Summary

- 4imprint Group Plc had anticipated a decline of 35% year-on-year in its revenue to USD 560 million during FY20.

- The underlying profit before tax had aligned with the management expectations during FY20.

- The Company had delivered Q4 FY20 order intake to around 70% of the prior year on an LFL basis.

- The Company had sufficient liquidity well supported by a net cash balance of USD 39.8 million as of 02 January 2021.

4imprint Group Plc (LON:FOUR) is the FTSE 250 listed consumer stock. The Company is engaged in the marketing of products in the U.S. FOUR’s shares have generated a return of about negative 27.81%.

The Company will announce full year FY20 results ending 02 January 2021 on 16 March 2021.

Business Model

The Company is engaged in the sale of promotional products under the brand name 4imprint. The Company operates through two subsidiaries –

- 4imprint Inc

- 4imprint Direct Marketing Limited

The Company is focused on four geographic regions –

- United Kingdom

- Ireland

- Canada

- United States

(Source: Company presentation)

Pre Closing Trading Update (for 12 months ending 02 January 2021, as on 21 January 2021)

- The weekly order intake had recovered significantly during the last two months of FY20. The Company had delivered Q4 FY20 order intake to around 70% of the prior year on an LFL basis.

- The Company had anticipated a decline of 35% in the unaudited group revenue to USD 560.0 million during FY20.

- The underlying profit before tax had aligned with the management expectations during FY20.

- The Company had sufficient liquidity well supported by a net cash balance of USD 39.8 million as of 02 January 2021.

Trading update as of 30 October 2020

- The Company had shown a decent recovery as weekly order intake remained at the levels of 60% of the order intake in the prior year during the four weeks of October 2020. The average weekly revenue during the four weeks in October 2020 was 65% of the levels achieved during an equivalent period of the prior year.

- The apparel segment had shown much-improved performance during the period. The apparel volume at Oshkosh Distribution Centre was operated at the same level as that in the prior year resulted in the permanent labour utilization capacity of 100%.

- The Company had a decent financial position as it is a debt-free company and maintained a cash balance of USD 40.1 million as of October 2020.

H1 FY20 Financial Highlights (for 26 weeks period ended 27 June 2020, as on 13 August 2020)

(Source: Company result)

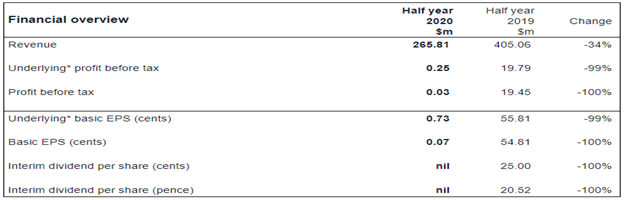

- The Company’s revenue plunged by 34% to USD 265.81 million during H1 FY20 ended on 27 June 2020.

- The Company had witnessed a growth in revenue of around 16% for the first two months of January 2020 and February 2020. The revenue had shown a substantial reduction of 54% in the four-month period from 01 March 2020 to 27 June 2020 due to the emergence of Covid-19 pandemic.

- The Company had managed to breakeven despite the business challenges presented by Covid-19 pandemic. The profit before tax was USD 0.03 million for H1 FY20.

- The basic earnings per share were 0.07 cents for the period while it was 54.81 cents for the prior year’s comparative period.

- The Group had not declared an interim dividend for H1 FY20 due to ongoing uncertainty. The Company had cancelled FY19 dividend of 59.00 cents to maintain the liquidity levels.

- The Company had a net cash balance of USD 37.49 million as of 27 June 2020.

- The free cash flow of the Company had shown a significant decline to USD 5.49 million. It did not include a special pension contribution of USD 9.14 million.

- The Group had a working capital balance of negative USD 4.04 million as of 27 June 2020.

Operational review (as of 13 August 2020)

(Source: Company result)

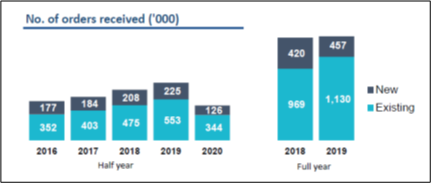

- The order processed by the Company got slipped to 470,000 during H1 FY20, while it was 778,000 during H1 FY19.

- The order count remained at the levels of 50% of the prior year during H1 FY20.

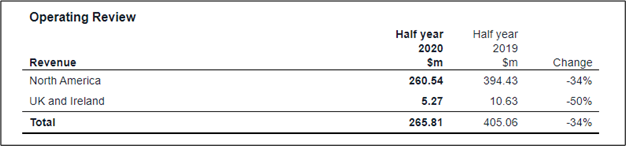

- The revenue across both geographic segments had shown a large drop. The North America segment revenue got reduced by 34% to USD 260.54 million during H1 FY20, and UK & Ireland segment had demonstrated a decline of 50% to USD 5.27 million for the six months period ended on 27 June 2020.

Share Price Performance Analysis of 4imprint Group Plc

(Source: Refinitiv, chart created by Kalkine group)

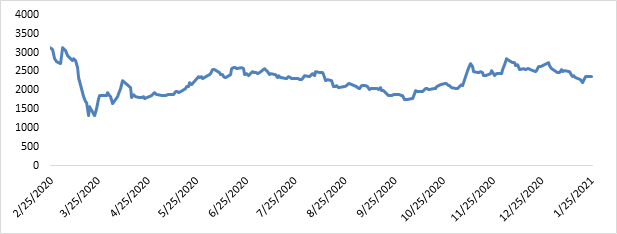

Shares of 4imprint Group Plc were trading at GBX 2,390.00 and were up by close to 0.63% against the previous closing price as on 25 January 2021, (before the market close at 09:00 AM GMT). FOUR's 52-week Low and High were GBX 1,067.31 and GBX 3,450.00, respectively. 4imprint Group Plc had a market capitalization of around £667.03 million.

Business Outlook

The Company is well-positioned to capitalize on the opportunities provided by recovering market conditions. The financial performance of the Company had meet the management expectations. The Company had shown a gradual increase in its weekly order intake throughout the year. The weekly order intake was plummeted to around 20% of the prior year levels during April 2020, and from thereon it had reached to 70% as of 02 January 2021, indicating the decent pace of recovery considering the current challenging environment.