Summary

- The bank has been insisting on opening a current account for its SME customers who wish to access “Bounce Back” stimulus loans that the government had announced after the imposition of the lockdown.

- CMA said that the bank limited the choice for the customers, in terms of what account they may want to open to avail those loans, which is an unfair business practice.

- CMA, in its investigation, found that as many as 30,000 of the bank's customers who ran their businesses using personal accounts were forced to open current accounts. These have a different charge structure than personal accounts.

In its latest crackdown on unfair business practices, the Competition and Markets Authority (CMA) of the United Kingdom has restricted Lloyds bank from forcing its customers to open current accounts to avail government loans under the “Bounce back” loan scheme.

These loans were rolled out to target small and medium-sized businesses in the country who were having difficulty availing other lockdown era stimulus loan schemes.

These bounce back loans were designed to be more convenient to avail with lucid eligibility conditions. The loans were introduced on 27 April 2020 by Rishi Sunak, chancellor of the UK treasury. They provide for a loan worth up to £50,000 with a government guarantee to the lenders.

At that time, the government had not put any restrictions on what type of accounts the customer might use to avail these loans and could very well be availed through a customer’s personal accounts. It is worth noting here that current accounts carry certain charges which are not there on personal accounts, because of which very small businesses prefer to use personal accounts in order to avoid these charges.

Thus Lloyd bank’s insistence on its customers to open current accounts to avail the government “Bounce back“ stimulus loans seemed unfair to the CMA. The CMA's order implies that the bank's actions were laced with the intention of deriving unfair gains at the expense of the unsuspecting customers.

The PPI scam

Lloyds bank has been embroiled with allegations of unfair trade practices for some time now and has also paid a heavy price for the same in the recent past. Earlier, the Lloyds group had also been affected by the PPI (payment protection insurance) scam that had caused significant damages to its finances.

It had to pay a compensation of £20 billion to customers, to whom it had mis-sold payment protection insurance over a period of nearly ten years. Only some time back a further court ruling was passed on the PPI scandal by the court. This could open the gates for more compensation claims on the bank.

Future implications of the CMS investigations

Though the CMA has not yet put any penalties on the bank for the alleged current account malpractices, there is a real possibility that some customers might just file a court case underpinning the CMA order.

Should such a claim materialize, and if any customer is able to win compensation in a court, it will open the flood gates for many more claims who had opened current accounts with the bank on its insistence.

However, the bank has said that it has informed its affected customers about the CMA order and also informed them about all the available options.

Nonetheless, given the possibility of potential compensation claims arising out of this controversy, the bank might have to increase its provisions, which would definitely have an impact on its bottom lines.

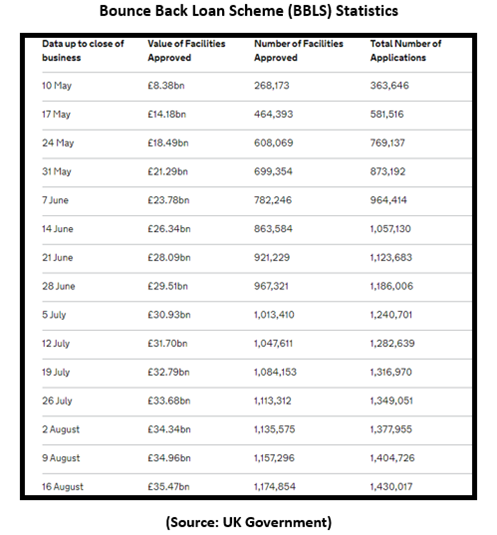

The Bounceback loan scheme

The bounce-back loan scheme was one of the major stimulus schemes that the UK government had announced during the lockdown period. The scheme was focused on small businesses, who could not avail other government loan offers.

It was offered with an objective of protecting these struggling SMEs from going bankrupt and also save millions of jobs associated with those businesses. These loans did not have stringent eligibility norms and did not require elaborate any application procedures that would otherwise be required for any loan scheme. Prospective borrowers could apply for these loans online, and avail of a loan amounting up to £50,000 interest-free for the first year without any payment obligations over that period. These loans carried governments guarantee against any defaults.

The scheme has benefited the British economy significantly in its fight against the coronavirus pandemic. Not only has this loan scheme helped businesses from going bankrupt, but it also helped them reopen faster, and their employees brought back from furlough at an accelerated pace. The swift pace of recovery recorded in several industries since the reopening of the lockdown has a significant contribution attributed to this scheme and as long as the economy fully recovers this scheme will continue to play a crucial role.

The performance of Lloyds Bank stock (LON:LLOY)

In the half-yearly report of the company for the period ending 30 June 2020 the company has made an underlying loss of £281 million but has made a statutory profit after tax of £19 million on account of the tax credits it has received.

The present controversy, as well as last week's court order that allowed customers to raise fresh claims over the PPI controversy, would require the bank to block a significant portion of its cash resources, which could adversely impact its lending capabilities.

In view of the present claims under both these controversies and the large amount of provisions that might be required to be kept aside, it could keep the banking group in the red for at least some time.

Also Read: Lloyds Banking Group PLC announced the suspension of dividends

Also Read: What’s Causing the Fall in the Share Price of Lloyd Banking Group?

Data Source – Thomson Reuters

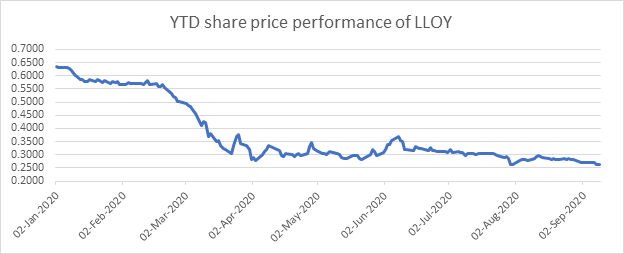

Since the beginning of the year, the shares of Lloyds Banking Group PLC (LON:LLOY) had been underperforming at the London Stock Exchange.

On 2 January 2020, the shares of the company were trading on the exchange at GBX 63.71 per share, and towards the end of March 2020, they took a sharp turn downwards to touch a much lower value of GBX 32.00 on 30 March 2020.

Since then, however, not much upward or downward movement has been seen in the stock. On 9 September 2020 at the close of trade the shares of the company were quoted at GBX 26.26.