Summary

- AJ Bell Plc has reported an increase in revenue of 21.0% during FY20.

- The customer retention rate remained high and stood at 95.5% for FY20.

- The increase in new customers have witnessed record growth and increased by 27%.

AJ Bell Plc (LON:AJB) is the LSE listed financial services stock. Based on 1-year performance, shares of AJB have generated a return of 11.03%. Shares of AJB were down by close to 1.44% from the last closing price (as on 04December 2020, before the market close at 08:20 AM GMT).

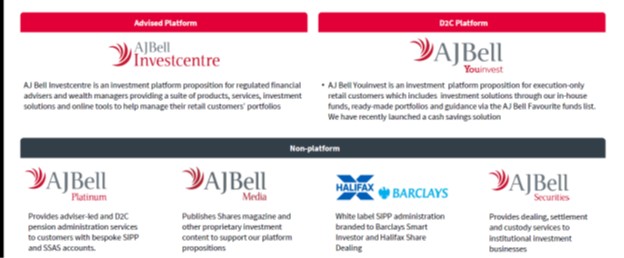

AJ Bell Plc is the FTSE 250 listed company, which is the UK based Company that provides investment platforms. Its flagship program includes AJ Bell Investcentre and AJ Bell Youinvest. AJ Bell Investcentre provides professional financial advisors and wealth managers assistance to manage their clients’ portfolio. AJ Bell Youinvest is direct to consumer retail investment platform.

(Source: Company presentation)

Industry Overview

The UK savings and investment market have achieved resilient growth in the last few years and will continue to carry the positive momentum in the near future. There are many driving factors such as strong demographic trends, government schemes for retirement savings and growing responsibility to take care of financial expenses. The emergence of Covid-19 pandemic has made people realize the importance of savings and investments. The industry has two addressable subsegments in relevance to AJ Bell Plc:

Advised market – The advised market usually serves smaller IFA firms. The UK advised market industry is growing at a CAGR of 8% from the last three years. The industry usually works on elements of manual paper-based processing; however, the pandemic has shifted the drive towards paperless, digitised processes, which advisers have quickly adopted.

D2C (Direct to customer) Market - The new generation customer is typically a younger, less experienced investor who surely has a smaller portfolio, to begin with when it was compared with customers five years ago. Moreover, they seek help and guidance as they start their long-term investment journey and are likely to engage with their investments using a mobile device.

Key Operational Highlights

AJ Bell Youinvest platform – This platform has seen the most successful year in the history of the Company. The Company has demonstrated a record growth in new customers and asset under administration (AUA). The number of customers has seen a 43% growth from 120,113 in FY19 to 172,183 in FY20. The underlying AUA inflow grew by 50% from £1.4 billion in FY19 to £2.1 billion in FY20. The COVID-19 pandemic has changed the consumer preferences, and a large number of customers are now having access to the digital platform. The proportion of customers who traded using the AJ Bell Youinvest mobile application increased to 35% in FY20 while it was 25% in FY19.

AJ Bell Investcentre platform – The number of customers grew by 10,855 from 98,056 in FY19 to 108,911 in FY20. The Company has launched the Retirement Investment Account (RIA) in January 2020, targeting customers having a pension less than £250,000. The Company has enhanced its investment portfolio through the launch of third-party managed portfolio service (MPS). AJ Bell Investcentre was categorized as the ‘Platform of the year’ at the Money Marketing Awards; in a survey organized by Platforum, AJ Bell Investcentre platform was rated as the best platform in light of Covid-19 services.

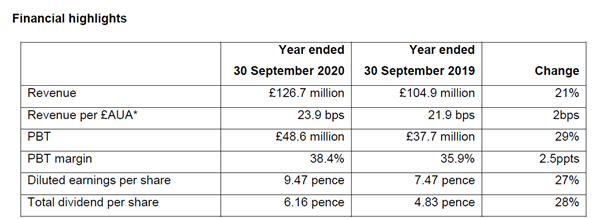

Financial Highlights (for FY20 ended on 30 September 2020 as on 03 December 2020)

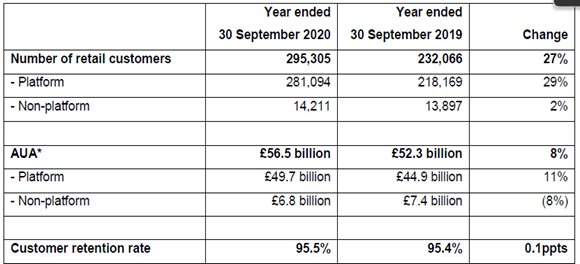

(Source: Company result)

(Source: Company result)

- The Company has reported 21% growth in revenue from £104.9 million for FY19 to £126.7 million during FY20.

- Similarly, Profit before tax of the Company went up by 29% from £37.7 million for FY19 to £48.6 million during FY20 driven by the high level of fresh customers and record dealing activity. The PBT margin has improved by 2.5% points to 38.4% during FY20 while it was 35.9% in FY19.

- The Company has announced an increase of 28% in total ordinary dividend for FY20 to 6.16 pence per share.

- The customer retention rate remained high and stood at 95.5% for FY20.

- With regards to its financial position, the Company has managed to increase its net assets by 27% to £109.5 million during FY20.

- Total asset under administration (AUA) went up by 8% to £56.5 million during FY20 from £52.3 million during FY19.

- The increase in customers has witnessed a record growth, and it has increased by 27% from 232,066 in FY19 to 295,305 in FY20.

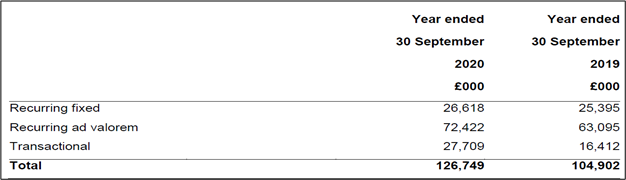

Segmental Revenues

(Source: Company result)

- Recurring fixed revenue has shown an increase of 5% to £26.6 million for FY20 while it was £25.4 million during FY19 driven by the increased pension administration revenue.

- The Company has reported an increase of 15% in its Recurring ad valorem revenue to £72.4 million driven by an increase in average Asset under administration (AUA) in the year held on the platform propositions.

- Transactional revenue has seen the maximum growth, and it grew by 69% to £27.7 million due to higher customer engagement throughout the year.

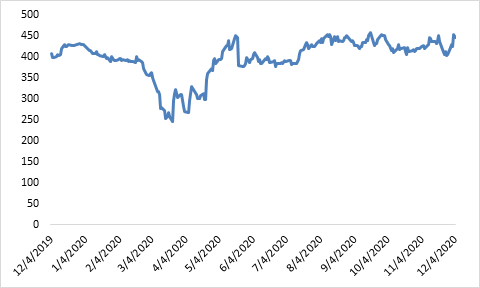

Share Price Performance Analysis of AJ Bell Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of AJ Bell Plc were trading at GBX 446.50 and were down by close to 1.44% against the previous closing price as on 04December 2020, (before the market close at 08:20 AM GMT).AJBs 52-week High and Low were GBX 467.58 and GBX 229.00, respectively. AJ Bell Plc had a market capitalization of around £1.74billion.

Business Outlook

The Company is highly cautious of the Covid-19 pandemic and uncertain about its duration, but estimated interest rates to remain at lower levels for a while. The lower interest rates would impact the revenue. The prospects of the platform market remain robust as a large number of customers would like to take control of their savings using flexible, economical, online solutions, either directly or with the support of an adviser.

The Company is not anticipating any change in material inflows and outflows. However, the Company is expecting its revenue margin to decline in FY22 from the levels of FY21 reflecting full impact of 2020 interest rate cuts as advised platform interest is expected to drop by 17 basis points while D2C platform is expected to drop by 31 basis points.