Highlights

- Investing in dividend stocks is a brilliant way to create a stream of long-term passive income.

- Sectors like utilities, healthcare, and industrial can be targeted for stocks offering steady and solid dividend yields.

Investing in dividend stocks is a brilliant way to create a stream of long-term passive income. However, investors must choose such stocks carefully, especially looking at the current market trends. Certain sectors can be targeted for dividend stocks with steady and solid dividend yields. The first sector to be considered is utilities, which offers defensive stocks with high dividend yields. Evidently, the demand for the services of companies belonging to this sector remained high even during the pandemic.

© 2022 Kalkine Media®

The second sector would be healthcare, which offers defensive stocks with low current dividend yields. These companies grow faster even if their yields are low, and thus they provide good returns over time.

The third sector to be considered is industrial, which offers cyclical stocks with low dividend yields, and not just for defensive stocks. However, economic slowdown may impact the cyclical stocks, so while choosing such stocks, other factors should be considered too. Lastly, investing in high-yield cyclical stocks is the best way to earn maximum passive income in the short or long run.

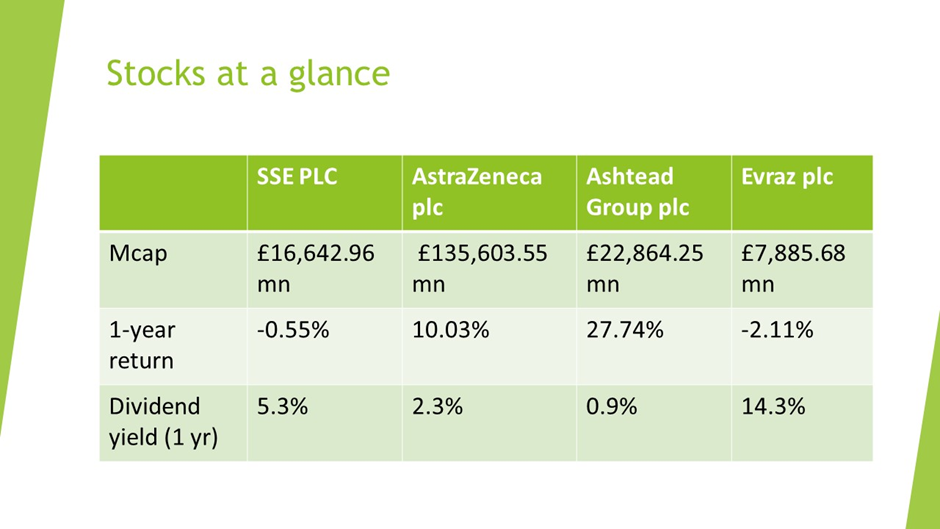

Let’s take a look at 4 UK stocks belonging to each of the above-mentioned categories that you can buy for passive income in the long run.

RELATED READ: Which FTSE Stocks will pay Bumper Dividends in January 2022?

© 2022 Kalkine Media®

Data: As of 24 January 2022

SSE PLC (LON: SSE)

Scotland-headquartered SSE PLC is a leading energy firm operating across the UK and Ireland. The market cap of the FTSE100-listed firm stands at £16,642.96 million, and it has given a negative return of -0.55% to its shareholders in the last one year as of 24 January 2022. The company is offering a dividend yield of 5.3% a year and its 5-year dividend yield stands at 6.7%. SSE PLC’s shares closed at GBX 1,540, down by 1.38%, on 24 January 2022.

AstraZeneca plc (LON: AZN)

Leading the UK’s healthcare industry AstraZeneca plc is a global pharmaceutical and biotechnology firm, known for its Covid-19 jab. The market cap of the FTSE100-listed firm stands at £135,603.55 million, and it has given a return of 10.03% to its shareholders in the last one year as of 24 January 2022. The company is offering a dividend yield of 2.3% a year and its 5-year dividend yield stands at 3.3%. AstraZeneca plc’s shares closed at GBX 8,316, down by 4.98%, on 24 January 2022.

RELATED READ: Which 5 FTSE shares you can buy for good passive income?

© 2022 Kalkine Media®

Ashtead Group plc (LON: AHT)

Industrial equipment rental corporation, Ashtead Group plc, is headquartered in London and operates in the UK, the US, and Canada. The market cap of the FTSE100-listed firm stands at £22,864.25 million, and it has given a return of 27.74% to its shareholders in the last one year as of 24 January 2022. The company is offering a dividend yield of 0.9% a year and its 5-year dividend yield stands at 1.4%. Ashtead Group plc’s shares closed at GBX 4,950, down by 3.55, on 24 January 2022.

Evraz plc (LON: EVR)

Evraz plc is a leading mining company engaged in vertically integrated steel manufacturing. The market cap of the FTSE100-listed firm stands at £7,885.68 million and it has given a negative return of 2.11% to its shareholders in the last one year as of 24 January 2022. Evraz plc is offering a dividend yield of 14.3% a year and its 5-year dividend yield stands at 11.2%. Evraz plc’s shares closed at GBX 496.50, down by 8.16%, on 24 January 2022.

.jpg)