Highlights

- Insider Nick (Philip) Rodgers acquired 31,292 shares of Cambridge Cognition Holdings Plc (COG).

- The transaction occurred at GBX 32 per share, totaling £10,013.44.

- Shares of LON:COG recently rose by 6.3%, reflecting renewed attention.

Insider Activity at Cambridge Cognition Holdings Plc

Cambridge Cognition Holdings Plc (LON:COG), a neuroscience technology company categorized under LON healthcare stocks, has drawn attention following an insider purchase by Nick (Philip) Rodgers. On December 23, Rodgers acquired 31,292 shares of the company at an average price of GBX 32 per share, amounting to a total transaction of £10,013.44. Insider transactions like these often attract scrutiny due to their potential implications regarding company performance and future prospects.

Cambridge Cognition shares opened at GBX 34 in the latest trading session, reflecting a 6.3% increase. Over the past months, the stock has demonstrated notable volatility, with a 52-week range between GBX 26.40 and GBX 60. Recent movements indicate renewed market interest, aligning with insider activity and broader market conditions. The company's 50-day moving average is GBX 28.62, while its 200-day moving average stands at GBX 36.69.

The company currently has a market capitalization of £14.26 million, with a P/E ratio of -850.00, suggesting that its valuation metrics are influenced by its growth-focused business model. Additionally, Cambridge Cognition’s beta of 0.72 implies moderate sensitivity to market fluctuations.

Financial and Operational Highlights

Cambridge Cognition operates with a quick ratio of 0.96 and a current ratio of 0.65, reflecting its near-term liquidity position. However, the company’s debt-to-equity ratio of 92.53 indicates a leveraged balance sheet, which may impact its financial flexibility.

Company Profile

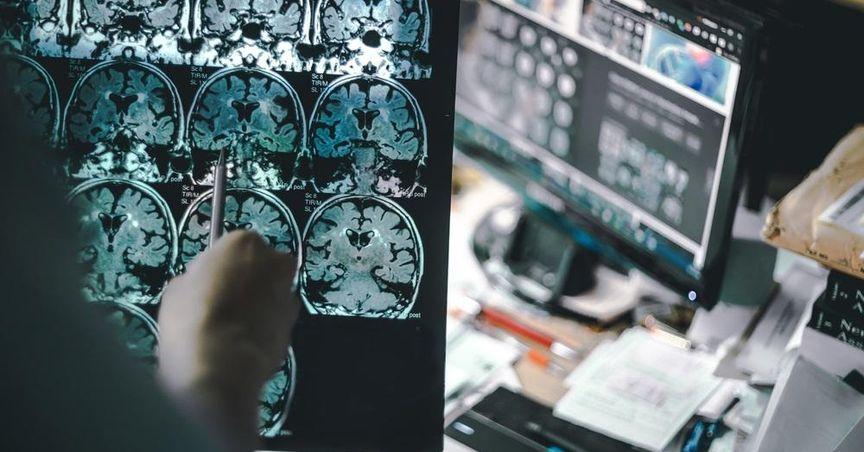

Cambridge Cognition Holdings Plc specializes in neuroscience technology, offering the CANTAB digital cognitive assessment platform. This innovative tool supports pharmaceutical companies in drug development by providing preclinical consultancy, pivotal study facilitation, and research efficiency enhancements. The company serves markets across the United Kingdom, the United States, the European Union, and other international regions.

Through its expertise, Cambridge Cognition aids sponsors in recruitment efforts, ensuring the development of safe and effective therapeutics. Its near-patient cognitive testing solutions represent a critical component in advancing neuroscience research and drug development.

Cambridge Cognition’s recent insider transaction, paired with its stock performance, has placed the company in the spotlight. Its technological advancements in neuroscience and drug development continue to define its market positioning, while insider activity further reinforces attention on the company's strategic direction.