Highlights

- A new CBI/PwC survey found that while volumes and profitability rose in the UK’s financial services industry, the growth in optimism eased in the 3 months to December 2021.

- Business volumes were found to have grown at the highest pace since June 2017, while profitability rose at the fastest pace since December 2015.

A new survey found that while volumes and profitability rose in the UK’s financial services industry yet, the growth in optimism had eased in the 3 months to December 2021.

According to the joint survey of UK’s Confederation of British Industry (CBI) and PwC released today, business volumes rose at a rate of 42 per cent, the highest pace since June 2017. And this pace is expected to remain in Q1 2022.

Comparatively, volumes had grown at a rate of 33 per cent in the Q3 2021 survey for the 3 months to September 2021.

The latest CBI/PwC survey also found that profitability rose at the fastest pace since December 2015 and had shown a robust growth rate for 3 quarters in a row. (In the earlier CBI/PwC Q3 2021 survey, profitability was at 29 per cent)

However, optimism witnessed a sharp dip to 15 per cent in the latest survey compared to 35 per cent in Q3 2021. PwC attributed this cooling of optimism closely to a mix of multiple factors, including the uncertainty relating to covid, increasing inflation, and other factors.

Amid this development, let us look at 2 AIM-listed stocks in the financial services sector and explore their investment prospects:

- Manx Financial Group PLC (LON:MFX)

Manx Financial Group is a financial services group and is part of the FTSE AIM All-Share index.

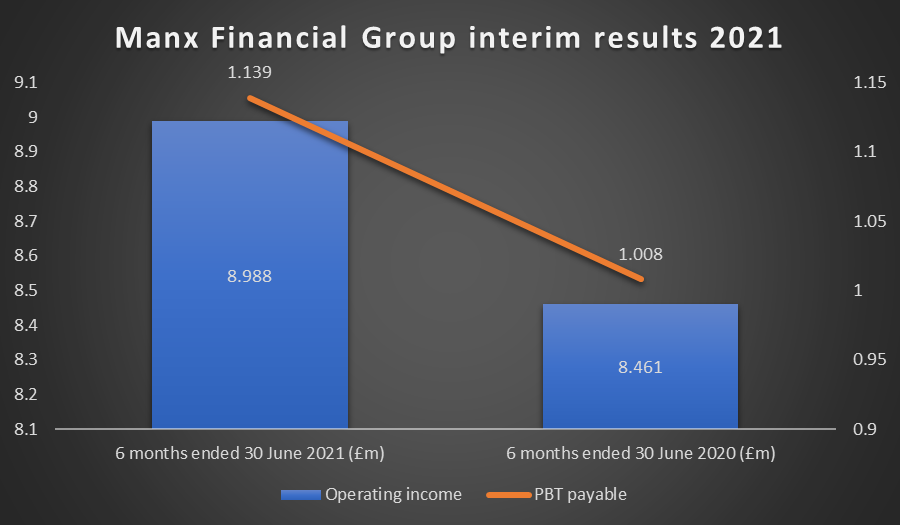

The group’s profit before tax (PBT) payable for the first 6 months ended on 30 June 2021 was £1.139 million, compared to £1.008 million in the previous year.

And its operating income, during the period, increased by about 6.2 per cent to £8.988 million, from £8.461 million in the year before.

©2022 Kalkine Media®

Its shares were trading flat at GBX 7.88 on 13 January at 08:06 AM BST. The FTSE AIM All-Share index was at 1,175.39, higher by 0.07 per cent.

The group’s market cap was at £9.00 million, and it has given a return of 4.86 per cent to shareholders on a 1-year basis as of date.

Related Read: Should you buy these 3 FTSE banking stocks now?

- ADVFN PLC (LON:AFN)

ADVFN is a financial information website and belongs to the FTSE AIM All-Share index.

The group said today that it is undertaking a formal strategic review of which one of its options include the sale of the group. The purpose of this review is to help maximize its shareholder value.

Its shares were trading at GBX 79.00, up sharply by 12.86 per cent on 13 January at 08:29 AM BST. The group’s market cap was at £ 18.28 million, and it has given a return of 158.33 per cent as of date.