Highlights

- Barclays reported a net income of £5.5 billion and profit before tax of £2.0 billion for Q3 2021 ended 30 September.

- Banco Santander’s total number of customers rose to 152 million in the first nine months of 2021, and about 54% of group sales during the period were through digital channels.

- Lloyds Banking Group recorded a profit before tax of £5,103 million for the nine-month period ended 30 September 2021 compared to £620 million in 2020.

Banking stocks are often seen as attractive investment options for investors, as they not only offer price appreciation but regular dividends as well to their shareholders.

Partly due to the COVID-19 pandemic and due to rising tech-savviness among people, many consumers today are opting for digital banking solutions. This is leading to the closure of a number of bank branches. In accordance with the demand, banks are streamlining resources and upgrading their digital banking options to best suit the needs of consumers today. Here is a review of the investment prospect in three banking stocks – Barclays, Banco Santander and Lloyds Banking Group.

(Data source: Refinitiv)

Barclays Plc (LON: BARC)

Barclays is an FTSE 100 listed banking firm that offers services to corporate, government and institutional clients. The company recently announced the appointment of the new CEO - CS Venkatakrishnan, who replaced Jes Staley. Recently, the company also announced the closure of its two Northamptonshire branches by early 2022, as customers move to use digital banking alternatives.

Barclays reported a net income of £5.5 billion and profit before tax of £2.0 billion for Q3 2021 ended 30 September. Its return on tangible equity (RoTE) for the period stood at 11.9%.

Barclays’ board announced a half-year dividend of 2.0 pence per share to shareholders.

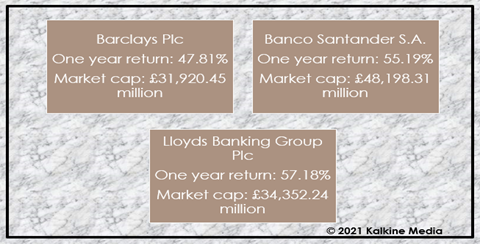

The shares of Barclays closed at GBX 190.00 on Tuesday, 9 November 2021, with a market cap of £31,920.45 million. In the last one year, the shares of Barclays returned 47.81% to shareholders.

Banco Santander S.A. (LON:BNC)

Banco Santander is a multinational financial services firm. It announced the opening of nine business centres for large companies, including Malaga, Seville, Zaragoza, Las Palmas, Tenerife, Murcia, Bilbao, San Sebastián and Valencia, in Spain.

For the first nine months of 2021, Banco Santander earned a total income of €34.6 billion and an attributable profit of €5,849 million. During the period, the company’s total number of customers rose to 152 million, and about 54% of group sales were through digital channels compared to 44% in the same period in 2020.

Banco Santander’s board announced an interim cash dividend of €4.85 cents per share.

The shares of Banco Santander closed at GBX 278.85 on Tuesday, 9 November 2021, with a market cap of £48,198.31 million. In the last one year, the shares of Barclays returned 55.19% to shareholders.

Lloyds Banking Group Plc (LON: LLOY)

Lloyds Banking Group is a financial services firm. For the nine-month period ended 30 September 2021, Lloyds Banking Group recorded a profit before tax of £5,103 million compared to £620 million in 2020, up by £4,483 million.

Lloyds Banking Group’s statutory profit before tax for Q3 increased by 96% to £2.0 billion from £1.04 billion in Q3 2020. Its underlying profit for the period also rose by 88% to £2.2 billion from £1.16 billion in the same period in 2020.

The shares of Lloyds Banking Group closed at GBX 48.38 on Tuesday, 9 November 2021, with a market cap of £34,352.24 million. In the last one year, the shares of Barclays returned 57.18% to shareholders.