Highlights

- GlaxoSmithKline Plc has come one step closer to the proposed demerger of its consumer healthcare business by announcing the name of the new entity.

- The proposed demerger will be a milestone in the company’s history which was first announced four years back.

The global healthcare firm GlaxoSmithKline Plc (LON: GSK) has come one step closer to the proposed demerger of its consumer healthcare business. The FTSE100 listed company has announced that the new consumer healthcare company will be named Haleon, which will be spun off from GlaxoSmithKline Plc by the mid of 2022.

The new entity, Haleon, will have a portfolio of many leading consumer brands like Sensodyne toothpaste, Panadol, and many more, which are expected to generate annual revenue of nearly £10 billion through sales. The new standalone company will compete in a £150 billion consumer healthcare sector, focusing on improving the health & wellbeing of consumers.

The demerger is expected to take place in mid-2022 after getting shareholders’ approval. The new entity will be headquartered in Weybridge, UK, and will have a valuation of close to £60 billion, making it eligible for a premium listing on the main market of the London Stock Exchange. At the same time, its ADRs will list on the US stock exchange.

© 2022 Kalkine Media®

© 2022 Kalkine Media®

The new company’s board will be led by chairman designate Sir Dave Lewis, while Brian McNamara is the CEO designate, as announced earlier in July 2021. The proposed demerger will be a milestone in the company’s history which was first announced four years back and comes after turning down multiple takeover attempts by Unilever Plc (LON: ULVR), with a final takeover bid of £50 billion in December 2021.

The demerger and listing of two separate entities, one focused on pharmaceuticals and vaccines and other business focused on consumer healthcare, would lead to better management, cost savings and unlocking of shareholder value. Further details about the proposed demerger, like operations and financial information of the new company, will be announced on capital markets day, which is scheduled for 28 February 2022.

Stock performance

(Image Source: Refinitiv)

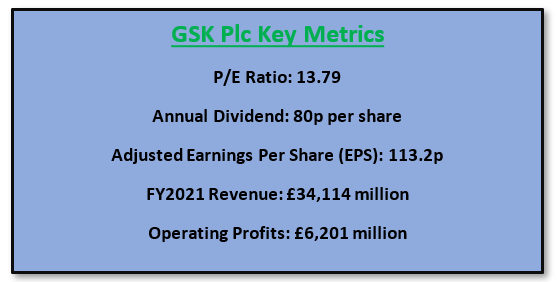

GSK Plc’s last close was at GBX 1,557 on 22 February 2022, with a market cap of £79,375 million. In the last one year, the stock has given 29.22% returns to its shareholders. The current dividend yield of the stock stands at 3.1%.

.jpg)