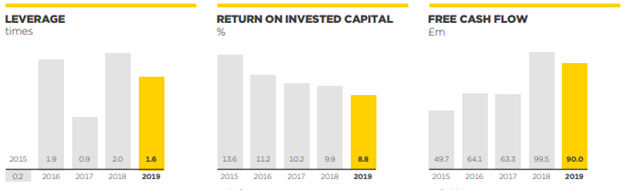

Key Performance Indicators for FY19

The revenue was £929.6 million in FY19, which increased from £862.7 million in FY18. The underlying EBIT margin improved to 12.5 percent from 12.0 percent a year ago. The basic earnings per share improved by 8 percent to 5.08 pence per share, which reflects the improved performance of the business. The leverage that measures Group’s ability to service debt obligation through cash flow generation was 1.6 times underlying EBITDA. The return on invested capital declined from 9.9 percent to 8.8 percent due to the acquisition of the Lagan Group in 2018. The free cash flow generation declined to £90.0 million from £99.5 million due to increased working capital expenditure.

KPIs for FY19

(Source: Company Website)

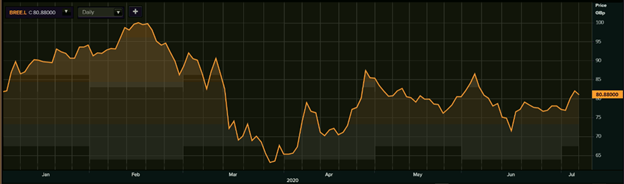

Share Price Performance

1-Year Chart as on July-7-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Breedon Group PLC’s shares were down by 1.37 percent and trading at GBX 80.88 per share (as on 7 July 2020, before the market close at 1.10 PM GMT+1). Stock 52-week High and Low were GBX 101.50 and GBX 56.00, respectively. The Group had a market capitalization of £1.38 billion.

Business Outlook

The Group believes that post-acquisition of assets from CEMEX in the UK, the position would further strengthen. The focus would remain to integrate the acquired business into the Group. The Group will continue to seek acquisition opportunities as there are still regions where the Group remain under-represented. Breedon is likely to benefit with an increase in capital infrastructure spending by the country. The Group intends to declare dividends starting from 2021 interim results.

Renew Holdings PLC (LON:RNWH) – Government package on infrastructure projects is a key opportunity

Renew Holdings PLC provides engineering services to maintain and develop UK Infrastructure in the Rail, Infrastructure, Energy and Environmental markets. The Company classifies the business into Engineering Services and Specialist building. The Engineering services maintain and renew UK infrastructure projects, whereas the Specialist services is engaged in structural engineering works in high quality residential and science projects.

FY2020 Interim results (ended 31 March 2020) as reported on 11 June 2020

The Company generated revenue of £313.6 million. The adjusted operating profit improved to £19.9 million from £18.4 million a year ago, with an adjusted operating margin of 6.4 percent in FY20. The statutory profit before income tax was £15.2 million. As on 31 March 2020, the order book stood at £690 million. The Engineering services generated revenue of £293.1 million with an adjusted operating profit of £20.5 million. The Specialist service revenue was £20.5 million, with an operating profit of £0.4 million. The order book for Engineering Services and Specialist Services was £591 million and £99 million, respectively.

As on 31 March 2020, the net debt was £16.1 million. The Company refinanced working capital facility of £44.2 million due in January 2024 from HSBC Bank and also had an uncommitted revolving credit facility of £15 million and the unsecured overdraft facility of £10 million.

Operational Highlights and Opportunity

Network Rail spending plan for CP6 is £48 billion over the next five years. Infrastructure spending under the Road Investment Strategy 2 (RIS 2) is expected to be close to £27.4 billion of which £11.9 billion will be for operations, maintenance and renewals. The Company has an opportunity to provide maintenance and renewal service across the national rail network and infrastructure projects. In the Energy sector, the Company has a prospect for decommissioning, asset care, maintenance, new build support and specialist manufacturing to thermal power and nuclear power facilities.

Cashflow Highlights in H1 FY2020

(Source: Company Website)

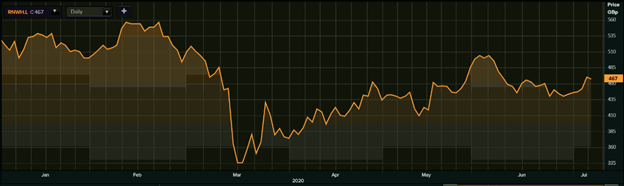

Share Price Performance

1-Year Chart as on July-7-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Renew Holdings PLC’s shares were down by 0.64 percent and trading at GBX 467.00 per share (as on 7 July 2020, before the market close at 1.10 PM GMT+1). Stock 52-week High and Low were GBX 570.00 and GBX 304.00, respectively. The Company had a market capitalization of £369.21 million.

Business Outlook

The acquisition of Carnell has strengthened the position for Highway projects. The Company would focus on robust business performance and strong revenue generation. The Company is positive over the UK Government’s committed expenditure of £640 billion on infrastructure projects via a five-year plan. The Company would take care of the safety measures to provide essential network services on the projects and currently remobilizing operations which were affected due to Covid-19.