Summary

- As per the Bank of England's reported data, in June 2020, the total gross capital issuance by UK residents was £71.6 billion. The issuance increased by £25.7 billion from £45.9 billion in May 2020.

- In June 2020, the PNFC sector issued bonds worth £12.7 billion, and the MFI sector issued commercial papers of £20.2 billion.

- HSBC Holdings announced a tender offer to purchase five senior notes and issued two new notes on the New York Stock Exchange.

- HSBC Holdings has suspended the fourth interim dividend for FY2019, and no dividend would be paid in FY2020.

- London Stock Exchange Group paid the final dividend of 49.9 pence per share for FY2019.

- The European Commission started phase two review of London Stock Exchange Group's acquisition of Refinitiv.

Given the above-market conditions, we would review two financial stocks - HSBC Holdings PLC (LON:HSBA) & London Stock Exchange Group PLC (LON:LSE). Both are listed on the FTSE 100. Let's walk through their financial and operational updates to understand the stock better.

HSBC Holdings PLC (LON:HSBA) – Revenue declined by 5 percent year on year in Q1 FY2020

HSBC Holdings PLC is a UK based international bank that serves close to 40 million customers in 64 countries. The Company provides finance to the businesses and manages customer's money through savings and investments. HSBC is listed on the FTSE 100 of the London Stock Exchange.

Tender Offer for Notes as reported on 28 May 2020

HSBC Holdings announced the tender offer to purchase five senior series notes worth close to USD 10 billion. The notes include USD 3 billion 3.400 percent senior unsecured loan, USD 2.5 billion 5.100 percent senior unsecured loan, USD 2.5 billion 2.950 percent senior unsecured notes and two USD 1 billion floating rate senior unsecured notes. All notes are due in 2021. HSBC Holdings issued two new notes, USD 2 billion 2.099 percent fixed-rate or floating rate senior unsecured notes due in 2026 and USD 1.5 billion 2.848 percent fixed-rate or floating rate senior unsecured notes due in 2031. The Company listed two new notes on the New York Stock exchange.

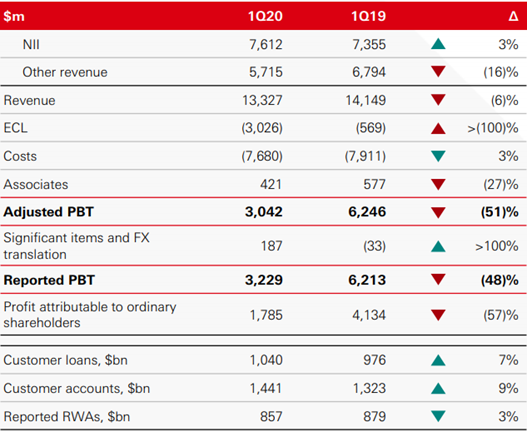

Q1 FY2020 Result update (ended 31 March 2020) as reported on 28 April 2020

The Company generated revenue of USD 13.6 billion in Q1 FY20 that was USD 14.4 billion a year ago. The profit before tax was USD 3.2 billion, which was down by 48 percent year on year. The lower profit was mainly due to credit impairment and higher expected credit losses. The expected credit losses (ECL) increased by USD 2.4 billion to USD 3.0 billion in the reported quarter. The increased ECL charge was mainly due to the lower oil prices and business exposure-related cost in Singapore. At on 31 March 2020, the ECL allowance was USD 11.1 billion The Company suspended the fourth interim dividend of USD 0.21 per share for FY2019 as per the directives received from Prudential Regulation Authority (PRA) of the Bank of England. The Company has stated that it would make no dividend payment for full-year 2020. On 25 June 2020, the Group appointed Anna Manz as Chief Financial Officer.

Q1 FY2020 Financial Summary

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-27-2020, before the market close (Source: Refinitiv, Thomson Reuters)

HSBC Holdings PLC's shares were trading at GBX 354.50 and were down by 2.83 percent against the previous closing price (as on 27 July 2020, before the market close at 9:30 AM GMT+1). Stock 52-week High and Low were GBX 671.40 and GBX 353.07, respectively. The Company had a market capitalization of £74.02 billion.

Business Outlook

The Company highlighted the impact of the pandemic on the business, and it is mindful of the fact that it could lead to higher expected credit losses. The revenue could be impacted due to the subdued customer activity and lower interest rates globally, to offset the decline in future revenue, the Company is taking cost-saving measures. However, the overall profitability is expected to be lower in FY20 when compared to FY19. The Company has deferred the risk-weighted asset (RWA) reduction programme that included some restructuring cost. The Company expects the RWA revenue growth to be in mid to high single-digit for FY20.

London Stock Exchange Group PLC (LON:LSE) – Strong performance in Q1 FY2020

London Stock Exchange Group PLC is a UK based financial markets infrastructure business. The Group has multi-asset index business with AUM of USD 15 trillion and ETF AUM of USD 765 billion benchmarked to the indices. In 2019, the global OTC clearing house cleared USD 1.2 quadrillion of notional value. The business divisions of LSE include Information Services, Post Trade Services, Capital Markets and Group Technology.

Q1 FY2020 Trading result (ended 31 March 2020) as reported on 21 April 2020

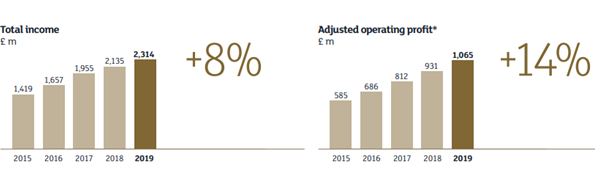

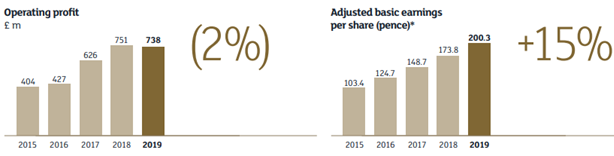

The Group performed well in the backdrop of the pandemic. It generated a revenue of £535 million, which was up by 10 percent year on year. The total income, including treasury revenue, was £615 million. The gross profit was up by 13 percent year on year to £555 million in Q1 FY20 from £490 million in Q1 FY19. The performance was supported by improved equity trading and higher clearing activity across OTC products. The Information Services division reported revenue of £215 million, which was up by 7 percent year on year from £201 million a year ago. The Post Trade division revenue increased by 12 percent year on year to £192 million in Q1 FY20 from £172 million in Q1 FY19. The Capital Markets and Technology generated revenue of £112 million and £14 million, respectively. The Capital Markets revenue increased by 15 percent year on year in Q1 FY20, whereas the Technology revenue growth was flat. As on 31 March, the Group had committed funding facility of over £600 million. London Stock Exchange paid the final dividend of 49.9 pence per share for FY2019 that reflected a full-year dividend payment of 70 pence per share. On 22 June 2020, the Group announced that the all-share transaction deal for the acquisition of Refinitiv had reached the second stage for review by European Commission. The Group proposed to acquire Refinitiv at a total enterprise of close to USD 27 billion.

FY2019 Financial Summary

(Source: Group Website)

Share Price Performance Analysis

1-Year Chart as on July-27-2020, before the market close (Source: Refinitiv, Thomson Reuters)

London Stock Exchange Group PLC's shares were trading at GBX 8,418.00 and were up 0.60 percent against the last closing price (as on 27 July 2020, before the market close at 9:30 AM GMT+1). Stock 52-week High and Low were GBX 8,628.00 and GBX 5,300.00, respectively. The Group had a market capitalization of £29.41 billion.

Business Outlook

The Group's primary focus and duty is uninterrupted functioning of the market and steady services for the customers. The Group is confident of the liquidity headroom and balance sheet strength to continue the business operations. London Stock Exchange Group would invest in businesses and work with customers to build partnerships and deliver advanced products and services.